The landscape of cryptocurrency exchanges is constantly evolving, with numerous platforms vying for the attention of eager investors. In this dynamic market, two notable names stand out: eToro and Coinbase.

Both exchanges have carved out distinct niches, offering a plethora of features geared towards both novice and experienced traders. In our comparison today, we will delve into the nuances of these platforms, laying out their offerings side-by-side to help you determine which might suit your crypto trading needs.

At a glance

| Category | eToro Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. | Coinbase Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. |

|---|---|---|

| Headquarters Location | International | International |

| Fiat Currencies Supported | USD | USD, AUD, GBP, CAD, EUR, NZD + 50 others |

| Total Supported Cryptocurrencies | 96+ | 243+ |

| Trading Fees | 1% | 0% - 0.60% |

| Deposit Methods | Bank Transfer, Debit Card, Cryptocurrency, Paypal, Skrill, Neteller, WebMoney | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay |

| Support | Facebook, Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket | Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android | Yes - iOS, Android |

| Our Rating | ||

| Review | Read full eToro review | Read full Coinbase review |

| Visit | Visit eToro

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk. eToro Service ARSN 637 489 466 Capital at risk. See PDS and TMD. This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal. |

Visit Coinbase |

About eToro Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

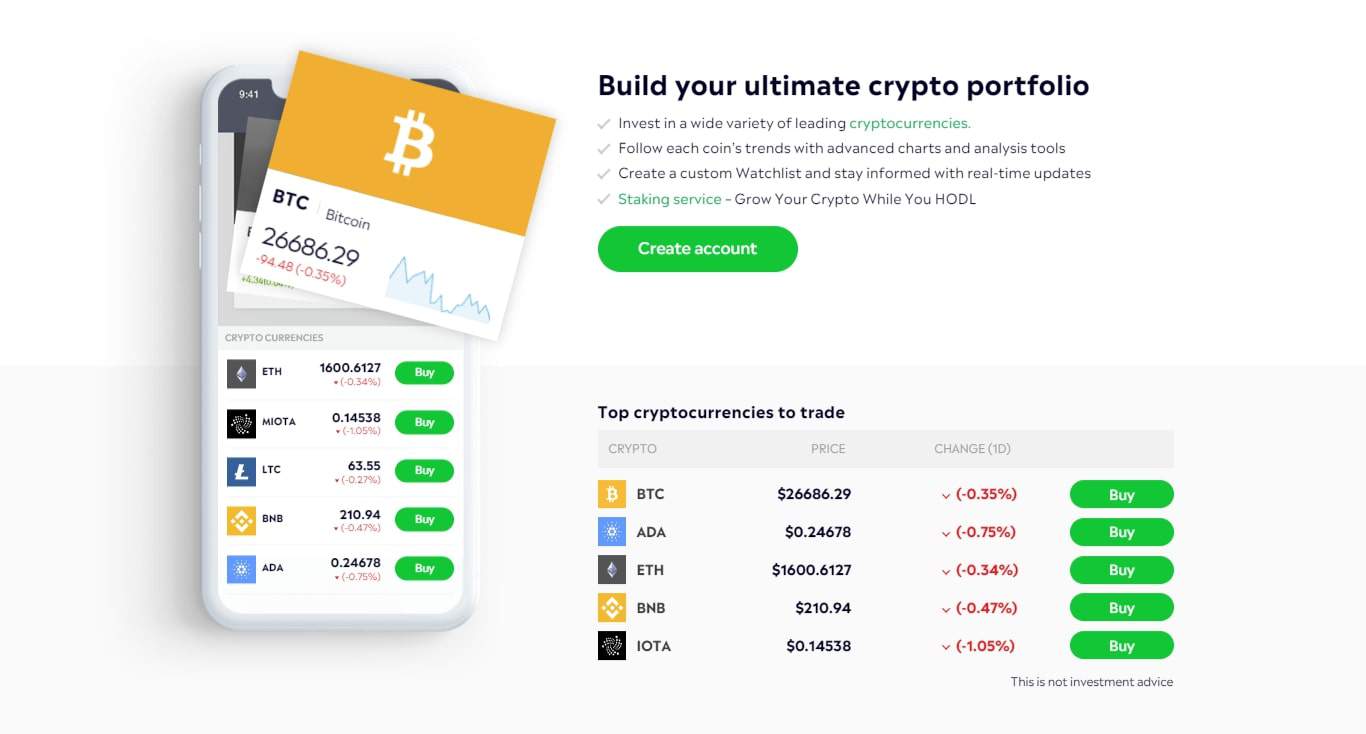

eToro is widely known as a social trading platform that encourages users to connect with one another, sharing strategies and insights. Established in 2007, it has expanded beyond its original trading boundaries, now offering access to a variety of cryptocurrencies alongside traditional financial products.

eToro stands out for its CopyTrader feature, which allows less experienced traders to replicate the trades of successful traders, and the eToro Club, offering a range of additional services to its members. This platform has become synonymous with democratising traditional investment through its innovative approach to social trading. It has leveraged the collective wisdom of its user community to create a unique collaborative trading environment.

