Pros

Cons

Quick Summary

| Headquarters Location | Brooklyn, New York, USA |

|---|---|

| Fiat Currencies Supported (through third party apps) | USD, AUD, GBP, CAD, EUR, NZD + 33 others |

| Total Supported Cryptocurrencies | 1786+ |

| Trading Fees | 0.30% |

| Deposit Methods | Cryptocurrency, MoonPay |

| Support | Twitter, Instagram, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS |

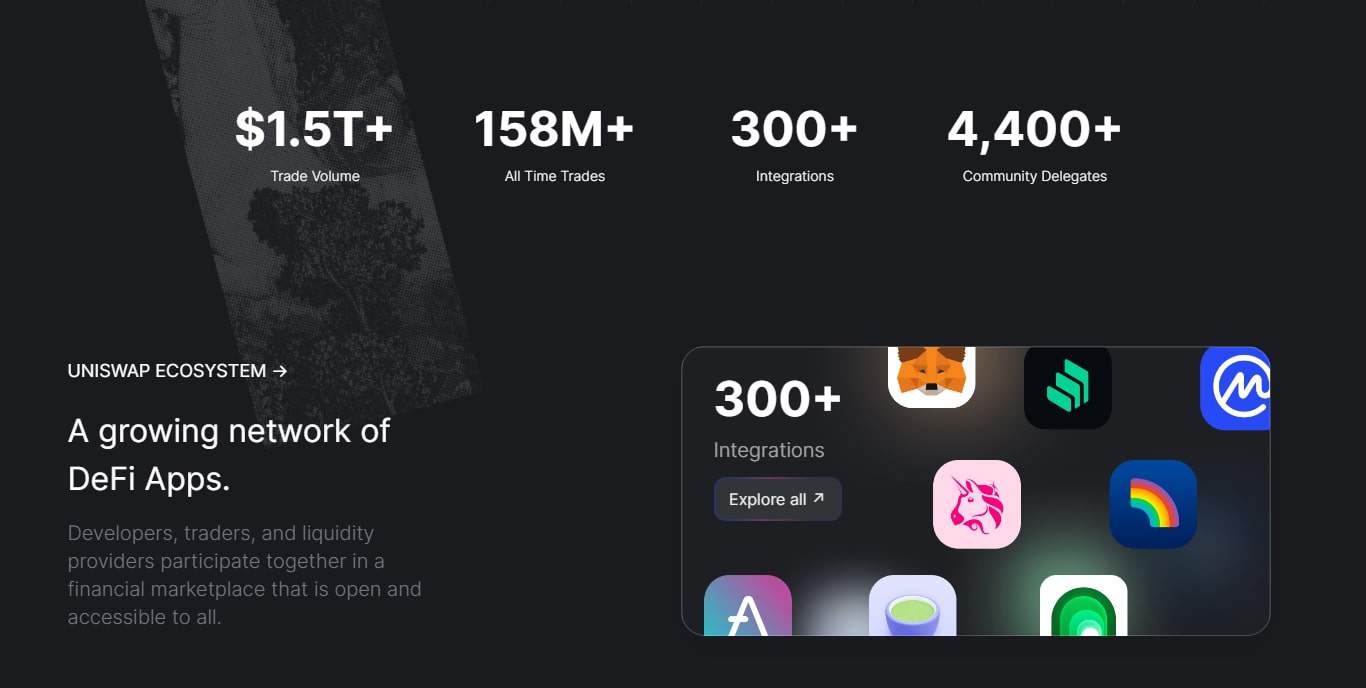

Uniswap is a shining example of the capabilities of decentralized applications (dApps) and has played an instrumental role in the growth of the decentralized finance (DeFi) ecosystem. The platform has devised an innovative model based on liquidity pools and automated market maker (AMM) technology to facilitate peer-to-peer cryptocurrency trading, eliminating the need for an order book or central intermediary. The Uniswap app allows users to access these features and participate in the DeFi revolution easily.

Operating primarily on the Ethereum blockchain, the Uniswap exchange allows almost any ERC-20 token to be exchanged with no listing fees. It also now supports many other popular chains including Arbitrum, Optimism, Base, Polygon, BNB and Avalanche. The automated market maker technology used by the Uniswap protocol adjusts the prices in the liquidity pools based on supply and demand dynamics to provide a fair market value and maintain liquidity.

