When diving into the world of cryptocurrency exchanges, Australian users are often met with a plethora of choices. Two standouts in the Australian crypto market are Digital Surge and CoinSpot.

Both platforms provide a gateway to the high-paced crypto exchanges, yet they offer unique features that cater to different user preferences. In this comprehensive comparison, we’ll scrutinise the aspects of each exchange, from fees to features, and ease of use to customer support, providing insights to help you decide which might fit your crypto trading needs.

At a glance

| Category | Digital Surge Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. | CoinSpot Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. |

|---|---|---|

| Headquarters Location | Brisbane, Australia | Melbourne, Australia |

| Fiat Currencies Supported | AUD | AUD |

| Total Supported Cryptocurrencies | 429+ | 535+ |

| Trading Fees | 0.5% | 0.10% - 1.00% |

| Deposit Methods | Bank Transfer, Cryptocurrency, Osko, PayID | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, PayID, Paypal, BPAY |

| Support | Facebook, Twitter, Live Chat, Help Center Articles, Support Ticket | Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android | Yes - iOS, Android |

| Our Rating | ||

| Review | Read full Digital Surge review | Read full CoinSpot review |

| Visit | Visit Digital Surge | Visit CoinSpot |

About Digital Surge Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

Digital Surge is an Australian cryptocurrency exchange that has carved out a reputation for its user-friendly interface and commitment to customer support. Founded by Josh Lehman and Dan Rutter, the platform is designed to simplify the process of buying and selling digital currencies.

Digital Surge stands out for its cool feature that allows users to pay their Australian bills using Bitcoin or other eligible cryptocurrencies. Their approach to crypto trading is tailored to both beginners and experienced traders, offering a broad range of digital assets in a secure environment. The evolution of Digital Surge is a testament to the dynamism of the cryptocurrency market in Australia.

From its inception, the exchange has been adept at navigating the rapidly changing landscape of digital currencies. Distinct events, such as the integration of utility features allowing the payment of Australian bills with Bitcoin, reflect an adaptability to user demands and broader market movements.

The platform’s growth and enhancements have been largely user-centric, focusing on demystifying cryptocurrencies for newcomers without sacrificing the depth required by more seasoned traders. This balance has cemented Digital Surge’s position within a competitive market.

Digital Surge Pros & Cons

Pros

Cons

About CoinSpot Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

CoinSpot, established by Russell Wilson, is another leading Australian-based crypto exchange platform that offers a wide array of digital currencies. CoinSpot prides itself on its security measures and a large selection of coins.

Their platform allows for quick and easy trading, deposits, and withdrawals, aiming to provide a comprehensive experience. CoinSpot also boasts features like coin staking and a NFT Marketplace, catering to a broad spectrum of digital asset enthusiasts, from those looking to trade major coins to collectors of digital artwork. Since its establishment, CoinSpot has witnessed the ebb and flow of the crypto industry, adapting to its volatility and the diverse needs of its user base.

The exchange has expanded its horizons beyond simple trading, accommodating the growing interest in alternative crypto assets and the burgeoning NFT market. Market trends have nudged CoinSpot to innovate continuously, ensuring that its platform remains relevant and compelling for a broad audience.

The exchange’s journey mirrors the maturation of the crypto space in Australia, rising from a niche interest to a mainstream financial pursuit.

CoinSpot Pros & Cons

Pros

Cons

Digital Surge vs CoinSpot: Supported Cryptocurrencies

In terms of total cryptocurrencies available, CoinSpot users have access to more cryptocurrencies. Digital Surge offers 429 cryptocurrencies whereas CoinSpot supports 535 cryptocurrencies.

For those interested in trading high market cap cryptocurrencies, Digital Surge supports 24 of the top 30, compared to CoinSpot which supports 25 of the top 30.

CoinSpot provides access to a wider range of cryptocurrencies, making it a potential go-to for traders seeking a diverse range. However, Digital Surge remains a strong competitor with its offerings.

