Please note: Binance has had regulatory challenges in the U.S. and EU. Binance was fined $4b on 21st Nov 2023 by a coordinated effort between the Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) and Office of Foreign Assets Control (OFAC) and the U.S. Commodity Futures Trading Commission (CFTC). Binance still remains the most used exchange in the world, but we would proceed with caution.

Featured In

Best International Cryptocurrency Exchange

Best International Cryptocurrency Exchange Best Crypto Exchange in Australia in 2025

Best Crypto Exchange in Australia in 2025 Best Cryptocurrency Exchange NZ

Best Cryptocurrency Exchange NZPros

Cons

Quick Summary

| Headquarters Location | International |

|---|---|

| Fiat Currencies Supported | USD, GBP, CAD, EUR, NZD + 75 others (some through third party apps) |

| Total Supported Cryptocurrencies | 419+ |

| Trading Fees | 0.0110% - 0.1000% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay, Banxa, Alchemy Pay, Mercuryo, Simplex, Wise, Skrill, Zelle |

| Support | Facebook, Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

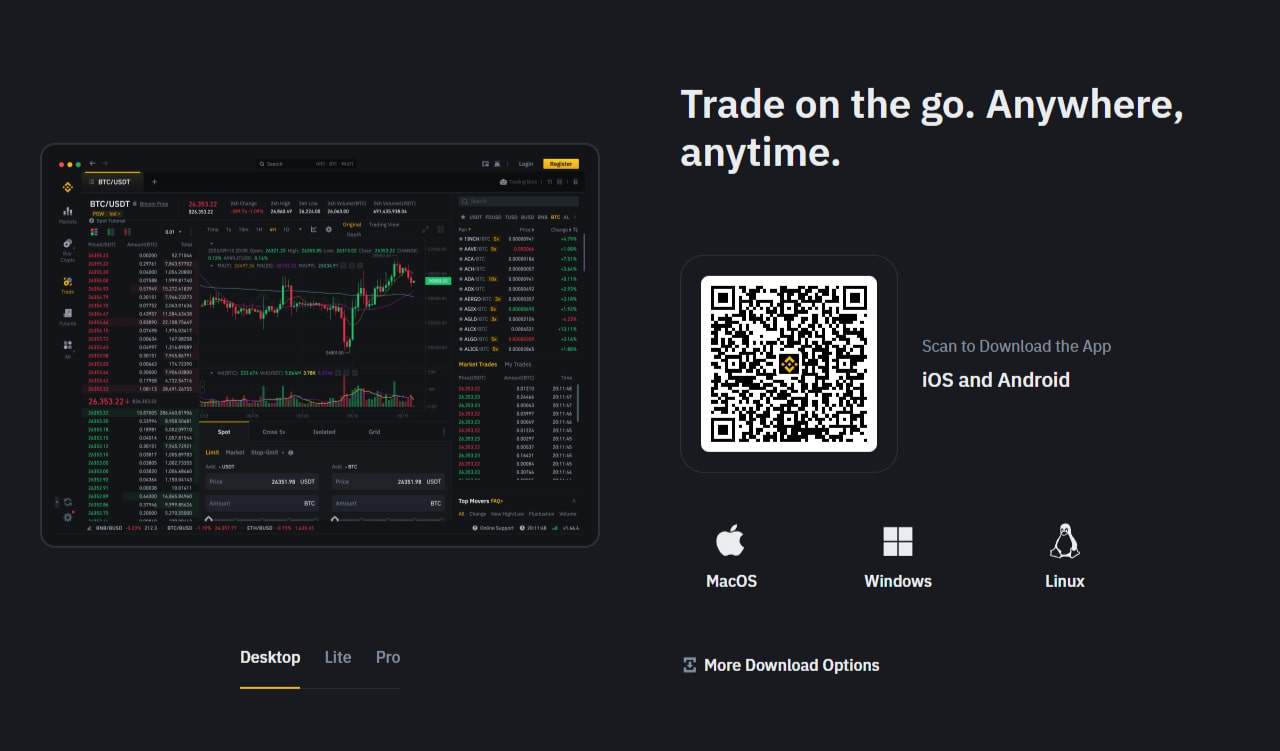

| Mobile App | Yes - iOS, Android |

The group behind the Binance platform includes top professionals with robust backgrounds in technology and finance, such as Richard Teng (CEO) and co-founders Heina Chen, Lilai Wang, and Rock. This consortium of crypto traders has utilized their extensive knowledge to establish a trading platform for cryptocurrency advocates around the globe.

