In the dynamic and ever-evolving world of cryptocurrencies, altcoins have emerged as a significant aspect, offering diversity beyond the mainstream Bitcoin and Ethereum. These alternative digital assets, ranging from utility tokens to DeFi projects, have opened new avenues for traders and investors alike.

Our curated list of the top 10 cryptocurrency exchanges is tailored to meet the diverse needs of altcoin enthusiasts. Whether you’re a seasoned trader or just starting, our selections cater to a variety of preferences, from decentralized exchanges (DEXs) offering innovative DeFi options to centralized platforms known for their extensive altcoin listings and advanced trading tools.

Each exchange featured in our list has been chosen based on several key factors. These include the variety of altcoins offered, ease of use, security measures, fee structures, unique features, and overall reliability. Our in-depth reviews provide insights into why each platform stands out in the crowded crypto exchange landscape.

Best Cryptocurrency Exchanges for Altcoins in 2025

- Best for Trading Binance Smart Chain Altcoins: PancakeSwap

- Best for a Wide Variety of Lesser-Known Altcoins: Gate.io

- Best for Early Access to Emerging Altcoins: MEXC

- Best for Ethereum-based Altcoin Variety: Uniswap

- Best for Easy Altcoin Swapping Without Registration: SimpleSwap

- Best for User Experience: KuCoin

- Best for Instant Altcoin Exchanges: Changelly

Why Trust Crypto Head

We have been committed to providing our readers with well-researched, unbiased, and reliable information since 2017. Our team consists of crypto experts who understand the importance of choosing the right exchange.

We have spent a huge amount of time over the years evaluating and comparing a range of crypto platforms. We use a rigorous methodology to evaluate each platform, considering factors like security, user experience, and fees.

219

Exchanges considered

134

Exchanges analysed

8,710

Data points collected

1. PancakeSwap - Best for Trading Binance Smart Chain Altcoins

Trading Fees

0.25%

Supported Crypto

2679+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR + 7 others Some through third party apps.

PancakeSwap is selected for its prominence as a leading decentralized exchange (DEX) on the Binance Smart Chain, known for its extensive range of altcoins, especially those in the DeFi ecosystem. The platform’s user-friendly interface and unique features like yield farming and liquidity pools make it an attractive choice for trading a variety of altcoins.

PancakeSwap is ideal for users interested in newer, often lesser-known cryptocurrencies, offering them opportunities to engage in decentralized finance (DeFi) with relative ease. Its low transaction fees and fast processing times further enhance its appeal for altcoin trading.

Launched in 2020, PancakeSwap has quickly become a favored platform for users looking to explore the diverse world of altcoins. Operating on the Binance Smart Chain, it offers significantly lower transaction fees compared to platforms on Ethereum, which is a key consideration for altcoin traders.

The exchange supports a broad spectrum of tokens, particularly focusing on newer and emerging tokens within the BSC ecosystem. PancakeSwap is especially known for its Automated Market Maker (AMM) model, which facilitates direct wallet-to-wallet trading.

A standout feature of PancakeSwap is its array of DeFi functionalities, including yield farming and staking, allowing users to earn rewards on their cryptocurrency holdings. The platform also features a lottery system and NFT marketplace, adding an extra layer of engagement for users.

While PancakeSwap offers a range of innovative features, it is important for users to conduct their due diligence, especially when dealing with less established altcoins. The platform’s design, however, remains focused on simplicity and ease of use, making it accessible to a broad audience interested in altcoin trading.

| Type | Fee |

|---|---|

| Trading Fee | 0.25% |

2. Gate.io - Best for a Wide Variety of Lesser-Known Altcoins

Trading Fees

0.00% - 0.10%

Supported Crypto

2168+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 80 others Only supports fiat currencies through third party apps.

Gate.io is chosen for its extensive selection of altcoins, making it one of the go-to platforms for traders looking to explore a wide range of alternative cryptocurrencies. The exchange is known for listing a large number of altcoins, including many emerging and lesser-known tokens, which is ideal for those seeking to diversify their crypto portfolio.