Digital Surge vs CoinSpot: Fees

| Fee Type | Digital Surge Fees | CoinSpot Fees |

|---|---|---|

| Deposit Fee (Bank Transfer) | 0% | Free |

| Deposit Fee (Credit Card/Debit Card) | N/A | 2.58% |

| Trading Fee | 0.5% | 0.10% - 1.00% |

| Withdrawal Fee (Bank Transfer) | 0% | Free |

Comparing the fee structures of Digital Surge and CoinSpot requires a look at the intricate details of each service. Digital Surge operates with a competitive trading fee model, while CoinSpot is known for its variable fee structure that adjusts based on the trading volume and method of transaction.

Both exchanges strive to keep fees transparent, with a focus on offering value to users. While specifics can fluctuate, it’s the nuances of their respective fee systems that could be a decisive factor for traders considering either platform. Understanding the fee structures of crypto exchanges is akin to navigating a financial labyrinth, where clarity and value are paramount.

Both Digital Surge and CoinSpot have crafted their fee schedules with an appreciation of this complexity, tailoring their approaches to meet the needs of their diverse user bases. They have each adopted fee models that aim to strike a balance between sustainability for the platform and fairness for the user.

These models reflect an understanding of the importance of cost in a trader’s decision-making process and demonstrate a commitment to competitive pricing within the ever-evolving crypto economy.

Digital Surge vs CoinSpot: Security

Security is paramount in the world of crypto exchanges, and both Digital Surge and CoinSpot take this aspect seriously. Digital Surge employs a robust security framework including two-factor authentication and cold storage for digital assets, aligning with industry standards.

CoinSpot, endorsed by Blockchain Australia, also upholds a high level of security, with biometric security features and a multi-layered strategy to protect users’ investments. Each exchange maintains a strong commitment to safeguarding user data and assets, though the specifics of their security protocols and the added convenience of certain features might resonate differently with users. In an industry where the integrity of digital assets is non-negotiable, Digital Surge and CoinSpot have each implemented rigorous security protocols to ensure the trust of their clients.

The strategic importance they place on security is evident in the continuous refinement of their protective measures. Digital Surge’s adoption of cold storage and two-factor authentication is a reflection of their commitment to industry best practices.

Similarly, CoinSpot’s comprehensive security stance, including biometric authentication, showcases an effort to stay at the forefront of safeguarding user assets. These security features are foundational to the credibility and reliability of the exchanges in the eyes of both new entrants and veteran traders.