The services offered by Binance extend well beyond those of a typical cryptocurrency exchange. It offers various trading resources and tactics to make asset transactions straightforward for both newcomers and experts.

Although Binance has faced regulatory challenges in the United States and Europe, it remains one of the most popular crypto exchanges.

About Binance

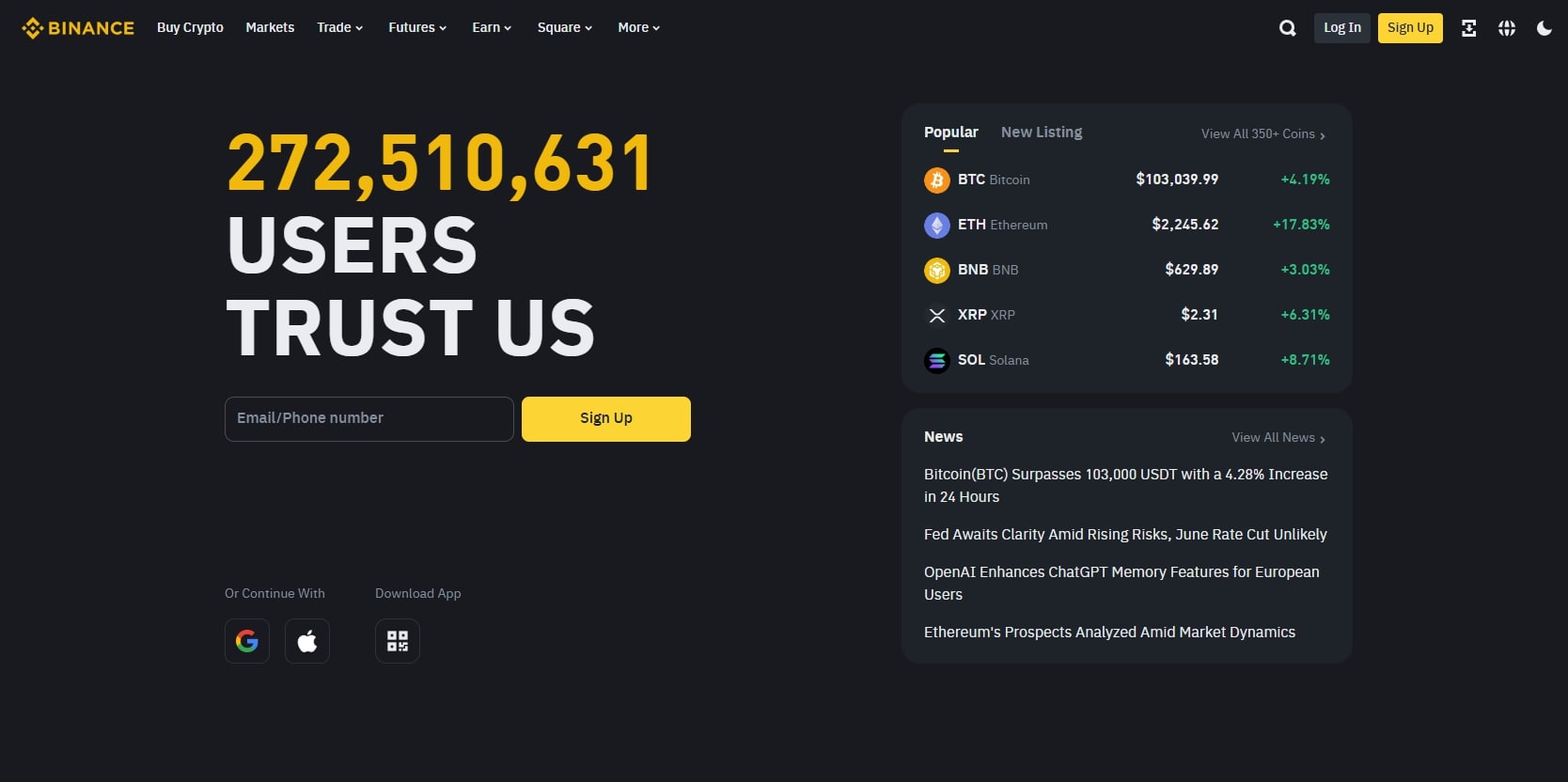

Launched in 2017 with Changpeng Zhao, also known affectionately within the crypto community as CZ, at its helm, Binance was poised for greatness. Its comprehensive selection of trading options and support for numerous cryptocurrencies quickly elevated it to the top ranks as the cryptocurrency exchange with the highest daily trading volume.

Binance has made itself available across many countries worldwide, facilitating international trading on a grand scale in certain countries. For American users specifically, Binance operates a specialized version called Binance.US that complies with US regulatory standards. This deliberate strategy has been instrumental in establishing Binance’s global business.

Binance’s commanding position in cryptocurrency trading didn’t come by accident. The secret behind its dominance lies in an unyielding infrastructure, an extensive assortment of services, competitively low fees, and continuous upgrades to its educational resources.

Also, by integrating these features and an NFT marketplace into its ecosystem, Binance has become an essential hub for traders internationally, setting industry benchmarks while doing so.

Founding and Expansion

The platform’s initial coin offering (ICO) in July 2017 garnered an impressive $15 million, setting up a solid base for its subsequent expansion.

Once operational, Binance quickly climbed to prominence primarily due to its effective trading mechanisms and comprehensive services. Its popularity skyrocketed so much that it had to temporarily halt new user sign-ups in January 2018 because of overwhelming demand.