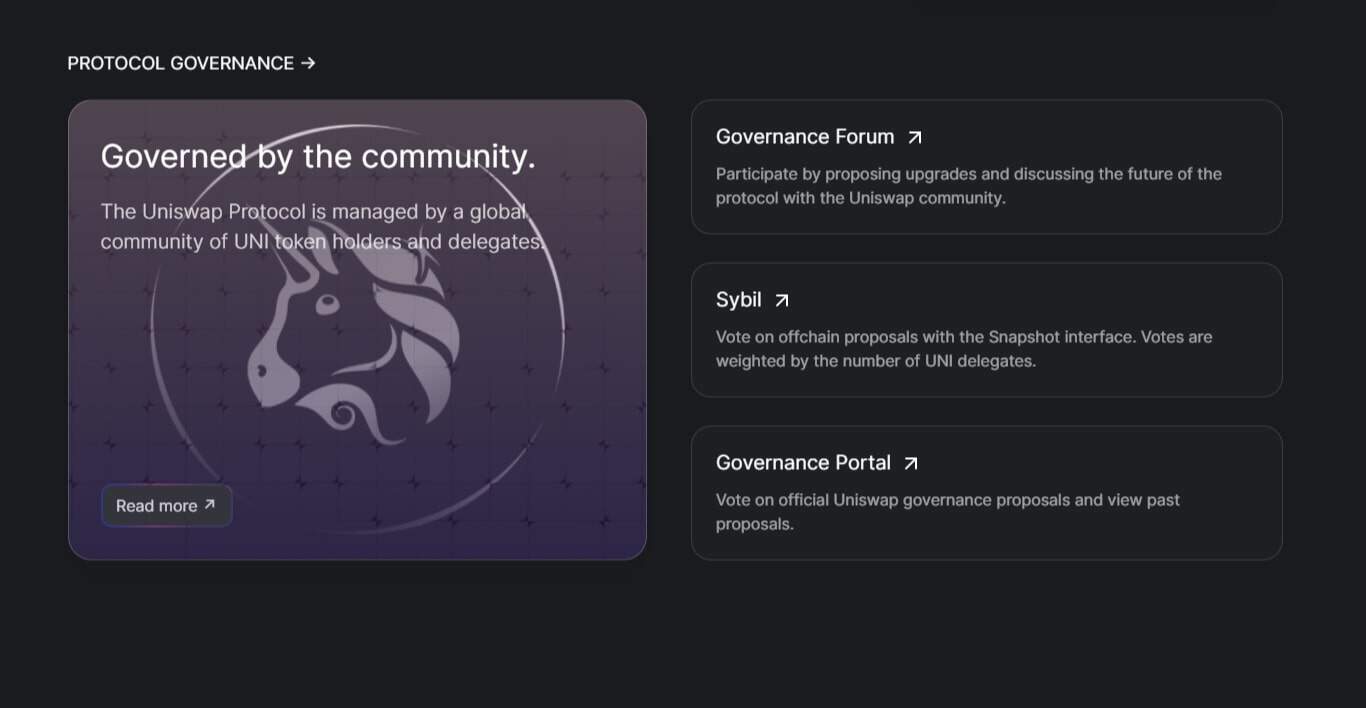

Additionally, the introduction of its native governance token UNI in September 2020 has empowered token holders with voting rights on project developments and platform governance.

About Uniswap

Uniswap was brought to life in 2018 by Hayden Adams, whose vision has changed the cryptocurrency landscape.

Uniswap enables anyone with various crypto wallets to trade tokens without needing a third-party intermediary. Uniswap’s Automated Market Maker (AMM) model brings this freedom and ease of trading to life, where token swaps are executed against liquidity stored in smart contracts.

Uniswap, being a decentralized exchange, offers the following benefits:

- Users maintain complete control of their digital assets

- Users have the autonomy to manage their assets and trade directly from their crypto wallets

Uniswap has a number of active social profiles including Twitter, Instagram, LinkedIn, Discord and Reddit.

Uniswap has a mobile app on the Apple App Store.

Uniswap Supported Cryptocurrencies

Uniswap supports trading on over 1786 cryptocurrencies on their platform. This exchange currently supports 16 of the top 30 market cap cryptocurrencies.

View all cryptocurrencies Uniswap supports

- $ADS

- $AI

- $ANRX

- $BLITSQUAD

- $FORWARD

- $HAMSTR

- $MECHA

- $MILLIWAYS

- $MNB

- $MONG

- $MUSIC

- $NET

- $NTMPI

- $PAAL

- $PAPER

- $PUMP

- $PUSS

- $ZKP

- ( ͡° ͜ʖ ͡°)