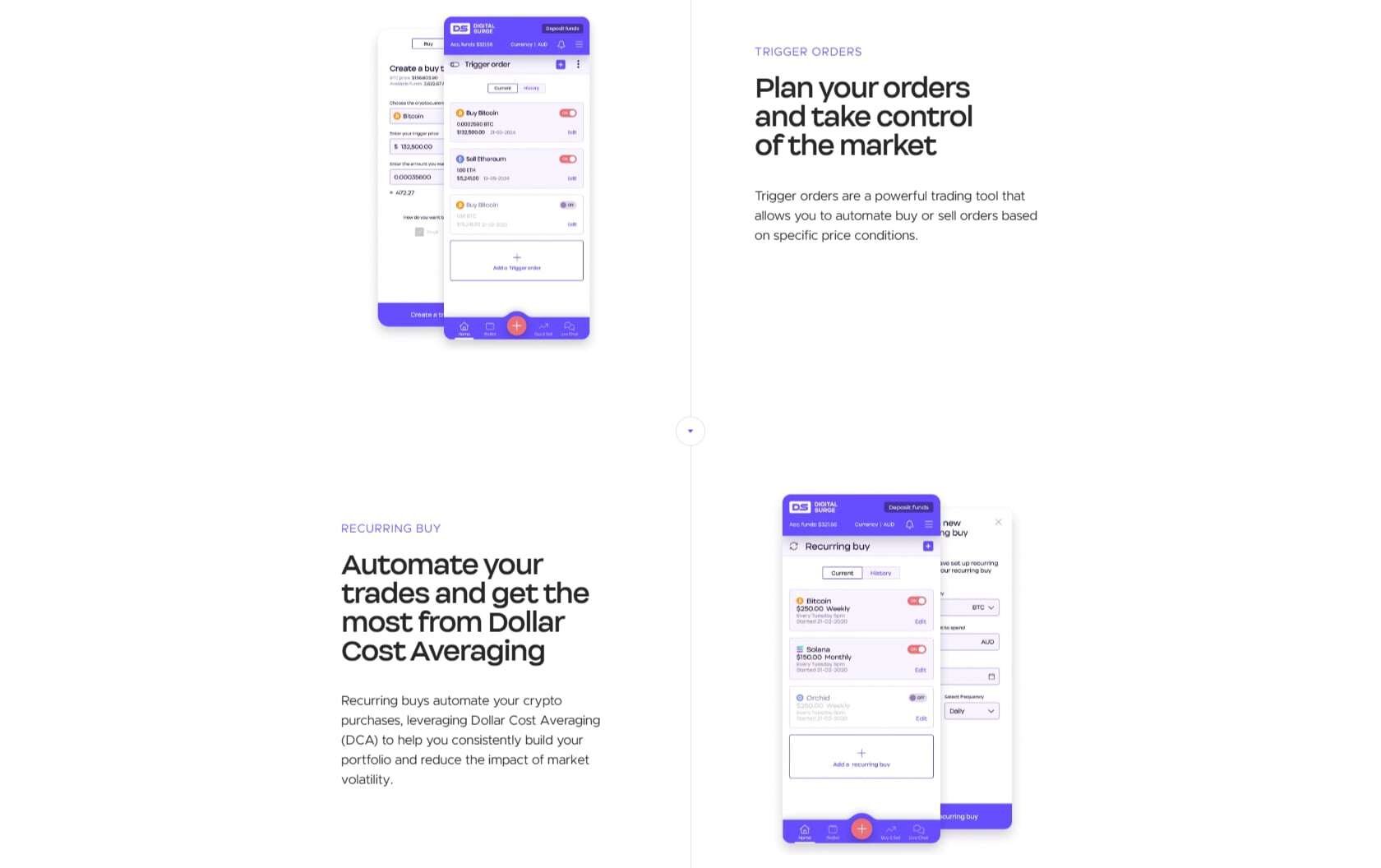

Digital Surge vs CoinSpot: Ease of use

User experience is often a key factor when choosing a crypto platform. Digital Surge boasts an intuitive interface perfect for beginner traders, while still offering advanced features that experienced traders require.

CoinSpot also provides a user-friendly environment with its clean layout and easy navigation. Both platforms offer mobile apps to trade cryptocurrencies on the go, ensuring users have full access to their accounts whether at home or on the move. Navigating a crypto platform with ease is a crucial aspect that both Digital Surge and CoinSpot have strived to perfect.

The design philosophies of each exchange underscore a dedication to user empowerment, enabling traders to engage with the platforms confidently and efficiently. The seamless experience provided by the mobile applications and desktop interfaces of both exchanges reveals an acute awareness of the importance of accessibility in the digital age.

This focus on user experience is a cornerstone of their service offerings, ensuring that both novices and experts alike can manage their crypto portfolios with a sense of autonomy and mastery.

Digital Surge vs CoinSpot: Support

Quality customer support can make or break a user’s experience with a crypto exchange. Digital Surge places a strong emphasis on personalised customer support, offering live chat and educational resources to assist users.

CoinSpot’s commitment to customer support is equally robust, with a reputation for quick response times and helpful assistance. Both exchanges have invested in comprehensive support teams to ensure users have access to help when they need it, particularly during busy periods or when navigating complex transactions. Exceptional customer support transcends mere assistance; it embodies the ethos of the exchange and its relationship with its users.

Both Digital Surge and CoinSpot have placed significant emphasis on building customer support infrastructures that reflect a deep understanding of user concerns and queries. The investment in live chat, educational resources, and responsive support teams is a clear indication of their commitment to customer satisfaction.

This approach to support is indicative of a broader philosophy that values user trust and aims to foster a welcoming and supportive environment for trading within the complex world of cryptocurrencies.

Digital Surge vs CoinSpot: Features

Both Digital Surge and CoinSpot offer a suite of features that enhance the trading experience without overwhelming the user. Digital Surge’s bill paying service is a standout, allowing users to directly pay Australian bills with Bitcoin, a unique convenience in the industry.