In anticipation of changing regulatory environments, Binance has adeptly shifted its headquarters from China, initially to Malta, before settling on the Cayman Islands. It also operates servers from jurisdictions with more favorable regulations. This tactical maneuvering has been integral in maintaining its operations within the bounds of international rules and sustaining its progress.

Binance has a number of active social profiles including Facebook, Twitter, Instagram, LinkedIn, Discord, Reddit, Telegram, TikTok and YouTube.

Binance has a mobile app on both the Apple App Store and Google Play.

Binance Supported Cryptocurrencies

Binance supports trading on over 419 cryptocurrencies on their platform. This exchange currently supports 24 of the top 30 market cap cryptocurrencies.

Download full list of cryptocurrencies Binance supports

Binance comes with an impressive selection of digital currencies. The platform facilitates trading for 419+ cryptocurrencies, positioning itself as a rich haven for those passionate about crypto trading.

Trading Experience

Binance provides a collection of trading choices on different trading platforms, encompassing spot trading, peer-to-peer (P2P) trading, margin trading, and over-the-counter (OTC) trading.

The Binance application’s interface is designed to be user-friendly, making the trading process enjoyable and straightforward.

Basic and Advanced Trading Interfaces

Binance is committed to serving the diverse needs of its trading community by providing two different user interfaces: Basic and Advanced.

The Basic Binance account interface delivers a streamlined, user-friendly experience with core trading functionalities tailored for new traders. In contrast, experienced traders can access Binance’s Advanced interface, which includes sophisticated charting features and extra resources that allow for meticulous analysis and strategic trades based on comprehensive data insights.

Trading Techniques

Binance caters to bold traders who are comfortable with high risk by providing sophisticated trading techniques.

Margin Trading

This feature allows up to 10x leverage on specific cryptocurrencies, opening the door for substantial rewards and increasing the potential risk. Traders can choose between cross and isolated margins, each offering varying risk control.