Gate.io appeals to altcoin traders due to its advanced trading features, combined with a secure and user-friendly platform. This makes it suitable for both experienced traders and those new to altcoin trading.

Founded in 2013, Gate.io has established itself as a prominent cryptocurrency exchange, particularly in the altcoin market. It offers a comprehensive range of cryptocurrencies, providing users with access to a wide array of altcoins, including many that are not commonly available on other platforms.

The platform provides advanced trading options, catering to a variety of trading strategies and preferences. Despite its advanced features, the interface is designed to be intuitive, ensuring ease of use for traders at all levels.

In terms of fees, Gate.io maintains a competitive fee structure. The fees are reasonable and transparent, making it a cost-effective option for altcoin traders.

Security is a strong focus at Gate.io, with robust measures such as two-factor authentication and cold storage of funds. The platform has a solid track record in terms of security, which is a crucial consideration for traders dealing with a diverse range of altcoins.

Customer support on Gate.io is commendable, with a responsive team and a comprehensive FAQ section to assist users. The exchange also provides educational resources, beneficial for those looking to expand their knowledge in altcoin trading.

Gate.io’s blend of a vast selection of altcoins, advanced trading features, strong security measures, and user-friendly interface makes it a top choice for traders interested in delving into the altcoin market.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | No fees listed. |

| Deposit Fee (Credit/Debit Card) | No fees listed. |

| Trading Fee | 0.00% - 0.10% |

3. MEXC - Best for Early Access to Emerging Altcoins

Trading Fees

0.00% - 0.05%

Supported Crypto

1963+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR + 19 others Some through third party apps.

MEXC is chosen for its impressive range of altcoins and innovative trading options, making it a standout exchange for altcoin enthusiasts. The platform is renowned for its early listing of promising new tokens, offering traders the opportunity to be among the first to invest in emerging cryptocurrencies.

The exchange is also appreciated for its user-friendly interface and advanced trading features, which are accessible to both seasoned traders and beginners. MEXC’s commitment to providing a diverse and dynamic trading environment makes it a prime destination for altcoin trading.

Established in 2018, MEXC has quickly gained recognition in the cryptocurrency community, particularly for its extensive altcoin offerings. The exchange is known for listing a wide variety of digital assets, including many lesser-known and emerging tokens.

MEXC provides a range of trading options, catering to the diverse needs and strategies of altcoin traders. Despite the sophistication of its trading features, the platform maintains an intuitive and easy-to-navigate interface.

In terms of trading fees, MEXC is competitive, offering reasonable rates that appeal to a broad spectrum of traders. The exchange has a tiered fee structure, which can be beneficial for users with higher trading volumes.

Security on MEXC is robust, with comprehensive measures in place to protect user funds and data. This includes multi-factor authentication, cold storage for digital assets, and regular security audits.

Customer support on MEXC is notable for its efficiency and availability. The platform provides a variety of support channels, including a detailed FAQ section, live chat, and email support, ensuring that users receive timely assistance.

MEXC’s extensive altcoin selection, combined with advanced trading features and strong security measures, makes it a top choice for traders looking to explore and invest in a wide range of alternative cryptocurrencies.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | Free via P2P |

| Deposit Fee (Credit/Debit Card) | Free via P2P |

| Trading Fee | 0.00% - 0.05% |

| Withdrawal Fee (Bank Transfer) | Free via P2P |

4. Uniswap - Best for Ethereum-based Altcoin Variety

Trading Fees

0.30%

Supported Crypto

4793+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 29 others Only supports fiat currencies through third party apps.

Uniswap is selected for its role as a leading decentralized exchange (DEX) that offers unparalleled access to a wide range of altcoins, especially Ethereum-based ERC-20 tokens. Its automated liquidity protocol is ideal for those seeking to trade altcoins in a decentralized manner without relying on traditional market makers.