This ethos has been a driving force in the platform’s evolution, reflecting a broader industry trend towards more interactive and communal financial platforms. Such features empower individuals to make decisions with confidence, drawing on the collective insights of seasoned traders.

eToro Pros & Cons

Pros

Cons

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

eToro Service ARSN 637 489 466 Capital at risk. See PDS and TMD.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

About Coinbase Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

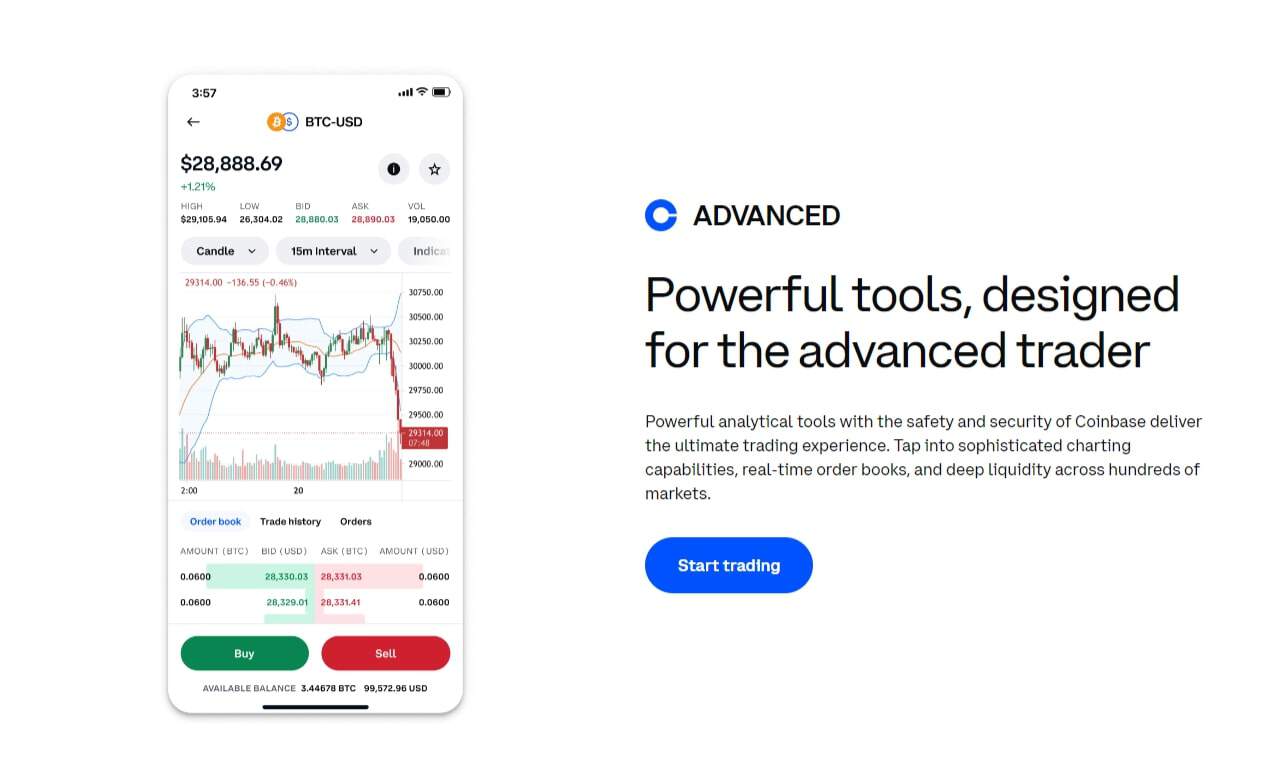

Coinbase, on the other hand, made its debut in 2012 and quickly established itself as one of the most accessible cryptocurrency exchanges for crypto beginners. Its user-friendly interface eases the process of buying, selling, and storing digital assets.

Coinbase is also known for its Coinbase Pro platform, designed for more experienced traders with features such as Advanced Trade, detailed charts, and a suite of additional trading tools. Stepping into the cryptocurrency markets, this exchange quickly became a gateway for many to the world of digital currencies. With an emphasis on simplicity and education, it has positioned itself as more than just a trading platform; it’s a comprehensive learning center for anyone seeking a basic understanding of cryptocurrency assets.

The platform’s journey has mirrored the increasing mainstream acceptance of digital assets by financial authorities, underscoring the importance of accessible crypto exchange platforms.