- .COM

- 0

- 0NE

- 0XBTC

- 18C

- 18SML711

- 1CAT

- 1GBP

- 1INCH

- 21DOGE

- 21XRP

- 33

- 3301

- 3CRV

- 3DT

- 404BLOCKS

- 404CATS

- 4B

- 4CHAN

- 4M4

- @LFG

- AA

- AAA

- AAVE

- ABI

- ABOND

- ABST

- ABT

- ABTC

- ABTO

- ACC

- ACH

- ACQ

- ACR

- ACX

- AD

- ADS

- ADT

- ADX

- AEG

- AEGIS

- AEVO

- AGB

- AGEUR

- AGII

- AGIX

- AGLD

- AGRS

- AI

- AIBABYDOGE

- AIGF

- AIMR

- AIN

- AIOZ

- AIT

- AJNA

- AKITA

- ALCA

- ALCX

- ALEPH

- ALEX

- ALI

- ALPH

- ALPHABET

- ALPHR

- ALT

- ALUSD

- ALVA

- AMD

- AMKT

- AMMX

- AMO

- AMP

- AMPL

- AMUX

- ANDY

- ANFD

- ANGLE

- ANKR

- ANKRETH

- ANS

- ANT

- ANTD

- APE

- API3

- APU

- APUFF

- APW

- APX

- ARA

- ARB

- ARBUZ

- ARC

- ARCD

- ARIA20

- ARKM

- ARTE

- ARTH

- ASH

- ASI

- ASIC

- AST

- ASTX

- ASX

- ATG

- ATH

- ATOR

- ATOS

- ATPAD

- AUCTION

- AUDD

- AUDIO

- AURA

- AUSD

- AUTO

- AUTUMN

- AVA

- AVAV

- AVI

- AVINOC

- AVT

- AWETH

- AXGT

- AXIS

- AXL

- AXS

- AZT

- B2M

- B3

- BABY

- BABYDOGE

- BABYPONKE

- BAD

- BADGER

- BAG

- BAHAMAS

- BAL

- BAM

- BANANA

- BANANACAT

- BAND

- BANK

- BAO

- BAOZ

- BARA

- BASEDAI

- BAT

- BBG

- BBL

- BBS

- BBTC

- BC

- BCAT

- BCAU

- BCT

- BCUG

- BCUT

- BDID

- BDT

- BDX

- BEAM

- BEAR

- BEARDY

- BEASTS

- BED

- BEEF

- BEER

- BEETCOIN

- BEFI

- BEG

- BELP

- BEN

- BEPRO

- BERRY

- BETA

- BETS

- BICO

- BIDEN

- BIEBER

- BIFI

- BIGTIME

- BIPS

- BIPX

- BIT

- BITCOIN

- BITS

- BKKG

- BKN

- BLEAT

- BLENDR

- BLID

- BLLB

- BLOCK

- BLOCKS

- BLOOD

- BLOX

- BLUE

- BLUR

- BLUSD

- BNB

- BNT

- BNTY

- BOB

- BOBA

- BOBO

- BOJACK

- BOLT

- BOME

- BOND

- BONE

- BONK

- BONZAI

- BOO

- BOOK

- BOOP

- BOSON

- BOTTO

- BOXETH

- BOXFEE

- BPX

- BRAINERS

- BRD

- BRETT

- BRI

- BRIGHT

- BRISE

- BRO

- BRWL

- BSGG

- BSKT

- BSSB

- BTC20

- BTC2X-FLI

- BTCBR

- BTCINU

- BTCP

- BTREE

- BTRFLY

- BTRST

- BTT

- BUCC

- BUGS

- BULLY

- BUMP

- BURN

- BUSD

- BUSY

- BUY

- BVM

- BXR

- BYTE

- BYTES

- BZZ

- C2H6

- CAD

- CADC

- CAH

- CAL

- CANDY

- CAPS

- CAPYBARA

- CARB

- CARBON

- CARD

- CARN

- CAST

- CAW

- CBABY

- CBETH

- CBX

- CBY

- CCBCH

- CCC

- CCDAO

- CDAI

- CDCETH

- CDFI

- CDT

- CEL

- CELL

- CELO

- CELR

- CERES

- CETH

- CETI

- CFD

- CGG

- CGLD

- CGPT

- CGT2.0

- CHAD

- CHDR

- CHEQ

- CHESS

- CHEX

- CHI

- CHIB

- CHKN

- CHO

- CHR

- CHZ

- CHZB

- CIOTX

- CIV

- CJPY

- CLB

- CLPC

- CLUB

- CLV

- CMB

- CMINER

- CMP

- CMPT

- CNC

- CND

- CNFI

- CNG

- CNLT

- CNV

- COBE

- COC

- COFFEE

- COLLE

- COM

- COMBO

- COMP

- CON

- CONG

- COPE

- COREDAO

- COSMIC

- COTI

- COVAL

- COW

- CPOOL

- CPRC

- CPU

- CQT

- CRAB

- CRAZYPEPE

- CRE

- CREAM

- CREO

- CRIMINGO

- CRO

- CROT

- CRPT

- CRU

- CRUNCH

- CRV

- CRVUSD

- CRYO

- CSCEC

- CSWAP

- CTG

- CTLS

- CTM

- CTO

- CTSI

- CUDOS

- CUP

- CV

- CVX

- CVXCRV

- CX

- CXO

- CYBER

- CZ

- D2T

- DACAT

- DAI

- DAM

- DAMEX

- DAMM

- DAMMO

- DAO

- DAR

- DATA

- DAVE

- DAWGS

- DAWN

- DBC

- DBI

- DC

- DCA

- DCAC

- DCARD

- DCEUR

- DCFC

- DCHF

- DCK

- DD

- DEAI

- DECI

- DEFI

- DEFROGS

- DEJITARU SHIRUDO

- DEL