Uniswap’s user-friendly interface and permissionless nature make it highly accessible for users interested in exploring the vast world of altcoins. The platform is particularly appealing for its ease of listing new tokens, providing traders with early access to emerging cryptocurrencies.

Since its launch in 2018, Uniswap has become a pivotal platform in the decentralized finance (DeFi) space. It operates on the Ethereum blockchain and is renowned for its Automated Market Maker (AMM) system, which facilitates the trading of a vast array of ERC-20 tokens.

The exchange is a popular choice for altcoin trading due to its open listing policy. Practically any ERC-20 token can be traded on Uniswap, giving traders access to a broad spectrum of altcoins, including many that are not available on centralized exchanges.

Uniswap’s fee structure is straightforward, typically charging a standard fee for trades, which is then distributed to liquidity providers. This fee model is transparent and consistent across all trading pairs.

Security on Uniswap is robust due to its decentralized nature. However, users are advised to exercise caution, especially when trading less-known tokens, as the permissionless environment can be susceptible to listing of tokens with lower liquidity or higher volatility.

The platform’s interface is designed to be intuitive, making it easy for newcomers to the world of altcoins to navigate and execute trades. While customer support is primarily community-driven, the vast array of online resources and active community forums provide valuable assistance to users.

Uniswap stands out as a leading DEX for altcoin trading, offering a combination of accessibility, a wide range of token listings, and a secure trading environment.

| Type | Fee |

|---|---|

| Trading Fee | 0.30% |

5. SimpleSwap - Best for Easy Altcoin Swapping Without Registration

Trading Fees

1%

Supported Crypto

1500+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 36 others Only supports fiat currencies through third party apps.

SimpleSwap, a relatively new entrant in the world of cryptocurrency exchanges, has quickly established itself as a top choice for altcoin enthusiasts. Its key strengths lie in its straightforward, no-registration trading process, and its vast selection of altcoins.

What makes SimpleSwap stand out is its commitment to ease of use. The platform is designed to facilitate quick and hassle-free exchanges between a wide range of cryptocurrencies. This user-friendly approach is particularly appealing to those who prefer a straightforward trading experience without the complexities of traditional exchanges.

SimpleSwap, while being a newer player in the crypto exchange market, has made a significant impact due to its user-centric design. The platform offers a seamless trading experience with a focus on a diverse range of altcoins, catering to the needs of altcoin traders.

The exchange doesn’t require users to create an account or undergo KYC procedures, which streamlines the trading process significantly. Users can simply select the cryptocurrencies they wish to exchange, input their wallet address, and execute the trade, all within a few clicks.

However, it’s important to note that while the platform’s lack of registration and KYC procedures enhances convenience, it may also have implications for security and regulatory compliance. Users should be aware of these aspects when trading on SimpleSwap.

In terms of fees, SimpleSwap maintains competitive rates, ensuring that users get good value for their exchanges. The platform also provides customer support through various channels, including live chat and email, offering assistance for any queries or issues.

SimpleSwap’s unique selling point is its straightforward, no-nonsense approach to cryptocurrency exchange. It is especially suited for users looking for a quick, easy way to swap a wide array of altcoins without the need for a cumbersome registration process.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | Not Listed |

| Deposit Fee (Credit/Debit Card) | Not Listed |

| Trading Fee | 1% |

| Withdrawal Fee (Bank Transfer) | Not Listed |

6. KuCoin - Best for User Experience

Trading Fees

0.025% - 0.100%

Supported Crypto

967+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 50 others Some through third party apps.

Please note: In March 2024 the US Justice Department charged KuCoin and two founders Chun Gan and Ke Tang alleging that they "affirmatively attempted to conceal the existence of KuCoin’s US customers in order to make it appear as if KuCoin was exempt from US AML and KYC requirements." We would suggest being cautious with using KuCoin at this time.

KuCoin earns its spot as a top cryptocurrency exchange for altcoins due to its extensive selection of digital assets and innovative trading features. Launched in 2017, KuCoin has rapidly grown into a global platform recognized for its diverse range of altcoins and user-friendly experience.