Coinbase Pros & Cons

Pros

Cons

eToro vs Coinbase: Supported Cryptocurrencies

In terms of total cryptocurrencies available, Coinbase users have access to more cryptocurrencies. eToro offers 96 cryptocurrencies whereas Coinbase supports 243 cryptocurrencies.

For those interested in trading high market cap cryptocurrencies, eToro supports 20 of the top 30, compared to Coinbase which supports 24 of the top 30.

Coinbase supports a significantly higher number of cryptocurrencies compared to eToro. With this in mind, Coinbase definitely has the edge for people looking to trade a wider range of cryptocurrencies.

eToro vs Coinbase: Fees

| Fee Type | eToro Fees | Coinbase Fees |

|---|---|---|

| Deposit Fee (Bank Transfer) | 0% | $0 - $10 |

| Deposit Fee (Credit Card/Debit Card) | 0% | $0 - $10 |

| Trading Fee | 1% | 0% - 0.60% |

| Withdrawal Fee (Bank Transfer) | 0% - $5 USD | $0 - $25 |

When it comes to fees, both eToro and Coinbase have structured their fee schedules to cater to a wide range of users, with various factors influencing the cost of transactions. eToro’s fees are incorporated into the spread, which can fluctuate with market conditions.

Coinbase operates on a maker-taker fee model on Coinbase Pro, while the standard platform includes a fee for cryptocurrency trading. Both exchanges charge fees for withdrawals and non-USD deposits, though the specific figures can vary. Transactional costs are a reality of trading, and understanding the fee structures is crucial for investors to optimise their investment strategy.

While specifics are ever-changing, the underlying principles remain; exchanges aim to balance the need for sustainability with competitive pricing to attract a broad user base. Both platforms employ a fee model that reflects their target user groups and market positioning, underpinning the importance of transparency and fairness in the fee structures of crypto exchanges.

eToro vs Coinbase: Security

Security is paramount in the realm of online trading, and both eToro and Coinbase have implemented strong security measures to keep customers’ investments safe. eToro employs advanced security protocols including encryption and multi-signature security, while Coinbase boasts a robust security feature set that includes FDIC-insured USD balances for eligible customers and cold storage for the majority of digital assets.

Each platform’s commitment to security underlines their efforts to maintain trust and protect users’ funds. In a sector where the stakes are as high as in the crypto markets, the level of security provided by an exchange is often a make-or-break factor for its users. Both platforms not only comply with industry-standard security measures but also incorporate additional layers of protection, such as user education and real-time monitoring systems.

This holistic approach to security highlights the exchanges’ understanding that maintaining the highest security standards is a continuous process requiring constant vigilance and innovation.

eToro vs Coinbase: Ease of use

Ease of use is a significant factor when choosing an exchange. Coinbase is often celebrated for its beginner-friendly exchange platform, offering a simple, intuitive interface that makes navigating the crypto market more accessible.

eToro also prides itself on user experience with a slightly different angle, focusing on social trading features that provide a more interactive and engaging platform for traders. Both platforms offer mobile applications, ensuring trading on the go is as seamless as possible. User-friendliness transcends mere aesthetic design; it encompasses the overall experience, from sign-up to the execution of complex trades.

Factors such as the clarity of information, the responsiveness of the interface, and the availability of support all contribute to the ease with which users can navigate the platforms. The commitment to a streamlined user experience reflects an acknowledgement that the ease of accessing and using trading platforms is integral to engaging and retaining a diverse user base.

eToro vs Coinbase: Support

Customer support is a crucial aspect of any service industry, particularly in the fast-paced world of crypto exchanges. Both eToro and Coinbase offer a selection of resources to assist their users.

eToro provides a customer service team alongside educational resources such as videos and articles. Coinbase also offers support through a help center and customer service, though some users report a lack of customer support responsiveness, which is a common critique across many crypto platforms. Support goes beyond troubleshooting; it is a comprehensive service that enhances the user’s journey on the platform.

It involves timely assistance, proactive resources, and a listening ear to user feedback. The level of support provided is indicative of the exchanges’ commitment to their user base, with the aim of fostering a supportive environment where users feel valued and heard.

In the fast-moving world of cryptocurrency exchanges, effective support services are vital in ensuring users’ continued trust and satisfaction.

eToro vs Coinbase: Features

Diving into the features of each exchange, it’s clear that eToro and Coinbase cater to different aspects of trading. eToro’s social trading platform allows investors to observe and follow the trading strategies of experienced traders, while its range of products includes CFDs and other financial trading options.

Coinbase, with Coinbase Advanced Trade, offers a more traditional exchange experience, with detailed analytical tools and direct order book transactions aimed at more advanced users. Feature sets are not just about quantity; they’re about the quality and integration of those features into the user’s trading experience. Both exchanges have striven to provide tools and services that resonate with their core trader base, from educational content that demystifies trading to advanced features that enable professional traders to execute complex strategies.