Futures Trading

This trading strategy enables traders to predict an asset’s future performance and aim to profit from trends in either direction. Binance amplifies the excitement within futures trading through options that support up to 125x leverage, significantly raising trade potential impact levels.

Two varieties of futures contracts are available, USDT-M futures and COIN-M futures, which provide versatile approaches suitable for diverse trading strategies. Given its aggressive fee structure, Binance Futures is particularly appealing to seasoned investors who are looking forward to the challenges offered by advanced market setups.

Leveraged Trading

With Binance’s leverage trading comes an opportunity for amplified market engagement without requiring collateral backing or handling maintenance margins while being spared from liquidation dangers. Yet this comes alongside other risks, such as perpetual contract market fluctuations affecting premiums, along with funding rates, which should be considered carefully.

Note: While the above trading mechanisms can lead to profitable outcomes, they inherently involve more significant risks. And so, before proceeding, it is essential to grasp how each strategy operates and its respective risks comprehensively.

Binance Fees

Binance distinguishes itself from popular exchanges through a fee structure that is influenced by the amount of trading volume and the balance of Binance Coin (BNB) held in an account. Binance also provides multiple strategies for users to decrease their fees, ensuring that trading remains economically advantageous.

Trading Fee Tiers

Binance employs a maker/taker fee structure, where the fees fluctuate based on users’ trading volume and Binance Coin (BNB) balance. The variation in these two factors determines different fee levels for traders.

Implementing this gradational approach involving both withdrawal fees and limits according to tiers not only rewards active traders with lower withdrawal fees and higher volumes but also encourages account holders on Binance to engage in trading activities. This allows them to fully enjoy their rewards while top-up funds using whichever bank transfers or payment method they prefer for added advantages.

Fee Reduction Techniques

Strategies to lower finance trading fees further encompass multiple approaches. Leveraging the platform’s native currency, Binance Coin (BNB), to settle trading fees can significantly lower fees and reduce trade expenses. This approach comes with a multitude of advantages, such as:

- It decreases the amount expended on transaction costs

- Users gain additional perks within the ecosystem

- BNB value could appreciate, enhancing fee savings

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 0% - 2% |

| Deposit Fee (Credit/Debit Card) | 0% - 2% |

| Trading Fee | 0.0110% - 0.1000% |

| Withdrawal Fee (Bank Transfer) | 0% - 1% |

Binance supports a range of different cryptocurrencies with varying withdrawal fees. When looking at Bitcoin, their withdrawal fee is 0.00003 BTC. The average across all other exchanges that we've reviewed is 0.000233 BTC. This means Binance charges below the industry average by 87.15%.

Binance has a maker/taker fee schedule which you can see below.

| Level |

30-Day Trade Volume (USD*)