KuCoin distinguishes itself with its unique offerings like a built-in P2P exchange, making it a versatile choice for both casual and advanced traders. Additionally, its user-centric approach, characterized by an easy-to-navigate platform and robust customer support, makes it highly accessible to a broad audience.

KuCoin, often referred to as “The People’s Exchange,” has established a strong presence in the cryptocurrency world with its extensive list of over 967+. This vast selection makes it an ideal platform for traders looking to explore beyond the mainstream cryptocurrencies.

One of the most notable features of KuCoin is its user-friendly interface, which is both intuitive for beginners and sufficiently advanced for experienced traders. The platform also offers various trading options, and a native token (KCS) which provides additional benefits like trading fee discounts and participation in token sales.

KuCoin’s fee structure is competitive, with low trading fees that decrease further for users holding its native KCS tokens. Additionally, the exchange offers several security features, including industry-standard encryption and multi-factor authentication, to ensure the safety of user assets.

However, it’s worth noting that KuCoin is not regulated in some major markets, which might be a concern for users looking for exchanges with more stringent regulatory oversight.

In terms of customer support, KuCoin provides a comprehensive help center, 24/7 live chat, and email support to assist users with any queries or issues, enhancing the overall trading experience on the platform.

Overall, KuCoin stands out as a versatile and user-friendly exchange, ideal for traders interested in a wide range of altcoins and innovative trading features. Its commitment to providing a comprehensive and secure trading environment makes it a preferred choice for many in the crypto community.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 1% |

| Deposit Fee (Credit/Debit Card) | 3.80% |

| Trading Fee | 0.025% - 0.100% |

| Withdrawal Fee (Bank Transfer) | Zero Via P2P |

7. Changelly - Best for Instant Altcoin Exchanges

Trading Fees

0.08% - 0.10%

Supported Crypto

36+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 100 others Some through third party apps.

Changelly has been chosen for its exceptional ease of use and flexibility in cryptocurrency trading. Since its inception in 2015, Changelly has made a name for itself as a reliable and straightforward exchange platform, particularly suited for those new to the world of cryptocurrencies.

What sets Changelly apart is its instant exchange service, allowing users to quickly swap between a wide variety of cryptocurrencies without the need for a traditional exchange. This simplicity, combined with competitive fees and a vast array of supported altcoins, makes it an ideal choice for those seeking a hassle-free trading experience.

Changelly offers a streamlined and intuitive platform, appealing particularly to those who prioritize ease and speed in their trading activities. The platform supports 36+ cryptocurrencies, giving users an expansive range of trading pairs.

The process of exchanging cryptocurrencies on Changelly is remarkably straightforward. Users can swap their assets in just a few steps, without the need for in-depth knowledge of the crypto market. This makes it particularly attractive for beginners or those who prefer a no-frills approach to trading.

In terms of fees, Changelly maintains transparency with a flat 0.08% - 0.10% fee for all crypto-to-crypto exchanges, which is competitive in the market. However, it is important to note that fiat-to-crypto transactions may incur higher fees and variable rates depending on the payment method and service provider.

Security-wise, while Changelly does not hold user funds (reducing certain risks), users should still practice due diligence, especially when providing wallet addresses for transactions.

Customer support on Changelly is robust, with 24/7 availability through live chat and email, ensuring that users’ queries and concerns are addressed promptly.

Overall, Changelly’s strength lies in its simplicity and wide range of supported cryptocurrencies, making it a go-to platform for quick and easy crypto exchanges.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 1% - 7% |

| Deposit Fee (Credit/Debit Card) | 1% - 7% |

| Trading Fee | 0.08% - 0.10% |

| Withdrawal Fee (Bank Transfer) | Not Listed |

8. SushiSwap - Best for Innovative DeFi Services with Altcoins

Trading Fees

0.30%

Supported Crypto

525+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 113 others Only supports fiat currencies through third party apps.