- DELTA RLP

- DEMONZ

- DENCH

- DENT

- DEO

- DEPAY

- DERC

- DERP

- DEV

- DEVT

- DEVVE

- DEXT

- DEXTF

- DF

- DG

- DGEN

- DHT

- DI

- DIA

- DIMO

- DINGER

- DINO

- DINU

- DIP

- DISCO

- DIVER

- DMT

- DMTR

- DN

- DN404

- DNNER

- DOG

- DOGC

- DOGECOIN

- DOGEGF

- DOGWIFHAT

- DOLA

- DOLZ

- DOMI

- DOOM

- DOOMER

- DOP

- DORK

- DOV

- DOVA

- DOX

- DPI

- DPS

- DR

- DRAG

- DRAGONX

- DRAK

- DREAM

- DRGN

- DSC

- DSETH

- DSU

- DSYNC

- DTH

- DUCK

- DUCKS

- DUSK

- DUST

- DVF

- DVI

- DVT

- DWIF

- DXD

- DXN

- DYAD

- DYDX

- DZAR

- DZHV

- EBTC

- ECL

- ECOTERRA

- ECOX

- EDGE

- EDOGE

- EEFI

- EFI

- EL

- ELA

- ELAND

- ELFI

- ELIT

- ELMT

- ELO

- ELON

- ELONINDEX

- ELUNR

- EMAID

- EMERALD

- EMP

- EMRLD

- ENA

- ENJ

- ENO

- ENQAI

- ENS

- ENTER

- EON

- EPEPE

- EPHIAT

- EPIKO

- EPOCH

- ERBB

- ERC20

- ERIC

- ERN

- ERR

- ERROR

- ESE

- ESOV

- ESS

- ETCH

- ETF

- ETH+

- ETH2.0

- ETH2X

- ETH2X-FLI

- ETHFI

- ETHIX

- ETHMNY

- ETHO

- ETHR

- ETHTC

- ETHTCG2

- ETHV

- ETHX

- EUL

- EURA

- EURC

- EURE

- EUROE

- EURT

- EUSD

- EWTB

- EXCITE BIKE

- EXD

- EXNT

- EXRD

- EZETH

- F404

- F9

- FABRIC

- FACTR

- FAKT

- FARM

- FCO

- FDUSD

- FDZ

- FEI

- FENIX

- FERC

- FET

- FFS

- FI

- FIDU

- FIEF

- FINALE

- FINE

- FLC

- FLIP

- FLOAT

- FLOKI

- FLOOR

- FLP

- FLRBRG

- FLT

- FLUX

- FMB

- FMC

- FNCT

- FOAM

- FOLD

- FOOM

- FORGE

- FORK

- FORT

- FORTH

- FOX

- FOXE

- FOXY

- FP

- FPI

- FPIS

- FRAX

- FREE

- FRENS

- FRG

- FRIC

- FROIG

- FRXETH

- FTM

- FTR

- FTX TOKEN

- FUN

- FUND

- FUNG

- FUSE

- FWB

- FWIF

- FXS

- G-BUCKS

- G-CRE

- G3

- GAIN

- GAL

- GALA

- GALEON

- GAMMA

- GAPE

- GAZA

- GBTC

- GBYTE

- GDAX

- GDIT

- GDT

- GEAR

- GEL

- GEM

- GEMAI

- GEN

- GENE

- GENETH

- GENI

- GENIE

- GENOME

- GENSLR

- GET

- GETH

- GF

- GFI

- GG

- GGTK

- GHO

- GHST

- GHX

- GIV

- GLM

- GLQ

- GMEE

- GMM

- GMT

- GNO

- GNOME

- GNUS

- GODS

- GOFURS

- GOG

- GOHM

- GOLD

- GOON

- GOVI

- GPBP

- GPT

- GPU

- GRAI

- GRAIN

- GRAVITAS

- GREEN

- GRG

- GRIDS

- GRIT

- GROK

- GROK2.0

- GROKS

- GROW

- GRT

- GSWIFT

- GTC

- GTCETH

- GTG

- GUIDE

- GUSD

- GYEN

- HABIBI

- HAI

- HAIR

- HAKA

- HAL

- HAMAZ

- HAN

- HARAM

- HARAMBE

- HARRIS

- HASHAI

- HAY

- HBOT

- HDRN

- HEART

- HEGIC

- HEHE

- HERA

- HETH

- HEX

- HFT

- HIFI

- HILO

- HIPP

- HIXOKDKEKJCJDKSICNDNAIAIHSBZNNXNXNDUJE

- HLX

- HMQ

- HMX

- HOME

- HONO

- HOP

- HOPE

- HOPPY

- HOPR

- HOSHI

- HOT

- HOTDOG

- HPO

- HUNT

- HVE2

- HYPE

- HYPER

- HYVE

- IAI

- IBIT

- ICE

- ICETH

- ICHI

- ICHING

- ICSA

- ID

- IDEX

- IDLE

- IDRT

- IETHV

- ILLITERATE

- ILV

- IMGNAI

- IMPT

- IMX

- INDEX

- INJ

- INNBC

- INS

- INSP

- INST

- INSTETH

- INSWETH

- INU

- INUINU

- INV

- INXT

- IOC

- IOTX

- IPOR

- IPT

- IQ

- IQT

- ISK

- ITX

- IUSD

- IXS

- IZE

- IZI

- JAM

- JARED

- JARVIS

- JASMY

- JAY

- JBX

- JCC

- JEFE

- JEFF

- JESUS

- JINLI

- JJ0001

- JOE

- JOEY

- JOVJOU

- JPEG

- JPG

- JPYC

- JUSTICE

- JZC

- KABOSU

- KAI

- KARATE

- KAS

- KASINU

- KATA

- KAYEN

- KCS

- KEEP

- KEL

- KEP

