Featured In

Pros

Cons

Quick Summary

| Headquarters Location | International |

|---|---|

| Fiat Currencies Supported | USD, AUD, GBP, CAD, EUR, NZD + 50 others |

| Total Supported Cryptocurrencies | 302+ |

| Trading Fees | 0.00% - 0.60% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay |

| Support | Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android |

Coinbase offers a secure digital platform that simplifies crypto transactions for its users – beginners and expert crypto traders.

The ability to make low-cost cryptocurrency transfers between Coinbase accounts is an attractive feature that adds convenience to its users. The company takes responsibility for security measures to ease customers’ concerns when using its platform.

Coinbase strives to pioneer an open financial system worldwide, with cryptocurrency investing as its mission. This vision places Coinbase at the forefront of the ongoing cryptocurrency expansion.

About Coinbase

Established in 2012 by co-founders Brian Armstrong and Fred Ehrsam, Coinbase has evolved into a publicly traded entity that supports 302+ cryptocurrencies.

The company offers two primary trading platforms – Original and Advanced. The Original platform simplifies the purchase of cryptocurrencies using fiat currencies such as USD, while Coinbase Advanced Trade has a specialized interface designed for experienced traders.

The exchange is also known for its distinct service, the Coinbase Wallet, which allows beginners and advanced users to retain complete control over their private keys. It also supports a broad spectrum of cryptocurrencies and all tokens compatible with Ethereum.

Coinbase has a number of active social profiles including Facebook, Twitter, Instagram, LinkedIn, Reddit, TikTok and YouTube.

Coinbase has a mobile app on both the Apple App Store and Google Play.

Coinbase Supported Cryptocurrencies

Coinbase supports trading on over 302 cryptocurrencies on their platform. This exchange currently supports 21 of the top 30 market cap cryptocurrencies.

Download full list of cryptocurrencies Coinbase supports

Trading Experience

Coinbase offers a straightforward trading experience, catering to the needs of both beginners and seasoned traders.

Maximizing Your Trading Experience

Coinbase provides a variety of advanced tools designed to improve your trading activities. The platform allows for the use of automated trading bots, which can organize strategies. Coinbase also offers advanced charting features via TradingView integration that include technical indicators like EMA, MA, MACD, RSI, and Bollinger Bands, as well as drawing instruments for detailed trade analysis.