SushiSwap is selected for its innovative approach in the decentralized finance (DeFi) space, particularly for those interested in decentralized exchanges (DEXs) and yield farming. Originating as a fork of Uniswap, SushiSwap has evolved with unique features like SushiBar and Onsen, offering a dynamic and rewarding experience for users.

SushiSwap stands out for its community-focused governance model and its SUSHI token, which not only acts as a tradeable asset but also gives holders a say in the platform’s future developments. This decentralized and participatory approach is a major draw for users who seek more control and involvement in their trading platform.

SushiSwap represents a paradigm shift from traditional centralized exchanges to a decentralized model, offering a unique array of tools and services in the DeFi landscape. It operates as an automated market maker (AMM), allowing users to trade directly from their wallets without the need for an intermediary.

A defining feature of SushiSwap is its liquidity pools, where users can supply assets and earn a portion of the trading fees as well as SUSHI tokens as rewards. The platform’s SushiBar allows users to stake their SUSHI tokens, earning additional rewards and participating in the governance of the platform.

While SushiSwap provides an advanced DeFi experience, it may have a steeper learning curve for those new to decentralized exchanges. However, for those familiar with DEXs, it offers an array of engaging and potentially lucrative opportunities.

In terms of security, being a decentralized platform, SushiSwap puts the responsibility of security largely in the hands of the users. It’s crucial for users to understand smart contract risks and wallet security when engaging with DeFi platforms.

Customer support is primarily community-driven, with resources like forums, Discord channels, and community guides available to assist users. This community-focused approach fosters a strong sense of involvement but might not provide the immediate or personalized support found in centralized exchanges.