- KEROSENE

- KEX

- KEY

- KING

- KITTY LITTER

- KIZUNA

- KLUB

- KMON

- KNC

- KNG

- KNINE

- KOI

- KOK

- KOMPETE

- KON

- KP3R

- KRL

- KROM

- KRX

- KSTA

- KUJI

- KUMA

- KXA

- L

- L2

- L2PAD

- LADYS

- LAI

- LAKE

- LBLOCK

- LBP

- LC

- LCX

- LDAO

- LDO

- LEASH

- LEO

- LEOX

- LEVER

- LGB

- LGBTQ

- LHC

- LIF3

- LINA

- LINK

- LINQ

- LINU

- LIQ

- LIQLIT

- LIT

- LK99

- LLM

- LMEOW

- LMR

- LMWR

- LNDX

- LOC

- LOCK

- LONDON

- LOOKS

- LOOM

- LOONG

- LORDS

- LOVE

- LOVESNOOPY

- LPT

- LQTY

- LRC

- LSETH

- LUCHOW

- LUCKY

- LUIS

- LUNA

- LUSD

- LYRA

- LYXE

- M2

- MAGATRUMP

- MAHA

- MAI

- MAL

- MANA

- MAP

- MARVIN

- MASA

- MASK

- MASQ

- MASYA

- MATCHA

- MATH

- MATIC

- MATTER

- MAVIA

- MAXI

- MAZZE

- MBONK

- MBX

- MC

- MCADE

- MCB

- MCG

- MCHC

- MCRT

- MDN

- MDT

- MDX

- MEGA

- MELANIA

- MELD

- MELON

- MEMAGX

- MEME

- MEOW

- MERC

- MET

- METH

- METIS

- METRO

- MEU

- MEVETH

- MFERS

- MGH

- MICKEY

- MIDWIT

- MILADY

- MIM

- MINER

- MINNIE

- MIX

- MKR

- ML

- MLH

- MLN

- MM

- MMA

- MMT

- MMVG

- MMX

- MNRCH

- MNT

- MNW

- MOBY

- MOCA

- MOG

- MOLLY

- MON

- MONAI

- MONKEEES

- MONKEYS

- MONKGG

- MOOH

- MOON

- MOONEY

- MOOX

- MORK

- MPETH

- MPL

- MPS

- MRF

- MT

- MTA

- MTLX

- MTO

- MTRM

- MUBI

- MUD

- MUMU

- MUNCHIES

- MUSE

- MUTE

- MVI

- MWSTETH-WPUNKS:20

- MXC

- MYRIA

- MYST

- MYTH

- MZERO

- MZM

- N

- N7

- NABOX

- NAKA

- NATI

- NAVI

- NBT

- NCR

- NCT

- NEAR

- NEF

- NEMS

- NEPE

- NESSY

- NETH

- NETVR

- NEXO

- NEXT

- NFAI

- NFD

- NFTC

- NFTL

- NFTX

- NFTY

- NGL

- NGN

- NHUB

- NII

- NKN

- NMR

- NOC

- NODED

- NOIA

- NORMIE

- NOTE

- NOW

- NPC

- NPEPE

- NRG

- NRK

- NSFW

- NTX

- NU

- NUT

- NUTS

- NVIR

- NXRA

- NYM

- NZDD

- O

- O3

- O404

- OBI

- OBOT

- OBTC

- OBX

- OCEAN

- OCH

- OCT

- OETH

- OG404

- OGN

- OGV

- OHM

- OJEE

- OK

- OKB

- OKINAMI

- OLAS

- OLM

- OLY

- OM

- OMG

- OMI

- OMNI

- ONDO

- ONEICHI

- OOFP

- OOKI

- OOKS

- OP

- OPIUM

- OPN

- OPSEC

- OPTIMUS

- OPUL

- ORAIX

- ORC

- ORDI

- ORDS

- ORN

- OS

- OSAK

- OSETH

- OSKY

- OSQTH

- OTACON

- OUSD

- OVOA

- OVR

- OX

- P404

- PABLO

- PACO

- PACT

- PAI

- PAID

- PAINT

- PAL

- PAN

- PANDA

- PANDORA

- PANTHER

- PAPER

- PAPRMEME

- PAR

- PARTY

- PAS

- PASG

- PASS

- PATEX

- PAW

- PAXG

- PBASED

- PCH

- PCSWAP

- PDA

- PDT

- PDX

- PEAS

- PEDALA

- PEEN

- PENDLE

- PENGU

- PEOPLE

- PEPCO

- PEPE

- PEPE2

- PEPECOIN

- PEPEL

- PEPES

- PEPEXL

- PEPINU

- PERP

- PET

- PETHOS

- PFPASIA

- PHA

- PICKLE

- PIKA

- PIN

- PINCEPTION

- PINEOWL

- PIP

- PIXE

- PIXEL

- PIXL

- PKF

- PLAY

- PLAYFI

- PLBT

- PLEB

- PLOT

- PLSB

- PLT

- PLU

- PMON

- PNDC

- PNK

- PNPC

- PNT

- POHM

- POINTS

- POL

- POLA

- POLK

- POLS

- POLY

- POMI

- POODL

- POOH

- POOL

- POP

- PORK

- PORK2.0

- PORT3

- PORTAL

- POW

- POWR

- PPEAS

- PPEPECOIN

- PPPP

- PRE

- PRIME

- PRIMEETH

- PRNT

- PRO

- PROM

- PROPC

- PROS

- PRQ

- PRT

- PRTC

- PRX

- PSALE

- PSI

- PSP

- PSWAP

- PSYOP

- PTOY

- PTT1

- PUFETH

- PUMLX

- PUNDIX

- PUPE

- PUPPIES

- PURPLE

- PUSH