The depth and breadth of these features are a testament to the platforms’ responsiveness to the evolving needs of the crypto community.

Final Thoughts

Comparing eToro and Coinbase reveals that each exchange caters to different trader needs and preferences. eToro’s social trading features and copy trading options make it appealing for those looking to leverage the expertise of top-performing traders.

Coinbase, with its straightforward interface and a wide selection of cryptocurrencies, serves as a solid foundation for individuals new to the crypto sphere. It’s important to weigh each platform’s features against your individual trading habits and investment goals. In the broader context, these exchanges reflect the diverse needs of the burgeoning cryptocurrency market.

They each offer a bridge between the nascent world of digital currencies and the established realm of traditional finance. The landscape they navigate is one of constant change, where adaptability and user-centric features dictate success.

As the digital finance sector continues to grow, these platforms, among others, will likely play pivotal roles in shaping its development.

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

eToro Service ARSN 637 489 466 Capital at risk. See PDS and TMD.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

eToro vs Coinbase: FAQs

When comparing eToro and Coinbase, the choice between the two depends on your specific needs and preferences in terms of trading and investing. eToro is known for its social trading platform which allows traders to follow and copy the trades of successful traders.

This feature might be appealing if you’re interested in seeing the trading strategies of experienced traders. On the other hand, Coinbase is recognized for its user-friendly exchange, making it a suitable option for crypto beginners.

It offers a variety of cryptocurrencies and is considered one of the popular cryptocurrency exchanges with a substantial user base. Security is a priority for both platforms; they utilize strong security measures to keep investors’ crypto assets safe.

Some potential downsides of using eToro include the withdrawal fee and the limited selection of cryptocurrencies compared to some other cryptocurrency exchanges. While eToro provides a social trading platform and a variety of digital assets, users may find the fee structures, including trading fees and non-USD deposit fees, to be a disadvantage.

Furthermore, eToro’s product range might not be as extensive as some other crypto exchanges, which could be a limitation for traders looking for a wide range of assets.

eToro aims to be competitive in the market by offering a platform that attracts a broad user base, from novice investors to experienced traders. They provide a variety of options for trading digital currencies and other assets.

The platform’s structure might include features that other platforms charge for, or they may have a different fee schedule that can sometimes result in lower costs for specific transactions or trades. Additionally, eToro’s social trading features like eToro CopyTrader may provide additional value that could be factored into their overall pricing strategy.

Whether a platform is ‘better’ than eToro depends on individual trading habits and preferences. Other platforms may offer different fee structures, a wider range of products, or different advanced features that might be more aligned with an investor’s strategy.

For instance, Coinbase Pro offers an advanced trading platform with a different fee schedule and additional trading features. Investors should consider their specific needs, such as the selection of cryptocurrencies, educational resources, and security measures when choosing a platform.

eToro is a well-known social trading platform with a presence in various markets, including Puerto Rico and the Northern Marianas, and operates under eToro USA LLC. It offers a selection of cryptocurrencies and employs security measures like cold storage and multi-signature security to protect customer assets.

eToro is also subject to oversight from financial authorities, adding a level of trust. It’s important for customers to research and consider eToro’s security, customer service, and regulatory compliance when deciding whether to trust the platform for their crypto investments.

eToro employs a range of security measures, including cold storage for digital assets, to ensure the safety of customers’ cryptocurrency balances. The company also provides features like eToro Money wallet, which allows users to transfer assets from the wallet for additional management.

However, as with any online trading platform, there is always a degree of risk. Traders should use personal best practices for security and may consider using personal wallets for long-term storage of cryptocurrencies.

Coinbase is one of the most well-known and widely used cryptocurrency exchanges, especially among traders in the United States. It offers a wide selection of cryptocurrencies and is known for its strong security measures, such as FDIC-insured USD balances for eligible customers and cold storage for the majority of crypto assets.

While it is considered a trusted platform in the market, customer trust is subjective and can vary based on personal experiences and individual requirements for security, customer service, and platform features.

Coinbase is often considered a user-friendly exchange, offering a wide range of cryptocurrencies and services like Coinbase Wallet and Coinbase Advanced Trade. It provides educational content to help users make informed trading decisions and has a strong focus on security, employing cold storage and other security features to keep investors safe.

Additionally, Coinbase offers a basic platform suited for beginners and an advanced platform for seasoned traders. Whether it is worth using depends on your trading preferences, the importance of educational resources, the fee structure, and whether the offered features align with your investment strategy.

eToro Disclaimer

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Smart Portfolios are not exchange-traded funds or hedge funds and are not tailored to your specific objectives, financial situations, and needs. Your capital is at risk. See PDS and TMD.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk. May not suffice as a basis for investment decisions.

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.