| Type | Fee |

|---|---|

| Trading Fee | 0.30% |

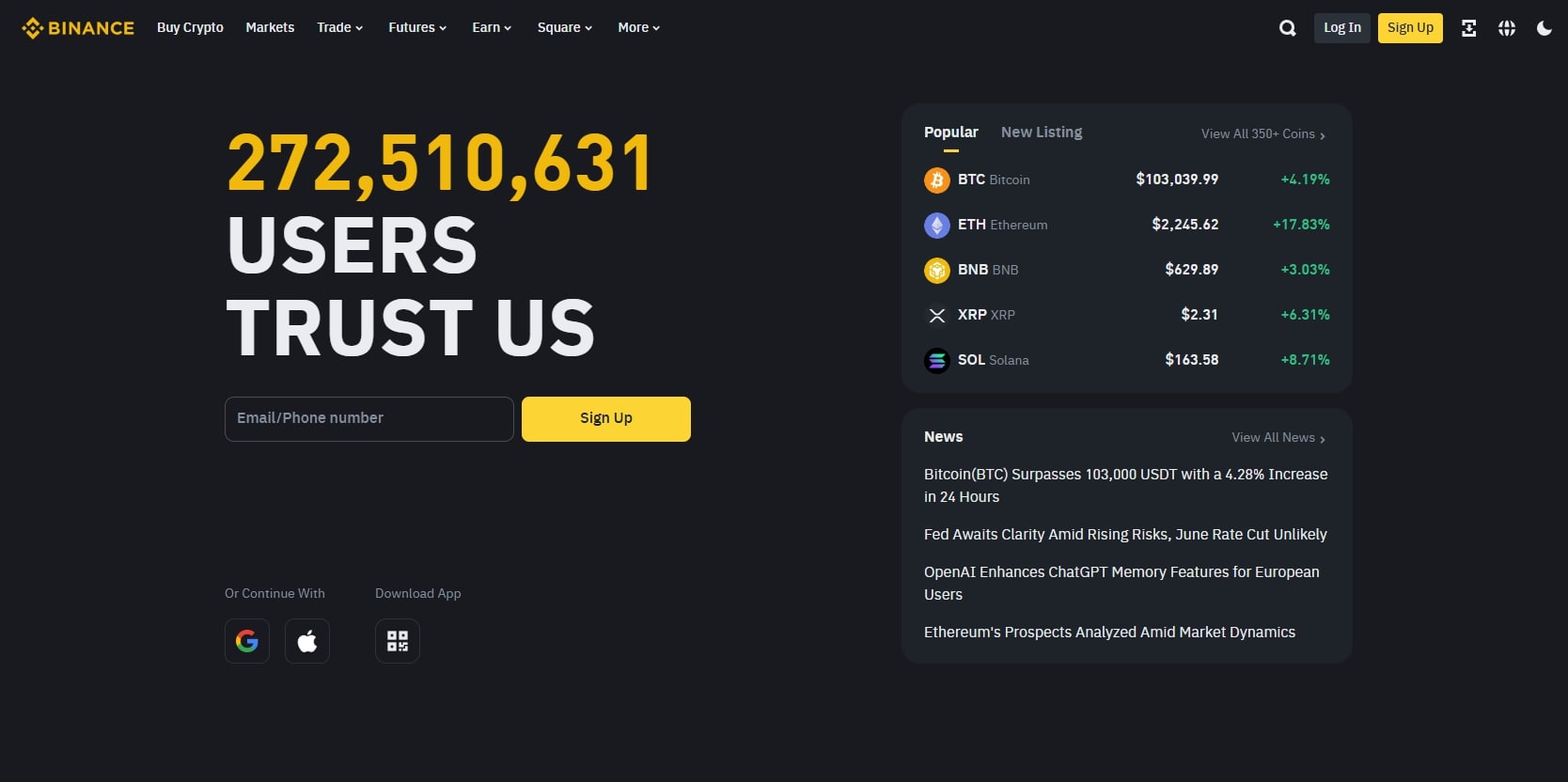

9. Binance - Best for Trading Experience

Trading Fees

0.0110% - 0.1000%

Supported Crypto

418+

Supported Fiat Currencies

USD, GBP, CAD, EUR, NZD + 75 others Some through third party apps.

Please note: Binance has had regulatory challenges in the U.S. and EU. Binance was fined $4b on 21st Nov 2023 by a coordinated effort between the Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) and Office of Foreign Assets Control (OFAC) and the U.S. Commodity Futures Trading Commission (CFTC). Binance still remains the most used exchange in the world, but we would proceed with caution.

Binance is selected for its status as one of the world’s largest and most comprehensive cryptocurrency exchanges. Since its launch in 2017, Binance has been at the forefront of the crypto trading industry, offering an extensive range of cryptocurrencies, advanced trading features, and a robust ecosystem.

Binance’s appeal lies in its deep liquidity, low trading fees, and a wide array of services including spot, and decentralized finance (DeFi) options. Its commitment to innovation, user experience, and security makes it a top choice for both novice and experienced traders globally.

Binance has rapidly grown into a crypto behemoth, providing a platform for trading an impressive array of cryptocurrencies. Its trading interface caters to all levels, from beginners to professional traders, with basic and advanced modes available.

The platform offers more than just trading. It includes a suite of additional services like Binance Earn for staking and earning interest, Binance Academy for educational resources, and Binance Smart Chain for DeFi applications. These features provide users with a holistic crypto experience, far beyond simple trading.

In terms of fees, Binance is known for its competitively low trading fees, which can be further reduced by using the Binance Coin (BNB) for transactions. The platform also emphasizes security, employing multi-tier and multi-cluster system architecture, along with two-factor authentication (2FA) and other security measures to protect user accounts and assets.

However, it’s important to note that Binance has faced regulatory scrutiny in various countries. This highlights the need for users to stay informed about the regulatory environment in their respective regions when using the platform.

Binance’s customer support includes 24/7 live chat, email, and an extensive FAQ section, providing users with a range of options to get assistance.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 0% - 2% |

| Deposit Fee (Credit/Debit Card) | 0% - 2% |

| Trading Fee | 0.0110% - 0.1000% |

| Withdrawal Fee (Bank Transfer) | 0% - 1% |

10. Bybit - Best for Trading Pairs

Trading Fees

-0.0050% - 0.1000%

Supported Crypto

530+

Supported Fiat Currencies

USD, AUD, GBP, CAD, EUR, NZD + 160 others Some through third party apps.

