When it comes to navigating the vast expanse of the cryptocurrency landscape, choosing the right exchange can be as crucial as the investments themselves. Two titans in this digital arena are Coinbase and Kraken, each boasting its unique features and capabilities.

In this comparison, we will delve into the core aspects of both exchanges, examining their strengths and differences to help users make an informed decision.

At a glance

| Category | Coinbase Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. | Kraken Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. |

|---|---|---|

| Headquarters Location | International | International |

| Fiat Currencies Supported | USD, AUD, GBP, CAD, EUR, NZD + 50 others | USD, AUD, GBP, CAD, EUR + 1 other |

| Total Supported Cryptocurrencies | 243+ | 244+ |

| Trading Fees | 0% - 0.60% | 0.08% - 0.40% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay, PayID, Osko |

| Support | Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket | Facebook, Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android | Yes - iOS, Android |

| Our Rating | ||

| Review | Read full Coinbase review | Read full Kraken review |

| Visit | Visit Coinbase | Visit Kraken |

About Coinbase Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

Coinbase, founded in 2012 by Brian Armstrong and Fred Ehrsam, is headquartered in San Francisco and has rapidly ascended to the ranks of leading cryptocurrency exchanges globally. Renowned for its user-friendly interface, Coinbase offers a gateway for both novice and experienced traders to engage with a variety of cryptocurrencies.

Its commitment to regulatory compliance and user security is well-documented, with features like FDIC-insured USD balances for US residents adding to its trusted status. The inception of this exchange marked a pivotal shift in the acceptance of cryptocurrencies, signalling a broader embrace of digital finance. Its journey has been shaped by collaborations with banking institutions and a progressive stance on regulatory engagement, contributing to the proliferation of cryptocurrency use.

This platform has also been part of critical discussions shaping the legislative framework around crypto, reflecting its influence in the space. As it expanded globally, strategic acquisitions and partnerships have been instrumental, enabling it to offer a wide range of services to a diverse customer base.

