When it comes to diving into the world of cryptocurrency, selecting the right exchange is crucial for both newcomers and seasoned traders. Coinmama and Coinbase are two titans in the cryptocurrency exchange landscape, each offering unique features and services.

This comparison aims to illuminate the differences and similarities between these platforms, helping users make an informed decision based on their individual needs.

At a glance

| Category | Coinmama | Coinbase Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. |

|---|---|---|

| Headquarters Location | Vancouver, Canada | International |

| Fiat Currencies Supported | USD, AUD, CAD, EUR + 42 others (some through third party apps) | USD, AUD, GBP, CAD, EUR, NZD + 50 others |

| Total Supported Cryptocurrencies | 41+ | 302+ |

| Trading Fees | 0.99% - 3.90% | 0.00% - 0.60% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Apple Pay, Google Pay, Skrill, Neteller, Giropay, Astropay, Khipu, WebPay, PSE, SPEI | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay |

| Support | Twitter, Help Center Articles, Support Ticket | Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Has no mobile app. | Yes - iOS, Android |

| Our Rating | ||

| Review | Read full Coinmama review | Read full Coinbase review |

| Visit | Visit Coinmama | Visit Coinbase |

About Coinmama

The emergence of Coinmama was a response to the growing need for easy access to cryptocurrencies. Over the years, it has navigated a rapidly evolving market, honing its services to cater to those who value quick and straightforward digital currency purchases.

Not just riding the wave of cryptocurrency popularity, Coinmama’s growth has been influenced by a global user base seeking diverse payment options to invest in digital assets. From economic fluctuations that triggered a surge in cryptocurrency adoption to regulatory changes impacting how exchanges operate, Coinmama has remained resilient, continuously adapting its platform to meet the shifting demands of the crypto space.

Coinmama Pros & Cons

Pros

Cons

About Coinbase Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

Coinbase’s trajectory mirrors the advent of cryptocurrencies into the mainstream finance dialogue. The platform’s expansion has often paralleled major industry milestones, such as the Bitcoin halving events and the Ethereum company’s growth.

As digital currencies gained a foothold in the public consciousness, Coinbase leveraged its user-friendly design to demystify the buying and selling process for digital assets. The exchange has weathered the unpredictable cycles of the cryptocurrency market, broadening its scope to include services for both individual enthusiasts and institutional clients, which has solidified its role as a pillar of the crypto exchange community.

Coinbase Pros & Cons

Pros

Cons

Coinmama vs Coinbase: Supported Cryptocurrencies

In terms of total cryptocurrencies available, Coinbase users have access to more cryptocurrencies. Coinmama offers 41 cryptocurrencies whereas Coinbase supports 302 cryptocurrencies. In this case, Coinmama limits access to a large number of cryptocurrencies, which can be a problem for many traders.

For those interested in trading high market cap cryptocurrencies, Coinmama supports 20 of the top 30, compared to Coinbase which supports 21 of the top 30.

Coinbase supports a significantly higher number of cryptocurrencies compared to Coinmama. With this in mind, Coinbase definitely has the edge for people looking to trade a wider range of cryptocurrencies.

Coinmama vs Coinbase: Fees

| Fee Type | Coinmama Fees | Coinbase Fees |

|---|---|---|

| Deposit Fee (Bank Transfer) | 1.5% - 1.89% | $0 - $10 |

| Deposit Fee (Credit Card/Debit Card) | 3.24% - 3.34% | $0 - $10 |

| Trading Fee | 0.99% - 3.90% | 0.00% - 0.60% |

| Withdrawal Fee (Bank Transfer) | Not Listed | $0 - $25 |

Understanding the fee structures of cryptocurrency exchanges can be as crucial as the trading experience itself. Both Coinmama and Coinbase employ a tiered fee system that reflects their aim to cater to a variety of users, from casual buyers to active traders.

As these platforms seek to balance operational costs with user convenience, they have developed pricing models that incentivise certain transaction types or payment methods. This approach not only dictates the competitiveness of the exchanges but also influences user strategies in managing their investments in digital currencies.

Coinmama vs Coinbase: Security

Both Coinmama and Coinbase have cultivated reputations as security-conscious platforms, a prerequisite in an industry where trust is paramount. Their commitment to security extends beyond compliance; it involves a proactive stance on protecting users.