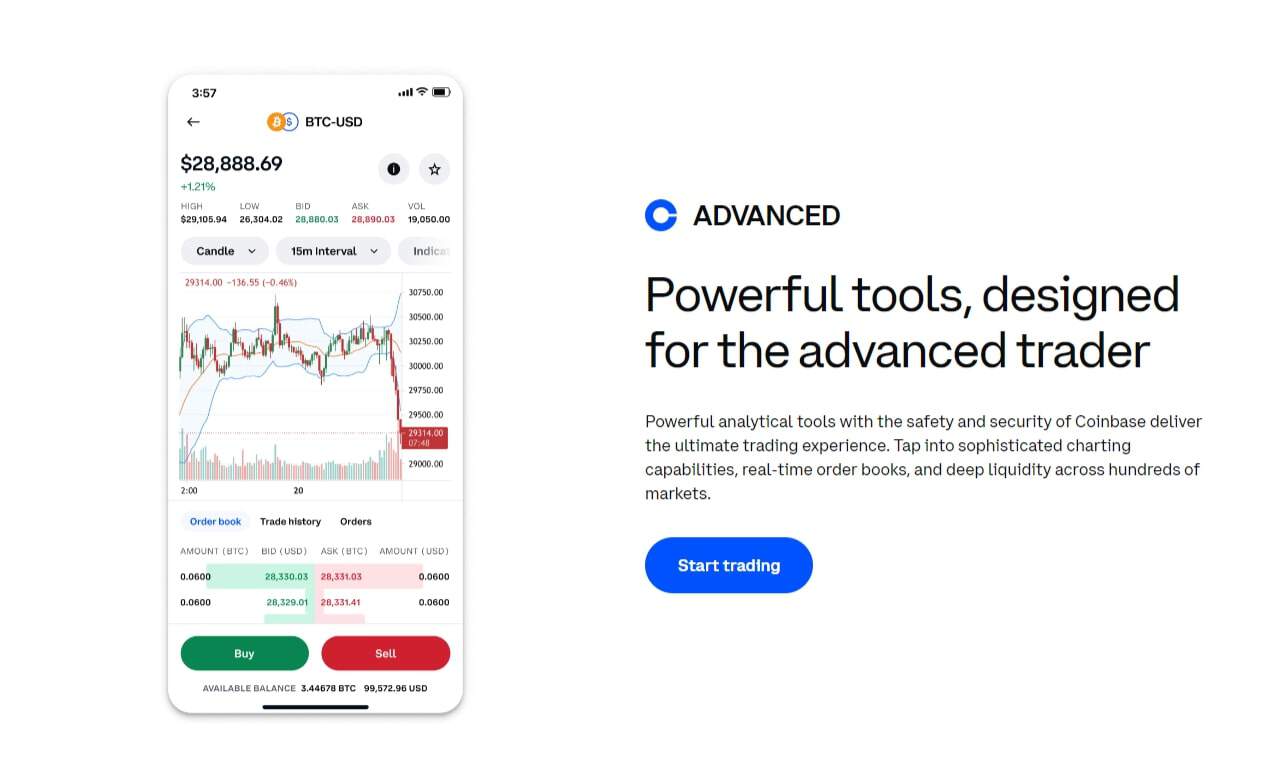

Advanced Trade for Seasoned Traders

Coinbase Advanced, formerly Advanced Trade, is a platform for seasoned traders. It provides an array of trading instruments at no additional subscription cost, and the associated fees are more economical than those on the standard Coinbase platform.

Coinbase Advanced users can incorporate TradingView indicators into their trades and use bots to execute trades automatically, increasing efficiency and accuracy in their trading tactics.

Traders using this advanced trading service also enjoy access to a broader range of market pairs and opportunities to receive increased staking rewards.

Trading Volume and Fee Discounts

Understanding the relationship between trading fees and trading volume on Coinbase can help users reduce costs.

The exchange operates on different trading fee structures, including a maker-taker fee model, which modifies charges based on the trader’s 30-day trade volume. Users benefit from reduced maker and taker fees when their trading activity increases.

Coinbase Fees

With Coinbase’s maker-taker fee system, the platform assigns different costs to orders based on whether they add liquidity (maker) or remove it (taker). The fees you encounter are structured according to your level of trading volume, providing an incentive for more frequent trading.

Fee Structure Transparency

Coinbase transparently displays its fee schedule on its website, guaranteeing that users have all the necessary information before executing any transactions on a crypto exchange. Should Coinbase’s fee structure be adjusted, users are promptly informed, allowing them to modify their trading approach as needed.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | $0 - $10 |

| Deposit Fee (Credit/Debit Card) | $0 - $10 |

| Trading Fee | 0.00% - 0.60% |

| Withdrawal Fee (Bank Transfer) | $0 - $25 |

Coinbase has a maker/taker fee schedule which you can see below.

| Tier | Taker Fee | Maker Fee |

|---|---|---|

| $0K-$10K | 60bps | 40bps |

| $10K-$50K | 40bps | 25bps |

| $50K-$100K | 25bps | 15bps |

| $100K-$1M | 20bps | 10bps |

| $1M-$15M | 18bps | 8bps |

| $15M-$75M | 16bps | 6bps |

| $75M-$250M | 12bps | 3bps |

| $250M-$400M | 8bps | 0bps |

| $400M+ | 5bps | 0bps |

Security - Is Coinbase Safe?

Coinbase prioritizes security on its site. The company safely stores the bulk of customer funds in offline cold storage to ensure safety against online threats.

The platform also offers various protective measures for user accounts, such as employing two-factor authentication (2FA), allowing only pre-approved withdrawal addresses, and providing secure vaults.

To enhance account safety, Coinbase implements additional safeguards, which include:

- Scanning the dark web actively to detect instances where customer passwords may have been compromised.

- Promoting the adoption of external security keys by users.

- Implementing onsite prompts designed to stop unauthorized attempts at accessing client accounts.

Historical Security Incidents

Despite its security protocols, Coinbase experienced several breaches between March and May 2021. During one significant breach in 2021, over 6,000 customers suffered losses when hackers stole funds by taking advantage of a flaw in Coinbase’s SMS account recovery mechanism.

Despite these setbacks, Coinbase has consistently upheld a strong reputation for security and ensured that all affected clients were compensated for their losses.

User Responsibility in Account Safety

Coinbase takes significant measures to ensure the safety of user accounts, but users themselves play an important role in safeguarding their account security. Here are some of the things that you can do to protect your digital assets:

- Implement two-factor authentication through verification apps for better protection.

- Maintain the confidentiality of your login details.

- Refrain from telling others your verification codes.