|

and/or | BNB Balance |

Maker / Taker

|

Maker / Taker

|

USDC Maker / Taker

|

USDC Maker / Taker

|

|---|---|---|---|---|---|---|---|

|

Regular User

|

< 1,000,000 USD

|

or |

≥ 0 BNB

|

0.1000% / 0.1000%

|

0.075000% / 0.075000%

|

Standard /

0.09500%

|

Standard /

0.071250%

|

|

VIP 1

|

≥ 1,000,000 USD

|

and |

≥ 25 BNB

|

0.0900% / 0.1000%

|

0.067500% / 0.075000%

|

Standard /

0.09500%

|

Standard /

0.071250%

|

|

VIP 2

|

≥ 5,000,000 USD

|

and |

≥ 100 BNB

|

0.0800% / 0.1000%

|

0.060000% / 0.075000%

|

Standard /

0.09500%

|

Standard /

0.071250%

|

|

VIP 3

|

≥ 20,000,000 USD

|

and |

≥ 250 BNB

|

0.0400% / 0.0600%

|

0.030000% / 0.045000%

|

Standard /

0.05500%

|

Standard /

0.041250%

|

|

VIP 4

|

≥ 75,000,000 USD

|

and |

≥ 500 BNB

|

0.0400% / 0.0520%

|

0.030000% / 0.039000%

|

Standard /

0.04700%

|

Standard /

0.035250%

|

|

VIP 5

|

≥ 150,000,000 USD

|

and |

≥ 1,000 BNB

|

0.0250% / 0.0310%

|

0.018750% / 0.023250%

|

Standard /

0.02600%

|

Standard /

0.019500%

|

|

VIP 6

|

≥ 400,000,000 USD

|

and |

≥ 1,750 BNB

|

0.0200% / 0.0290%

|

0.015000% / 0.021750%

|

Standard /

0.02400%

|

Standard /

0.018000%

|

|

VIP 7

|

≥ 800,000,000 USD

|

and |

≥ 3,000 BNB

|

0.0190% / 0.0280%

|

0.014250% / 0.021000%

|

Standard /

0.02300%

|

Standard /

0.017250%

|

|

VIP 8

|

≥ 2,000,000,000 USD

|

and |

≥ 4,500 BNB

|

0.0160% / 0.0250%

|

0.012000% / 0.018750%

|

Standard /

0.02000%

|

Standard /

0.015000%

|

|

VIP 9

|

≥ 4,000,000,000 USD

|

and |

≥ 5,500 BNB

|

0.0110% / 0.0230%

|

0.008250% / 0.017250%

|

Standard /

0.01800%

|

Standard /

0.013500%

|

Security - Is Binance Safe?

Recognizing the critical importance of security in cryptocurrency transactions, Binance has implemented stringent measures to protect its users’ accounts. These protective strategies lie in two-factor authentication (2FA) and address whitelisting, thereby establishing a fortified trading environment for participants.

Security Protocols

Binance employs state-of-the-art security measures, which include:

- Artificial intelligence risk control

- Identity and facial recognition

- Big data analytics

- Cyber forensic investigations

However, keep in mind that high security can sometimes come at the cost of complexity.

Previous Security Incidents

Like any significant platform, Binance has not been immune to security breaches. A successful attack on Binance happened in May 2019. Rather than succumbing to this setback, Binance bolstered its defenses and created a safeguard fund to protect users against similar future events.

Although stringent security protocols are in place, some instances of reported fraudulent activity remain within the peer-to-peer section of Binance’s market as complaints about accounts being frozen come to light. As a substantial crypto exchange and platform, it is also confronted with typical obstacles such as unforeseen downtime for maintenance and sporadic exposure to security threats.

It should be noted that despite these concerns, Binance has always employed proactive measures to deal with such issues.

Binance Customer Support

Binance offers many support alternatives facilitated by a team of committed customer service employees who strive to guarantee an uninterrupted trading journey for their clientele, thereby upholding its overall favorable standing regarding user gratification.

Support Channels

The exchange has established multiple channels of customer support to quickly and efficiently resolve any questions or problems that users might encounter. Also, thanks partly to an extensive FAQ section filled with thorough explanations available online, many common issues can often be addressed independently without having recourse directly from someone within their account assistance teams.

User Reviews

User reviews provide a valuable perspective on Binance’s performance. While several complaints revolve around customer service, it’s essential to remember that no platform is perfect.

Still, it’s important to note that some Binance users have encountered issues with the exchange’s KYC verification process, including delays and requests for additional documentation. Updating personal information on the platform, such as changing a name after marriage, has also been reported to be challenging for some users.

Some Binance users have also reported withdrawal difficulties, finding the comprehensive security measures somewhat complex. Despite this, the robust security measures ensure that Binance remains one of the safest platforms for crypto trading.

On the positive side, many Binance users mention a favorable, relatively seamless experience with the platform, despite some difficulties. This suggests that while there may be areas for improvement, the overall user experience on Binance is generally favorable.

Ultimately, the company is committed to continually improving its services based on user feedback. The goal is to provide a seamless and enjoyable trading experience for all users, regardless of their trading knowledge or experience.

Binance Support Channels

Binance Coin (BNB) and Its Use Cases

The Binance Coin (BNB) is a pivotal element in Binance’s expansive network of services, which offers numerous applications. It not only fuels transactions on the Binance Smart Chain but also facilitates lowered trading fees and allows for involvement in token sales hosted via the Binance Launchpad, thus cementing its position as an integral part of the entire ecosystem.