Please note: On February 21, 2025, the cryptocurrency exchange Bybit suffered a major security breach, leading to the theft of approximately $1.4 billion in various cryptocurrencies, including Ethereum (ETH) and staked Ether tokens. The attacker gained unauthorized access to one of Bybit’s cold wallets, transferring funds to unidentified addresses. Bybit’s CEO assured users that the exchange remains solvent and that all client assets are 1:1 backed, with withdrawals continuing as usual. However, users are advised to exercise caution and monitor updates on Bybit’s security measures and ongoing investigations.

ByBit is selected for its strong focus on advanced trading features, making it a significant player in the cryptocurrency exchange landscape. Launched in 2018, ByBit has quickly gained popularity among traders for its user-friendly interface and emphasis on speed, reliability, and customer support.

Key features that set ByBit apart include its leverage trading options, perpetual contracts for multiple cryptocurrencies, and advanced order types, catering to experienced traders seeking a sophisticated trading environment. Additionally, ByBit’s commitment to security and a seamless trading experience has garnered it a loyal user base.

ByBit, established in 2018, has rapidly carved out a niche in the crypto market. The platform is well-regarded for its intuitive interface, making it accessible for newcomers, while also providing the depth of features that seasoned traders expect.

The exchange specializes in leverage trading, offering up to 100x leverage on certain contracts, which is a major draw for traders looking to amplify their trading strategies. ByBit also offers perpetual contracts for cryptocurrencies like Bitcoin, Ethereum, and others, allowing for more flexible trading without expiry dates.

In terms of trading fees, ByBit is competitive, often offering lower fees compared to other major exchanges. The platform also prides itself on its reliable and swift trade execution, reducing the risk of slippage even during market volatility.

Security is a paramount concern for ByBit, which employs multiple layers of protection for users’ funds and data, including an offline cold storage system, real-time monitoring, and two-factor authentication.

Customer support is another strong point for ByBit, with 24/7 availability via live chat, email, and social media platforms. The platform also offers a comprehensive help center and various educational resources to assist traders in navigating its features.

Overall, ByBit stands out as a top choice for those interested in crypto trading, offering a blend of advanced trading features, competitive fees, and a strong emphasis on security and customer support.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | Depends on Fiat Currency |

| Deposit Fee (Credit/Debit Card) | Depends on Fiat Currency |

| Trading Fee | -0.0050% - 0.1000% |

| Withdrawal Fee (Bank Transfer) | Depends on Fiat Currency |

How to Choose the Best Crypto Exchange

Selecting the right cryptocurrency exchange is a crucial step for any trader or investor. It can influence not only your trading experience but also the security of your investments. Here are key factors to consider when choosing the best crypto exchange for your needs:

- Range of Altcoins Offered: If you’re specifically interested in altcoin trading, look for exchanges that offer a wide variety of alternative cryptocurrencies. This includes not only the number of altcoins available but also the diversity in terms of utility, market cap, and technology.

- Security Measures: The security of your funds should be a top priority. Examine the security protocols the exchange has in place, such as two-factor authentication (2FA), cold storage options for digital assets, and the history of security breaches, if any.

- User Interface and Ease of Use: Whether you’re a beginner or an experienced trader, a user-friendly interface can significantly enhance your trading experience. Look for platforms that offer intuitive navigation, clear trading tools, and helpful resources.

- Fee Structure: Understanding the fee structure is vital as it can impact your profitability. Look for transparency in fees, including deposit, withdrawal, and trading fees. Some exchanges offer lower fees for higher trade volumes or for using their native tokens.

- Liquidity: High liquidity ensures that you can buy and sell assets quickly and at a price close to the market rate. Exchanges with higher trading volumes typically provide better liquidity.

- Regulatory Compliance: The regulatory status of an exchange can affect its reliability and the level of consumer protection it offers. Opt for exchanges that comply with regulations in their operating jurisdictions.