CoinSpot, on the other hand, rounds out its services with a NFT Marketplace and interest-earning wallets, appealing to a wide range of user interests and investment strategies. The features provided by each exchange showcase their understanding of market needs and user preferences. Delving into the array of features on offer by Digital Surge and CoinSpot reveals a landscape rich with tools and services designed to enrich the trading experience.

Digital Surge’s bill payment option represents a marriage of cryptocurrency utility with everyday financial tasks, a nod to the practical applications of digital currencies. CoinSpot’s NFT Marketplace and interest-earning opportunities indicate a broader vision that encapsulates the multifaceted nature of the crypto ecosystem.

Such features demonstrate the exchanges’ dedication to crafting a comprehensive experience that caters to the evolving preferences and strategies of their user base.

Final Thoughts

In conclusion, both Digital Surge and CoinSpot present compelling offerings to the Australian crypto market. The choice of exchange ultimately depends on individual needs and preferences.

Digital Surge’s straightforward approach and bill payment feature might appeal to those seeking an easy entry into crypto with additional everyday utility. CoinSpot, with its extensive coin selection and additional features like NFT marketplace and earning interest on coins, might attract those looking for a broader range and deeper engagement with digital assets. The trajectory of digital finance is inextricably linked to the innovation and services provided by crypto exchanges.

Digital Surge and CoinSpot have each contributed to the shaping of this landscape, offering platforms that not only serve as entry points into the world of digital currency but also as hubs for ongoing engagement with the technology. Both exchanges have tapped into the pulse of the crypto ecosystem, evolving with its trends and serving the varied interests of the Australian market.

Their individual offerings underscore the rich diversity within the crypto exchange space, with each platform potentially serving different segments of a growing and dynamic user base.

Digital Surge vs CoinSpot: FAQs

CoinSpot, while a widely used platform in the Australian crypto market, does have some disadvantages that users might consider. For instance, compared to other Australian cryptocurrency exchanges, it may have higher transaction fees and withdrawal fees, which could be a decisive factor for some traders.

The platform may not cater to advanced traders seeking advanced trading features like those found on some other crypto trading platforms, such as margin trading or a broader range of derivatives markets. Additionally, while CoinSpot offers a wide range of cryptocurrencies, seasoned traders interested in a larger array of trading pairs might find the selection limiting.

It’s important to also note that CoinSpot does not offer an NFT marketplace, which could be a cool feature for those interested in the digital artwork and blockchain technology space. For Australian users particularly, the lack of certain deposit options like cash deposits available on platforms such as Independent Reserve or the BPAY Cash Deposit feature could be less convenient.

Lastly, while CoinSpot is known for its user-friendly interface and strong commitment to customer support, it may not offer the lowest trading fees in the industry, which is something budget-conscious users may consider when comparing Aussie platforms like Digital Surge or CoinJar.

If CoinSpot were to shut down, it could lead to several repercussions for its users. Firstly, users would need to consider the security of their digital assets.

CoinSpot employs cold storage for the majority of the crypto assets on its platform, which is a security measure to protect from unauthorized access. However, in the event of a shutdown, users may face challenges in accessing their crypto assets or digital currencies.

It is standard for exchanges to provide authentication measures like two-factor authentication to secure user accounts, but this would not be relevant in the event of a complete shutdown. Users would likely be instructed to withdraw their funds to an external wallet or another exchange.

For those concerned about market volatility, such an event could cause fluctuations, especially if it affects trading volumes significantly. Withdrawals might be delayed during such busy periods while the exchange deals with the increased volume of transactions.

Australian users should also be aware that they may need to seek financial advice or even legal advice to navigate the complexities of retrieving their assets from a shuttered exchange. It’s advisable for traders to keep records of their transaction history and maintain control over their digital currencies by using personal digital wallets outside of the exchange.

To withdraw money from CoinSpot, users need to follow the exchange’s withdrawal process. This usually involves logging into your CoinSpot account, navigating to the ‘Withdraw’ section, and selecting ‘Bank Transfer’ to transfer your funds into an Australian bank account.