- PUT-IN

- PUTIN

- PVFYBO

- PXETH

- PYR

- PYUSD

- QANX

- QDT

- QKNTL

- QLT

- QNT

- QORPO

- QRDO

- QSP

- QUACK

- QUAI

- QUBE

- QUIQ

- RACER

- RAD

- RADAR

- RAE

- RAI

- RAIL

- RAIN

- RAINI

- RAIT

- RARE

- RARI

- RATE

- RATS

- RBC

- RBLZ

- RBN

- RBX

- REEE

- REEF

- REMIT

- REN

- RENBTC

- RENQ

- REPV2

- REQ

- RETH

- RETH2

- REVV

- RFD

- RFK

- RFKJ

- RFOX

- RGHT

- RIBT

- RICE

- RICK

- RING

- RIO

- RIPDOGE

- RIVUS

- RLB

- RLC

- RLY

- RMV

- RND

- RNDR

- RNG

- ROAR

- ROCK

- RODO

- ROKO

- RON

- ROOT

- ROP

- RPILL

- RPK

- RPL

- RPTC

- RSC

- RSETH

- RSR

- RSS3

- RST

- RSWETH

- RTH

- RUG

- RUNE

- RUNIC

- RVST

- RWS

- RYOSHI

- SABAI

- SABR

- SACKS

- SAFETH

- SAI

- SAIL

- SAITABIT

- SAITO

- SAMA

- SAMALTMAN

- SAN

- SAND

- SATOSHI

- SAVM

- SBIO

- SCALE

- SCHRODI

- SCLM

- SCOTTY

- SD

- SDAI

- SDAO

- SDAX

- SDEX

- SDG

- SDL

- SDOG

- SEAM

- SEED

- SEEDS

- SELF

- SEN

- SENATE

- SES

- SETH

- SETH2

- SEXY

- SFI

- SGR

- SGT

- SHAPE

- SHARES

- SHEB

- SHEETP

- SHFL

- SHI

- SHIA

- SHIB

- SHIBA2

- SHIBARIUM

- SHIK

- SHIT

- SHK

- SHMU

- SHOOKI

- SHOP

- SHRAP

- SHROOM

- SHX

- SI

- SIDUS

- SIFU

- SILO

- SILV2

- SIMP

- SIPHER

- SISC

- SIX

- SKEB

- SKEL

- SKEY

- SKIN

- SKRIMP

- SKYNET

- SLACK

- SLI

- SLN

- SLOP

- SLOPY

- SLP

- SLR

- SMART

- SMILEY

- SMOG

- SMT

- SMTX

- SMURFS

- SNEK

- SNIPE

- SNOW

- SNSY

- SNT

- SNTZL

- SNX

- SOCKS

- SODO

- SOL

- SOLIDX

- SOLVE

- SOMM

- SORA

- SOS

- SOTU

- SOUL

- SOV

- SPARK

- SPAY

- SPC

- SPEED

- SPELL

- SPLY

- SPONGE

- SPOT

- SPT

- SQT

- SQUID

- SSNC

- SSV

- STAO

- STAR

- STASH

- STATE

- STBU

- STC

- STETH

- STFX

- STG

- STKAAVE

- STMATIC

- STMX

- STONE

- STORJ

- STOS

- STRDY

- STRK

- STTAO

- SU

- SUDO

- SUKU

- SUMMER

- SUPER

- SURE

- SUSD

- SUSDE

- SUSHI

- SVETH

- SWAP

- SWASH

- SWEAT

- SWETH

- SWFTC

- SWISE

- SWITCH

- SWK

- SWTH

- SX

- SYN

- SYNC

- T

- TADPOLE

- TAI

- TAIL

- TALK

- TAMA

- TAURUS

- TBANK

- TBTC

- TCR

- TDC

- TEAM

- TEL

- TENET

- TEPE

- TEQ

- TEST123

- TEXAN

- TFT

- TGC

- THE

- THE ONE

- THEO

- THOL

- THUSD

- TIA

- TIME

- TIP

- TITANX

- TKAI

- TKB

- TKING

- TKX

- TLOS

- TMNT

- TNT

- TOIL

- TOKA

- TOKEN

- TOKENWATCH

- TONCOIN

- TONE

- TOPIA

- TORN

- TOS

- TOWER

- TOYBOX

- TPRO

- TPT

- TPU

- TRAC

- TRADE

- TRB

- TRDM

- TREE

- TRESTLE

- TRG

- TRIAS

- TRIBE

- TRISM

- TROLL

- TRSY

- TRU

- TRUF

- TRUTH

- TRVL

- TRX

- TRXC

- TSCT

- TSUKA

- TUNA

- TUNE

- TURBO

- TURT

- TUSD

- TXJP

- TXT

- TYPE

- TYRANT

- UBT

- UBX

- UDOGE

- UDT

- UDW

- UEFN

- UERII

- UFO

- UFT

- UJENNY

- ULX

- UMA

- UNA.WEMIX

- UNB

- UNCX

- UNDER

- UNI

- UNI-V2

- UNIDX

- UNIETH

- UNIFI

- UNION

- UNIVERSE

- UNQT

- UNT

- UOS

- UPVEMBER

- USDA

- USDC

- USDD

- USDE

- USDM

- USDP

- USDT

- USDV

- USDY

- USHIB

- UST

- USX

- UTU

- UWU

- VAI

- VAL

- VARK

- VCX

- VEE

- VEGA

- VEMP

- VEUR

- VEXT

- VGA

- VINCE

- VINU

- VIRTUAL

- VITA

- VITA-FAST

- VLIZ

- VMINT

- VMPX

- VMX

- VNV

- VNXAU

- VOLTA

- VOW

- VPAD

- VPP

- VRA

- VROOM!