- Customer Support and Community: Good customer support can be invaluable, especially in resolving urgent issues. Check the availability of support channels like live chat, email, or phone. Also, consider the strength and activity of the exchange’s user community.

- Additional Features and Tools: Some exchanges offer extra features like staking, margin trading, or access to specific DeFi projects. Depending on your trading style and interests, these features can add significant value.

- Performance and Reliability: Consider the exchange’s history of downtime and its ability to handle high traffic during peak trading times. Reliable performance is crucial in fast-paced crypto markets.

- Educational Resources: Especially for beginners, having access to educational materials can be a huge benefit. Look for exchanges that provide learning resources to help you understand various aspects of cryptocurrency trading.

By carefully considering these factors, you can choose a cryptocurrency exchange that not only meets your trading needs but also provides a secure and enjoyable trading environment. Remember, the best exchange for you is one that aligns well with your individual trading strategy and goals.

Final Thoughts

Each exchange we’ve featured stands out for its unique strengths, whether it’s the depth of altcoin offerings, cutting-edge trading features, robust security measures, or user-friendly interfaces. From decentralized exchanges that champion the spirit of DeFi to centralized platforms offering advanced trading tools and high liquidity, the range of options caters to a wide spectrum of trading preferences and strategies.

The importance of careful selection cannot be overstated in the world of cryptocurrency trading. Security, fees, liquidity, and user experience are key considerations that should guide your choice. It’s crucial to align your selection with your individual trading goals and risk tolerance.

Moreover, the world of cryptocurrencies is constantly evolving, with new altcoins and innovative platforms emerging regularly. Staying informed and adaptable is essential in this rapidly changing environment. The exchanges we’ve reviewed offer a gateway to this evolving landscape, each providing a unique window into the vast universe of altcoins.

FAQs

Binance is widely recognized for supporting a large number of cryptocurrencies. It offers a vast range of altcoins compared to most other exchanges.

Other exchanges like KuCoin also support a considerable variety of coins, including many smaller and less-known altcoins.

To buy new altcoins, you can explore platforms like Binance, KuCoin, and Uniswap. These exchanges are known for listing new altcoins relatively quickly.

Decentralized exchanges (DEXs) like Uniswap or Sushiswap often list new tokens faster than centralized exchanges, as they don’t have the same listing processes.

Additionally, Initial Coin Offering (ICO) platforms or new project launches on platforms like PancakeSwap are also places to find new altcoins.

Binance is generally considered the largest exchange for altcoins in terms of trading volume and the variety of altcoins available.

It offers a wide range of altcoins and is known for its high liquidity, making it a popular choice for altcoin traders. Other large exchanges for altcoins include KuCoin, and OKEx.

Methodology

Our team employs a rigorous rating process, analysing various criteria to determine our star rating system. This system allows us to condense our extensive research into an easy-to-understand format. For a deeper dive into our rating process, check out our full methodology.

We assess crypto exchanges based on the following criteria:

- Platform Usability: How user-friendly is the platform for beginners? What advanced tooling and charting features are available for seasoned traders?

- Supported Cryptocurrencies: What's the range of supported cryptocurrencies, and how frequently does the exchange add new ones?

- Supported Fiat Currencies: How many fiat currencies are supported? Are the banking relationships direct or through third parties?

- Deposit and Withdrawal Methods: Are there diverse methods for account funding and withdrawals?

- Fees: How competitive are the trading, deposits, and withdrawal fees? Is the exchange known for adding large spreads to conversions?

- Customer Support: How accessible and helpful is the customer support team? Are multiple support methods available?

- Exchange Activity: How proactive is the exchange in terms of updates? Is their social media presence active, and do they engage with the community regularly?

- Security: What security measures are in place to safeguard users, such as Two-Factor Authentication (2FA), relevant certifications and general security processes? If the exchange has experienced significant hacks, how have they addressed and evolved from those incidents?

- Regulatory Registrations: Does the exchange meet the necessary regulatory requirements to operate in Australia?