Coinbase Pros & Cons

Pros

Cons

About Kraken Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

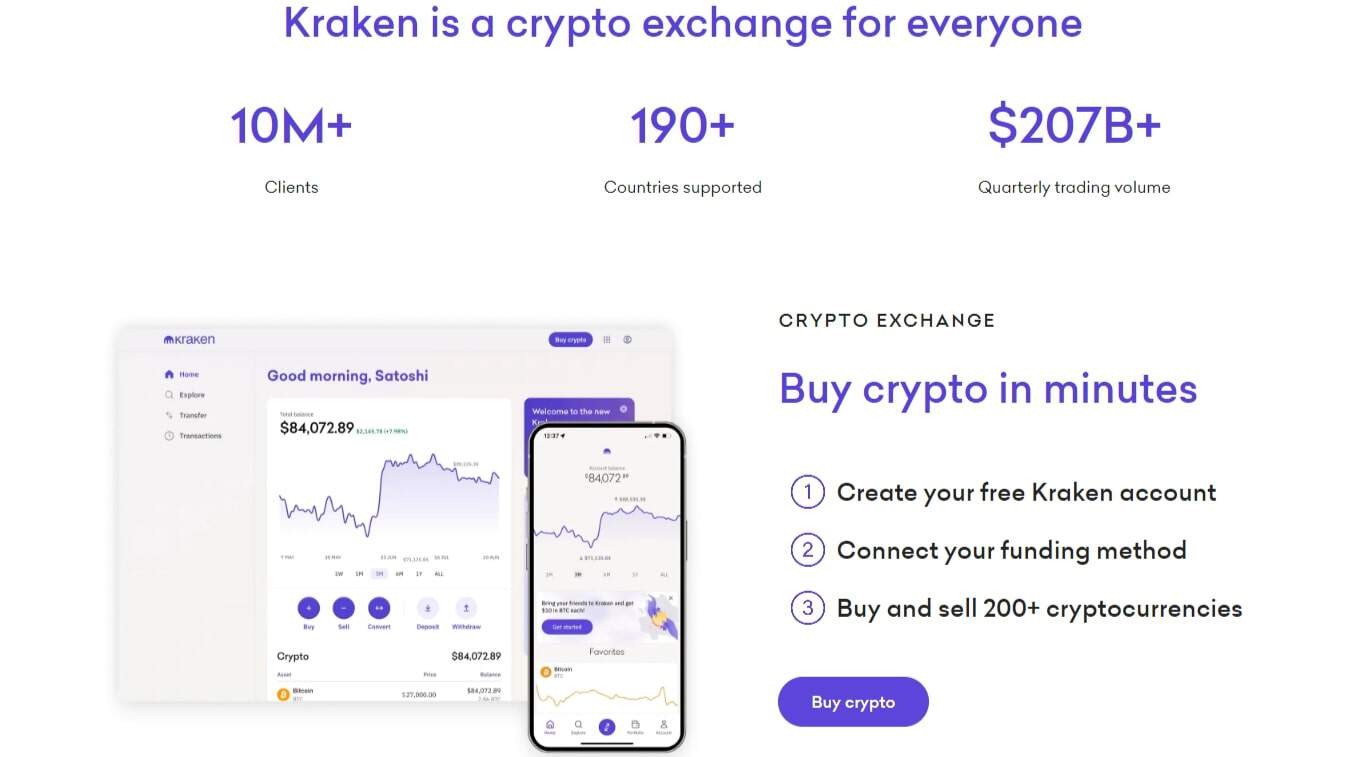

Kraken, established in 2011 by Jesse Powell, stands as one of the oldest and most respected cryptocurrency exchange platforms. Also based in San Francisco, Kraken has built a reputation for its focus on security and a comprehensive suite of advanced trading options.

Offering a robust range of cryptocurrencies, Kraken appeals to a spectrum of users, from beginner investors to advanced cryptocurrency traders seeking a sophisticated trading experience. From its inception, the second exchange has been a vanguard in the cryptocurrency domain, contributing to the industry’s infrastructure and standards. Its evolution has been marked by a commitment to providing traders with a secure and reliable platform, weathering the volatile nature of the crypto markets.

By remaining attuned to the needs of both retail and institutional investors, the exchange has introduced progressive features that have broadened its appeal. Furthermore, its active participation in cryptocurrency advocacy and education underscores its dedication to advancing the ecosystem.

Kraken Pros & Cons

Pros

Cons

Coinbase vs Kraken: Supported Cryptocurrencies

In terms of total cryptocurrencies available, Kraken users have access to more cryptocurrencies. Coinbase offers 243 cryptocurrencies whereas Kraken supports 244 cryptocurrencies.

For those interested in trading high market cap cryptocurrencies, Coinbase supports 24 of the top 30, compared to Kraken which supports 23 of the top 30.

Kraken provides access to a wider range of cryptocurrencies, making it a potential go-to for traders seeking a diverse range. However, Coinbase remains a strong competitor with its offerings.

Coinbase vs Kraken: Fees

| Fee Type | Coinbase Fees | Kraken Fees |

|---|---|---|

| Deposit Fee (Bank Transfer) | $0 - $10 | $0 USD - $5 USD |

| Deposit Fee (Credit Card/Debit Card) | $0 - $10 | Not Listed |

| Trading Fee | 0% - 0.60% | 0.08% - 0.40% |

| Withdrawal Fee (Bank Transfer) | $0 - $25 | $0 USD - $35 USD |

Both Coinbase and Kraken structure their fees to accommodate varying levels of trading volume and user engagement. Without delving into specific numbers, it’s important to note that each platform employs a maker-taker fee model, which is standard across the industry.

Users might encounter differences in transaction fees, withdrawal fees, and other service-related charges, which are dependent on factors such as payment method and trade frequency. Understanding the nuances of fee structures is crucial for traders to optimise their investments. While both platforms strive to maintain competitive fees, they also offer discounted rates to high-volume traders, which reflects their commitment to catering to active trading enthusiasts.

It’s also worth noting that the choice of currency options for funding accounts can influence the overall fees incurred, as currency conversion may play a role. Traders are encouraged to evaluate their trading frequency and payment methods to discern the most cost-efficient path.