BNB Tokenomics

During Binance’s Initial Coin Offering (ICO), investors were allotted Binance Coin (BNB), which is now utilized to streamline transactions and settle payment fees on the Binance platform. The platform incentivizes users by allowing them to trade and pay trading fees with BNB.

To elevate token value for investors, Binance strategically orchestrates quarterly token destruction. These token burns systematically diminish the available supply, thus potentially heightening intrinsic value.

Binance Smart Chain

The Binance Smart Chain is a significant innovation in the decentralized finance (DeFi) sector. Designed to solve prominent issues in DeFi (specifically slow transaction speeds and high gas fees), it offers high-performance transactions with low fees.

The Binance Smart Chain enhances BNB’s utility by supporting high-performance transactions with low fees. This is a game-changer for DeFi applications and protocols, enabling them to operate faster and cost-effectively. BNB is poised to become a key player in DeFi due to its compatibility with DeFi applications and protocols via the Binance Smart Chain.

Beyond the DeFi realm, BNB’s utility in real-world applications has become evident, with many merchants accepting it as a form of payment. Additionally, BNB holders can use their tokens to deposit funds and participate in token sales hosted on the Binance Launchpad, providing them with investment opportunities in emerging blockchain projects.

Binance Products and Services

The Binance platform extends beyond mere trading functionalities, delivering a diversified suite of financial tools and offerings. Among them are:

- Staking

- Savings

- DeFi Services

- Yield farming

These features enable users to garner passive earnings on their cryptocurrency holdings, thus bolstering the comprehensive appeal of what the Binance platform brings to its user base.

Staking

Binance.US caters to customers by offering staking services specific to proof-of-stake (PoS) coins. By holding these PoS coins on the platform or account and engaging in their staking process, users can acquire rewards, thereby augmenting their ability to generate returns from their cryptocurrency holdings.

Savings

The Binance Savings service features two account types: Flexible Savings account and Locked Savings account.

Flexible Savings accounts offer fluctuating interest rates, low fees, and the convenience of depositing funds anywhere and withdrawing funds anytime. Locked Savings accounts grant higher fixed interest rates in exchange for keeping deposits locked over a specified term.

DeFi Services

Despite potential perils, including impermanent loss or an unstable market climate, Binance’s suite of DeFi-related facilities grants users access to possible opportunities to accumulate considerable returns on their cryptographic investments.

Yield Farming

These services permit users to garner rewards by contributing liquidity to assorted liquidity pools located within Binance’s decentralized finance (DeFi) ecosystem.

Yield farming was introduced as a means for users to gain exposure to emerging tokens and foster involvement in the DeFi space. It quickly gained traction among many Binance users.

The process of yield farming on the platform unfolds with Binance users allocating their digital currency holdings into various liquidity pools managed by Binance. The mechanism is outlined below.

- Participants inject their digital currencies into these designated pools.

- Their contributed assets are then paired with those from other participants, thus enabling trading pairs.

- In return for providing this service, participants can obtain variable reward yields from these activities.

How to Sign Up on Binance

- Create Account - Visit the Binance website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you can deposit using the deposit methods listed below, including some options through third party apps.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

Binance Alternatives

Kraken

Total Supported Cryptocurrencies

431+

Trading Fees

0.08% - 0.40%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 1 other

OKX

Total Supported Cryptocurrencies

314+

Trading Fees

-0.005% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Bybit

Total Supported Cryptocurrencies

523+

Trading Fees

-0.0050% - 0.1000%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 160 others

Final Thoughts

Binance distinguishes itself from other exchanges by having a broad selection of cryptocurrencies, low transaction fees, strong security measures, and advanced trading features.

The platform appeals to various users, from those new to crypto to experts in the field and from occasional investors to dedicated DeFi advocates. However, its user interface can prove to be complicated for beginners. With some reports that customer support can sometimes respond slowly, newbies might find using the platform frustrating.