Users are required to have their bank account details verified on CoinSpot before initiating a withdrawal. It is important to consider the withdrawal fees and transaction fees that may apply, as well as any potential delays during peak periods.

CoinSpot aims to provide excellent customer service experiences, so users can reach out to their customer support teams if they encounter any issues or require assistance during the withdrawal process. Additionally, for security reasons, users might be prompted to complete authentication steps such as two-factor authentication before the transaction can be finalized.

Always ensure compliance with the platform’s security instructions and withdrawal limits.

Protecting your CoinSpot account involves several security measures. Firstly, employ a strong password for your account and update it regularly.

Make use of two-factor authentication (2FA), which provides an extra layer of security beyond just the password. CoinSpot also offers biometric security options, such as fingerprint or facial recognition, depending on your device’s capabilities.

Be cautious of phishing attempts and ensure that you are accessing the genuine CoinSpot exchange interface and not a fraudulent site. It’s also wise to review and follow any security instructions provided by CoinSpot.

For added security, do not share your login credentials with others and consider using a hardware wallet or cold storage for a significant portion of your digital assets. Regularly monitoring your transaction history and account activity can help you spot any unauthorized transactions quickly.

CoinSpot, like other Australian exchanges, is dedicated to maintaining a secure exchange environment and provides resources and educational materials to help users understand the best practices for protecting their digital currencies.

CoinSpot is registered with Blockchain Australia, which is the industry body that represents Australian businesses and individuals participating in the blockchain and digital currencies space. Although CoinSpot is not directly regulated by the Australian Securities and Investments Commission (ASIC), it complies with Australian laws and regulations pertaining to financial transactions and the cryptocurrency industry.

As a part of its commitment to security and best practices, CoinSpot follows Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) guidelines. It is also registered with AUSTRAC, the Australian government agency responsible for preventing, detecting, and responding to criminal abuse of the financial system to protect the community from serious and organized crime.

Digital Surge is considered a secure exchange within the Australian cryptocurrency market, implementing industry-standard security measures to protect user funds and information. These measures include two-factor authentication (2FA), which adds an additional layer of security to user accounts.

Digital Surge also utilizes cold storage for the safeguarding of digital assets, which is a common practice within the industry for reducing the risk of unauthorized access. The exchange’s commitment to customer support includes providing personalized customer support and educational resources to help users navigate the platform safely.

While Digital Surge, like other crypto exchanges, is vigilant in protecting against financial crimes, users should perform their own due diligence and make use of all the security features offered by the platform. It’s important for users to keep informed about the latest security practices and to use individual protective measures such as secure passwords and not sharing sensitive information.

CoinSpot is an Australian-based cryptocurrency exchange platform founded by Russell Wilson in 2013. Since its inception, it has grown to become one of the most prominent and trusted exchanges in the Australian market.

The platform places a strong emphasis on user security, customer service, and providing a user-friendly interface that caters to both beginner traders and more experienced individuals. CoinSpot has established a reputation for a wide range of available digital currencies and a commitment to customer support, making it a key player in the Australian crypto industry.

Deciding whether Swyftx or CoinSpot is better depends on the specific needs and preferences of the user. Both Swyftx and CoinSpot are Australian cryptocurrency exchanges that offer a range of key features aimed at both beginner and seasoned traders.

Swyftx provides an array of trading pairs and has been noted for its user-friendly interface and a commitment to customer support. CoinSpot, on the other hand, offers a wide range of cryptocurrencies and has a strong focus on security, employing measures like two-factor authentication and cold storage.

Both platforms are known for their competitive trading fees within the Australian market and have established reputations based on their comprehensive learning resources, customer service experiences, and trading platforms. Users may compare the trading volume, market fee, withdrawal fees, and the range of digital assets available on each platform to determine which aligns better with their trading experience and financial goals.

Notably, CoinSpot provides additional features like the ability to pay Australian bills with Bitcoin, which could be a cool feature for some users. It’s essential for users to consider their individual requirements, conduct due diligence, and possibly consult a financial advisor when choosing an exchange.

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.