Coinbase vs Kraken: Security

Security is a paramount concern in the crypto space, and both Coinbase and Kraken go to great lengths to protect their users’ assets. Coinbase utilises a variety of security measures, including two-factor authentication, wallet services with a combination of online and offline storage, and insurance coverage for digital assets held on their platform.

Kraken’s security is equally stringent, with air-gapped cold storage for the majority of assets, strict physical security measures like armed guards, and a bug bounty program to continually enhance its defences. Both platforms enforce rigorous security protocols to safeguard users’ assets and personal information. One employs security via hardware keys and key permission controls, ensuring that users have granular authority over their accounts.

The other complements its security measures with regular audits and a comprehensive list of security features that fortify its infrastructure against potential threats. The continuous refinement of security practices is indicative of their proactive approach to combating the ever-evolving cybersecurity challenges.

Coinbase vs Kraken: Ease of use

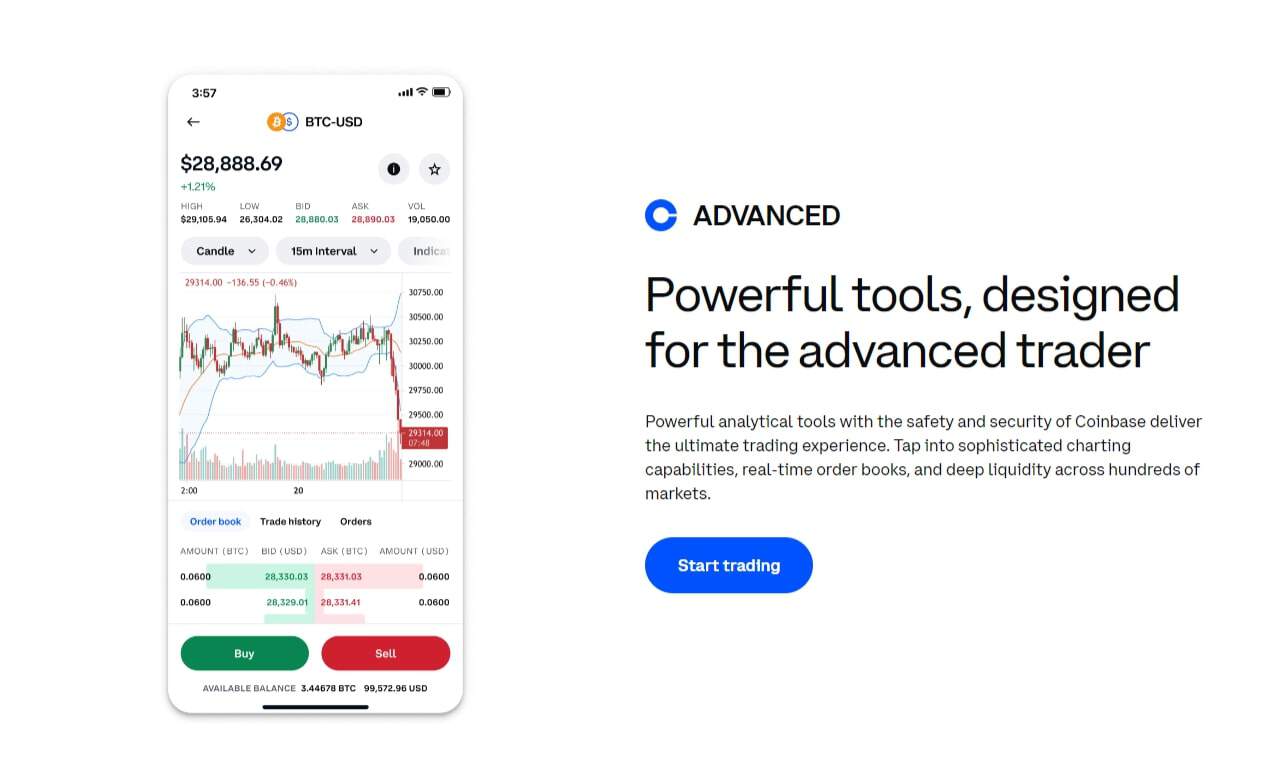

Coinbase boasts a simple, intuitive interface that caters to beginners and those looking for a straightforward crypto investing journey. The platform’s ease of navigation makes it a preferred choice for users new to the cryptocurrency market.