Overall, the Binance app and platform meet users’ demands through continuous innovation and a desire for excellence. For this reason, a lot of users continue to trust the platform despite the many issues linked to the company.

Binance FAQs

Binance is considered one of the largest cryptocurrency exchanges globally in terms of trading volume and user base. It offers a wide variety of cryptocurrencies for trade and has built a reputation in the crypto industry for its extensive selection of trading options and features.

Binance has implemented a range of security measures, including holding customer funds in cold storage to protect them from unauthorized access, and it has a dedicated customer service team to address any issues. However, like any crypto trading platform, there are risks involved, and it has faced regulatory issues in various countries.

Traders must perform their due diligence and review the terms of service, fee structure, and any Binance review they can find to make an informed decision.

Whether you should stay on Binance depends on your satisfaction with their services and how well the platform meets your trading needs. Binance is known for catering to both beginner and experienced traders, providing a comprehensive collection of products, including Binance Futures and Binance Spot.

It supports a wide range of cryptocurrencies and has advanced trading options for users seeking more complex trading systems. It’s essential to consider the fee structure, the range of tradable cryptocurrencies, and any potential regulatory issues that might affect your region.

Comparing Binance with other popular exchanges like Coinbase may also help you decide whether it aligns with your trading goals and preferences.

If you want to see how Binance compares to other crypto exchanges, read our articles comparing Binance vs Coinspot, Binance vs Poloniex, and Binance vs Swyftx.

Binance does not have a strict minimum deposit amount, but they do have minimum trade values that could indirectly dictate how much you need to deposit to start trading efficiently. The minimum amount for a trade will vary depending on the cryptocurrency and market conditions.

For fiat currency deposits, like dollar deposits via bank transfer, the minimum amount can vary depending on the payment processor and the user’s location. It’s advised to check Binance’s deposit fees and minimum requirements for the currency you wish to deposit, whether it’s fiat or crypto assets like Bitcoin or Ethereum.

On the Binance platform, users might generate returns on their crypto holdings in multiple ways, such as trading cryptocurrencies on the market. Price movements allow traders to earn profits by buying low and selling high.

Additionally, Binance offers products like Binance Savings and Binance Staking, which allow users to hold their cryptocurrency and potentially earn rewards. The platform also features a peer-to-peer trading function, which can be another avenue for active traders to engage in transactions.

It’s important to note that all trading involves risks, and earning daily is not guaranteed.

Binance offers several avenues for users looking to utilize the platform for financial gains. The primary method is through cryptocurrency trading, where traders analyze the market conditions and execute trades based on current market prices and price movements.

Experienced traders may use advanced trading tools and features such as Binance Futures to leverage exposure to various crypto assets. Users can also participate in Binance’s featured products like Binance Savings and Binance Staking to potentially grow their holdings.

However, it’s vital to understand the associated risks, including the risk of liquidation in margin trading, and that making money is not guaranteed. Traders should use advanced risk control solutions and only trade with funds they can afford to lose.

Binance has a trading fee of 0.0110% - 0.1000%.

Binance operates as an international cryptocurrency exchange and offers its services to users worldwide, including in Australia. The platform provides a wide range of crypto services and products and adheres to the regulatory requirements set by Australian authorities.

However, due to the dynamic nature of the cryptocurrency industry and the evolving regulatory landscape, it’s important for users to stay informed about the current legal status and compliance of any crypto exchange, including Binance, within their jurisdiction. Australian users can also consider Binance’s customer service and Binance Review for additional assurance.

Binance has not announced any plans to shut down its services in Australia. The exchange continues to offer a broad range of products to Australian traders, including spot trading, Binance Savings, and access to hundreds of cryptocurrencies.

While Binance aims to comply with local regulations in the markets in which it operates, users need to stay updated with any official announcements from the company regarding their services in Australia, as regulatory conditions can change. Users are encouraged to monitor Binance’s official communications and relevant regulatory news for the latest information on their operations.

Binance User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for Binance - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.