Coinbase Customer Support

Coinbase’s customer support system has received varied feedback from its users. While a majority of users are happy with the platform’s service, dissatisfied customers have encountered issues such as the following:

- Delayed email replies spanning 48 to 72 hours.

- Complicated telephone service routes.

- Ineffective problem-solving proposals from the support team.

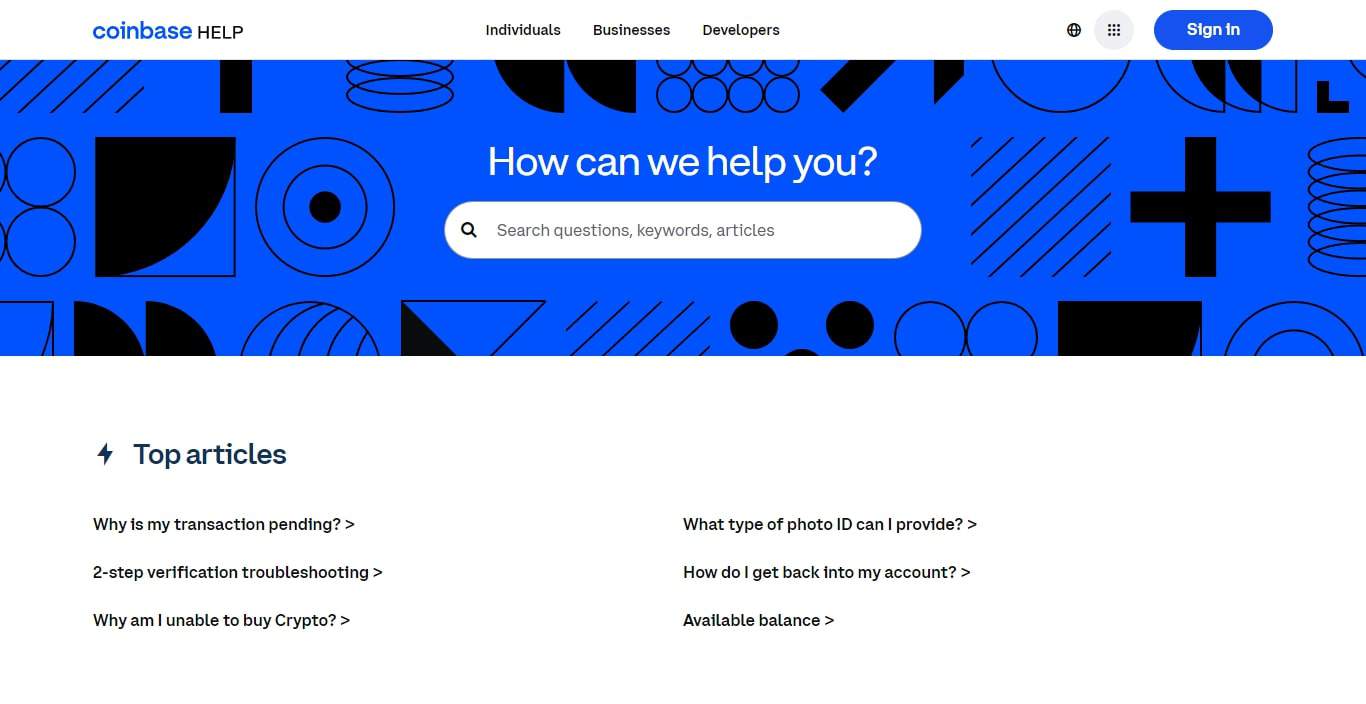

Accessing Help Resources

Coinbase’s help page offers articles and informational topics to assist its users. The company also provides multiple channels for assistance (e.g., social media), so there are many avenues to reach them.

Resolving Issues with Coinbase Support

Should you find your account frozen or terminated, it’s recommended that you read Coinbase’s terms of service thoroughly. Remember that any violation of their terms of service can cause your account to be closed or terminated.

Coinbase Support Channels

Rewards and Incentives for Coinbase Users

Coinbase provides an array of benefits and perks for its users.

Coinbase Earn Program

Coinbase Earn allows users to get free cryptocurrency by participating in educational courses about different cryptocurrencies. This feature gives a monetary incentive and enhances user knowledge of upcoming digital currencies.

Staking on Coinbase

The platform supports staking on Proof of Stake cryptocurrencies, enabling users to gain extra crypto rewards as they contribute to the network’s security. Staking can yield up to 10% APY returns on certain cryptocurrencies. With a global expansion in mind, Coinbase has rolled out its staking and stablecoin USDC offerings to over 110 countries.