- VSP

- VXV

- VYBN

- WAGMI

- WALLET

- WAMPL

- WAO

- WAR

- WAS

- WAVAX

- WAVX

- WAXP

- WBAI

- WBEAM

- WBGL

- WBNB

- WBRGE

- WBTC

- WCELL

- WCFG

- WCOMAI

- WCTC

- WDOGE

- WEED

- WEETH

- WEOWNS

- WETH

- WF9

- WFIO

- WFLOW

- WG0

- WGK

- WHETH

- WHITE

- WHO

- WHRH

- WILD

- WILDFIRE

- WIN

- WINTER

- WIS

- WKRU

- WLD

- WLYX

- WMC

- WMINIMA

- WMT

- WNXM

- WOJAK

- WOMBAT

- WOO

- WOOF

- WOOFY

- WOOL

- WORF

- WPC

- WPCT

- WPEPE

- WPLS

- WPOKT

- WPPC

- WRLD

- WSB

- WSH

- WSM

- WSTETH

- WSTOR

- WTAO

- WTF

- WTK

- WTON

- WX

- WXMR

- X

- X8X

- XAI

- XALPHA

- XAUT

- XBASKET

- XBTC

- XCHF

- XCM

- XCORN

- XCUR

- XD

- XDAO

- XDEFI

- XDOGE

- XED

- XEN

- XENO

- XFT

- XI

- XIN

- XLON

- XMON

- XMT

- XNL

- XONE

- XOR

- XPR

- XPT

- XRA

- XRGB

- XRICE

- XRT

- XSGD

- XSOY

- XTP

- XTREME

- XVS

- XWHEAT

- XWING

- XYO

- XYXYX

- YAI

- YCO

- YFI

- YFII

- YFLOW

- YGG

- YLD

- YUAN

- YUP

- ZAAR

- ZAP

- ZAPI

- ZARP

- ZCHF

- ZCN

- ZCX

- ZEN

- ZENF

- ZENIQ

- ZERO

- ZETA

- ZK

- ZKML

- ZOE

- ZOOA

- ZRX

- ZURR

- ZUSD

- ZUZALU

- ZVT

- ZYN

- μ0N1

- μAZUKI

- μBAKC

- μBAYC

- μBEANZ

- μCAPTAINZ

- μCLONEX

- μCOOL

- μDEGODS

- μDOODLE

- μELEM

- μES

- μGHOST

- μJEERGIRL

- μKONGZBABY

- μLP

- μMAYC

- μMFER

- μMIL

- μMOONBIRD

- μNKMGS

- μNOBODY

- μOTHR

- μPOTATOZ

- μPPG

- μSAPS

- μTENJIN

- μTINFUN

- μWOW

- μY00T

- μϾ721

- μ⚇

- шайлушай

- ♆

- ✺RUG

- 九錫

- 抖音青蛙

- 魔族

- 똥코인

- 𝕏PAY

- 🌐

Uniswap provides users access to a wide selection of tokens for trading. However, the rising popularity of Uniswap has attracted the attention of scammers, making it essential for users to be vigilant when engaging with tokens on the platform. Fraudulent activities on Uniswap may involve the creation of counterfeit tokens, project exit scams, or liquidity pool manipulations aimed at deceiving investors.

Users can verify token authenticity through reputable sources like CoinMarketCap or CoinGecko, which provide legitimate links to Uniswap trading pairs, reducing the chances of encountering fraudulent tokens.

Spotting Scams and Fake Tokens

To avoid falling prey to scams on Uniswap, users should:

- Conduct thorough research on project teams

- Verify smart contract audits

- Use trusted sources

- Scrutinize social media presence and community reviews

- Analyze token details such as the contract address, liquidity, volume, and social media presence

By following these steps, users can ensure token authenticity and spot potential scams on Uniswap when they swap tokens.

Fake tokens that mimic established ones using similar names and symbols to trick users are a common scam tactic, especially before the official tokens are listed. Investors should also be alert for liquidity pulls or ‘rug pulls,’ where liquidity is suddenly removed from a token pool, leaving holders unable to sell their tokens.

Trading Experience

Trading on Uniswap can be complex for beginners because of the technicalities involved. However, it can be a rewarding experience once users understand the mechanism. The platform offers a variety of features that make it a hotbed for cryptocurrency enthusiasts, including:

- Decentralized trading

- Liquidity pools

- Automated market making

- Wide range of supported tokens

One of the significant aspects of Uniswap that draws traders is its support for low market-cap altcoins. This means traders can access many cryptocurrencies that might not be available on more traditional platforms. This access to many tokens and being on the cutting edge of crypto trading technology make Uniswap an appealing platform for experienced traders.

Uniswap Fees

Uniswap charges a standard trading fee of 0.30% for swapping tokens, which is integrated into its transaction price formula.

Each swap on Uniswap requires the payment of network fees, which are separate from the Uniswap trading fees. The fees collected from token swaps contribute directly to the liquidity reserves, thereby rewarding liquidity providers by enhancing the value of their shares in the pool.

| Type | Fee |

|---|---|

| Trading Fee | 0.30% |

Security - Is Uniswap Safe?

Uniswap uses smart contracts to handle transactions, so the integrity of these contracts is crucial for the platform’s security. However, smart contracts contain vulnerabilities attackers can exploit under certain conditions, as with the KyberSwap security breach in 2023.

The KyberSwap incident illustrates that smart contracts can still contain vulnerabilities even with advancements such as Elastic Pools and the Cross Ticks algorithm designed to update liquidity ranges dynamically. Exploiting such vulnerabilities can be complex and may not be easily triggered in everyday transactions, requiring specific conditions and precise operations.