On the other hand, Kraken offers a more complex user experience with Kraken Pro and Kraken Terminal, designed for users who require advanced trading interfaces and real-time market data. For those new to the cryptocurrency space, these platforms provide streamlined interfaces that remove the complexity from digital currency transactions. The beginner-friendly platform with its simple user interface enables users to make crypto purchases with ease, while the debit card purchases feature facilitates instant integration with everyday finance.

Conversely, the exchange catering to more advanced users presents a range of tools and features that, while complex, deliver a powerful environment for intricate trading strategies.

Coinbase vs Kraken: Support

Customer support is critical in the fast-paced world of crypto trading, and both Coinbase and Kraken provide support channels to assist their users. Coinbase has an extensive help centre and offers email support, while Kraken also features 24/7 live chat and email assistance.

The level of support may vary based on the complexity of issues and the volume of support requests each platform receives. With the dynamic nature of cryptocurrency markets, timely support can be the linchpin for a positive user experience. Both exchanges provide educational materials that empower users to navigate the intricacies of crypto trading.

Moreover, the levels of customer support, including assistance with withdrawal limits and verification processes, are tailored to match the diversity of user expertise. While one platform might be an excellent choice for those seeking guidance on simple transactions, the other is well-equipped to handle the complexities that seasoned investors may encounter.

Coinbase vs Kraken: Features

Both exchanges offer an array of features to enhance the trading and investment experience. With Coinbase, users benefit from educational resources like Coinbase Earn, a dedicated wallet app, and the ability to use a debit card for instant purchases, Coinbase Pro for more advanced trading options, and staking rewards for certain crypto assets.

Kraken stands out with its futures trading, margin trading, and a comprehensive set of advanced tools within the Kraken Pro interface that cater to more experienced traders. Depth of features is a hallmark of both exchanges, with one offering a secure storage solution that doubles as a crypto wallet, allowing for both investment and utility. The other exchange’s advanced features cater to active users who require a comprehensive suite of trading options, including spot trading and advanced trading tools for frequent trades.

These features underscore their commitment to providing a holistic trading environment suitable for a broad spectrum of investors, from those making their first crypto transactions to sophisticated traders.

Final Thoughts

Deciding between Coinbase and Kraken is a matter of personal preference and trading needs. Each platform provides a secure and comprehensive service for crypto trading and investment.

While Coinbase shines with its simplicity and ease of use for crypto newcomers, Kraken offers depth in its advanced trading features and security measures for seasoned crypto enthusiasts. The future of digital finance continues to unfold, with crypto exchanges like these playing a pivotal role. They stand as gatekeepers of innovation, continuously adapting to the changing landscape of digital currencies and the evolving needs of crypto investors.

As technology advances and regulation matures, these platforms are poised to redefine the boundaries of cryptocurrency trading and investment, cementing their positions as pillars of the digital economy.

Coinbase vs Kraken: FAQs

- Variety Matters: If you’re looking for a wider variety of altcoins, platforms like Binance or KuCoin might be more appealing.

- Fee Structures: Consider fee structures. Platforms like Kraken or Bitstamp may have different fee models that could be more cost-effective depending on your trading habits.

- User Experience: Some users prefer the user interface and experience of platforms like Gemini or Binance.

- Regional Availability: Not all platforms are available in every region. Local exchanges might offer advantages in terms of support and fiat currency options.

- Fees: Coinbase is often criticized for its higher fees compared to other exchanges, especially for small transactions.

- Asset Selection: While it has a good selection of cryptocurrencies, it might not have as wide a range as other exchanges like Binance.

- Customer Support Issues: Some users have reported issues with customer support responsiveness.

- Privacy Concerns: There have been concerns about privacy and data use, as Coinbase is a fully regulated exchange.

- Strong Reputation: Kraken is known for its strong focus on security and has a good track record in this area.

- Security Features: It offers robust security features like two-factor authentication and a global settings lock.

- Regulatory Compliance: Being compliant with various regulatory requirements adds to its safety profile.

- But Remember: No exchange is 100% safe. It’s always wise to use additional personal security measures like hardware wallets for large holdings.

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.