Coinbase Wallet

The Coinbase Wallet gives users control over their crypto holdings. Rather than being kept on Coinbase’s servers, it keeps cryptocurrencies secure on the user’s device. The Coinbase wallet employs several layers of protection, such as the following:

- Multi-signature validation.

- Biometric entry systems like fingerprint or facial recognition.

- Two-step verification process (2FA).

- Options for backup and system restoration.

The Coinbase Debit Card

The company now offers the Coinbase Card, a prepaid Visa debit card that connects directly to holders’ Coinbase account balances. This card simplifies cryptocurrency spending for holders.

Perks are involved as those who use the card can get back up to 4% in various cryptocurrencies, allowing them to earn rewards through usage.

Regulatory Compliance and Legal Aspects

For starters, Coinbase complies with AML (anti-money laundering) and KYC (know your customer) rules.

Understanding Coinbase’s Legal Standing

Coinbase has secured numerous licenses and registrations from different countries around the world, demonstrating its commitment to meeting regulatory standards necessary for international operations. These authorizations strengthen Coinbase’s legal position and affirm its continuous compliance with global regulations, permitting it to engage in cryptocurrency trading activities internationally.

The Importance of Compliance for Users

Compliance is equally important for users. To stop fraudulent activities and as a legal mandate, Coinbase requires its users to verify their identity. This measure secures the user’s account and upholds the platform’s integrity.

How to Sign Up on Coinbase

- Create Account - Visit the Coinbase website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you'll be able to deposit using the deposit methods listed below.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

Coinbase Alternatives

Binance

Total Supported Cryptocurrencies

421+

Trading Fees

0.0110% - 0.1000%

Fiat Currencies Supported

USD, GBP, CAD, EUR, NZD + 75 others

Kraken

Total Supported Cryptocurrencies

431+

Trading Fees

0.08% - 0.40%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 1 other

OKX

Total Supported Cryptocurrencies

313+

Trading Fees

-0.005% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Final Thoughts

Coinbase stands out as a good place for cryptocurrency transactions. It has a user-friendly interface, great cryptocurrency selection, advanced trading tools, strong security protocols, and opportunities to earn rewards. The platform is suitable for beginners and experienced traders alike.

Adhering to legal and regulatory requirements is also important for cryptocurrency exchanges to enable them to function globally, and Coinbase places great importance on this aspect of their business.

Coinbase’s customers also have a role in maintaining security. Users must proactively protect their accounts to keep their cryptocurrencies safe.

Even though there are some complaints about the platform’s customer support, Coinbase continues to be a dominant force in the cryptocurrency space.

Are you curious to compare Coinbase’s performance against other cryptocurrency exchanges? Check out our articles Coinbase vs CoinSpot, Coinbase vs Kraken, Coinbase vs Coinmama and Coinbase vs eToro!

Coinbase FAQs

Coinbase, one of the largest cryptocurrency exchanges globally, has established a reputation as a trustworthy, full-featured platform for buying, selling, and trading cryptocurrencies. It’s important to note that it is a regulated entity in the United States and complies with various financial services and consumer protection laws.

However, as with other online services, users should be cautious and apply security measures (like strong passwords) when using the platform.

Generally, users can withdraw their funds from Coinbase to their bank account or other external wallets. If there are withdrawal issues, they could be due to maintenance, security checks, or account verification processes.

Users must ensure they comply with any requested verification steps to avoid problems.

Making a specific amount, such as $100 a day on Coinbase or any other exchange, involves trading, which comes with risks. Users must conduct thorough research, understand market trends, and only invest what they can afford to lose.

It’s also important to be aware of the volatility in the cryptocurrency market.

No online platform can be considered 100% safe from all potential risks, including security breaches or system failures. Coinbase implements security measures to protect user accounts and funds, such as two-factor authentication (2FA) and FDIC insurance for USD balances.

Still, users should take personal security measures to minimize cryptocurrency risks.

Coinbase uses encryption and other security protocols to protect the connection with users’ bank accounts. However, as with any financial service, users must have strong passwords, enable 2FA, and monitor their accounts for unauthorized activities.

Coinbase has a subscription service called Coinbase One, which offers benefits like zero-fee trading and account protection. The fees for such services may vary, but you can expect to pay around $30 monthly.

Coinbase requires users to verify their identity to comply with regulatory requirements. They claim to store personal information securely and only use it for verification purposes.

Users should ensure they understand the platform’s privacy policy and the measures it takes to protect personal data.

Coinbase User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for Coinbase - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.

Best Cryptocurrency Exchange for Beginners

Best Cryptocurrency Exchange for Beginners