The KyberSwap breach, which involved a series of calculated steps, including using flash loans and manipulating trade functions, highlights the technical sophistication required to execute such attacks. This unfortunate incident underscores the importance of consistent coding and business logic in smart contract development to prevent security vulnerabilities. The KyberSwap case is a stark reminder of the risks associated with decentralized trading platforms, the critical need for in-depth code audits, and the need to understand business logic to ensure security.

Uniswap Customer Support

Uniswap does offer direct support through the use of support tickets. However, as is the case with most decentralized platforms, it’s not great! Instead, they expect users to rely more on community forums and online documentation. This is another reason why Uniswap isn’t great for beginners, as it can be challenging to understand the platform.

However, since most of the processes are decentralized, limited problems can occur, most of which have an answer in the documentation. It’s likely that if you have any issues on this exchange you’ll be heading over to forums like Reddit to get answers from users.

Uniswap Support Channels

Earning with Uniswap: Liquidity Provision and Yield Farming

Users can earn on Uniswap in two primary ways – by providing liquidity to pools or participating in yield farming strategies.

Providing Liquidity

Users can become liquidity providers on Uniswap by adding an equal value of two different tokens to a liquidity provider’ pool. In return, providers receive special tokens representing their pool share, enabling them to claim fees.

Uniswap V3 introduced the concept of concentrated liquidity, allowing users to provide liquidity across decentralized exchanges within specific price ranges for improved capital efficiency. When providing liquidity, selecting the price range is crucial, as earning fees are contingent upon the market price staying within this range.

Yield Farming Strategies

The concept of yield farming involves depositing digital assets into DeFi protocols to earn rewards. Some users actively move their assets around to capture the highest available annual percentage yield (APY).

While yield farming can be profitable, it requires a good understanding of the DeFi space and the ability to evaluate the risks and rewards of various protocols.

Uniswap’s UNI Token and Governance

Uniswap’s native token (UNI) plays a crucial role in the platform’s governance. It enables token holders to propose changes, vote on protocol upgrades, and manage the Uniswap treasury and the protocol fee switch. The distribution of UNI tokens was designed to be broad and equitable, with allocations to previous users, liquidity providers, the Uniswap treasury, team members, and governance initiatives.

The UNI token governs Uniswap’s community treasury, with the funds available for:

- grants

- partnerships

- liquidity mining programs

- other ecosystem growth initiatives

The token holders make these decisions. Uniswap provides staking rewards to UNI holders to encourage engaged and responsible governance participation.

Risks Involved in Using Uniswap

While Uniswap offers many opportunities for trading and earning, users should be aware of the risks involved. One such risk is impermanent loss, which occurs when the price of assets in a liquidity pool diverges from the price at the time of deposit. This could result in losses for the provider compared to just holding onto the assets.

Furthermore, the potential for smart contract vulnerabilities poses another risk. Projects without thorough audits can signal the potential for underfunded legitimate ventures or fraudulent schemes. Therefore, users must exercise due diligence and caution while using Uniswap to trade or earn.

How to Sign Up on Uniswap

- Create Account - Visit the Uniswap website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you'll be able to deposit using the methods listed below. Remember this exchange only supports depositing fiat currencies through third party apps it supports.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

Uniswap Alternatives

1inch

Total Supported Cryptocurrencies

267+

Trading Fees

0%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 10 others

OKX

Total Supported Cryptocurrencies

320+

Trading Fees

0.08% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Bancor Network

Total Supported Cryptocurrencies

239+

Trading Fees

0.1%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 70 others

Final Thoughts

Uniswap is a decentralized exchange that offers a unique trading and earning platform. Its model is based on liquidity pools and AMM technology, which gives users control over their assets and the ability to earn through liquidity provision and yield farming.

However, like any financial platform, Uniswap has risks, including impermanent loss, smart contract vulnerabilities, and potential scams. Therefore, users should exercise caution and conduct thorough research before engaging with tokens on the platform.

Uniswap FAQs

Uniswap is a decentralized finance (DeFi) platform that operates on blockchain technology, which has intrinsic security features such as encryption and smart contracts. However, like any online platform, users should practice due diligence and safety precautions, such as safeguarding private keys and being aware of phishing scams.

Uniswap does not hold your funds, so there is no traditional withdrawal process. Instead, you interact directly with the smart contracts using a cryptocurrency wallet.

If you want to “withdraw” your assets, you would trade your tokens for a stablecoin or another cryptocurrency and then transfer them to an exchange or wallet that allows you to convert into fiat currency.

Uniswap as a platform has not been hacked, but the DeFi space has witnessed incidents where users have lost funds due to smart contract vulnerabilities or other exploits in peripheral systems. Users should stay informed about the latest security updates and practices.

People use Uniswap primarily for swapping different Ethereum-based tokens without needing an intermediary. It’s also used for providing liquidity to the market and earning trading fees in return, as part of liquidity pools.

Uniswap fees can be high due to Ethereum network congestion, which increases gas prices. Gas prices are the fees required to conduct a transaction on the Ethereum network, and they fluctuate based on demand.

Transactions on Uniswap may fail due to several reasons, such as insufficient gas fees leading to an incomplete transaction, slippage settings being too low in a highly volatile market, or network congestion causing delays.

Uniswap typically charges a 0.3% fee per swap, which is automatically taken from the traded amount. This fee goes to liquidity providers as an incentive for supplying liquidity to the pool.

Uniswap User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for Uniswap - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.