From advanced encryption techniques to the continual security audits, these exchanges strive to stay ahead of potential threats. The security features they champion not only defend against unwanted users but also instil confidence among their clientele, a key component in sustaining their operations within the risky crypto market.

Coinmama vs Coinbase: Ease of use

The focus on creating a user-friendly experience is evident in the design principles of Coinmama and Coinbase. They aim to remove barriers that can intimidate those new to cryptocurrencies, simplifying navigation and transaction processes.

By emphasising an intuitive journey from onboarding to transaction completion, these platforms have helped broaden the appeal of cryptocurrencies. The attention to detail in their user interfaces reflects a deep understanding of customer needs, marrying functionality with simplicity.

Coinmama vs Coinbase: Support

Customer support remains a cornerstone of the user experience, and both Coinmama and Coinbase acknowledge this through their commitment to service excellence. Their support systems are designed with a user-first philosophy, aiming to provide clear, helpful, and timely assistance.

As the crypto market grows in complexity and scale, the ability of these exchanges to maintain and evolve their support frameworks will be instrumental in fostering lasting user relationships and enhancing the overall perception of the cryptocurrency trading environment.

Coinmama vs Coinbase: Features

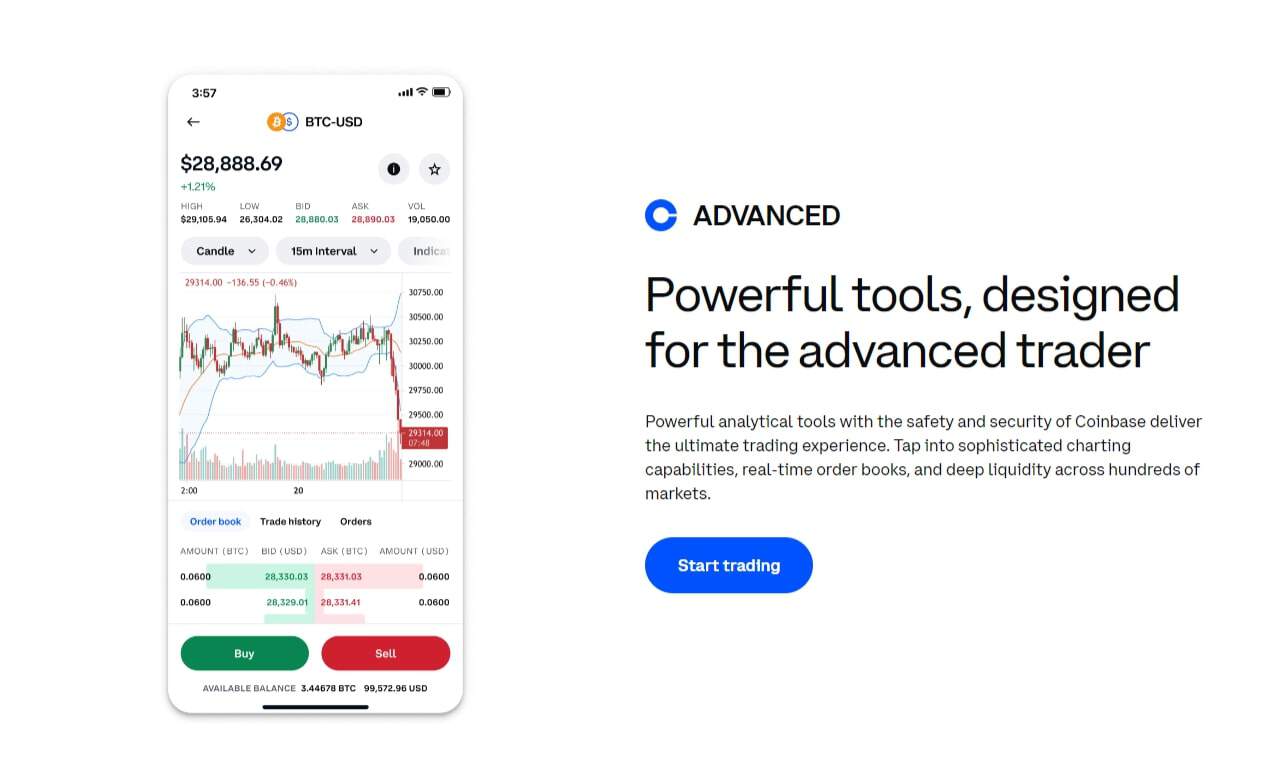

A deep dive into the trading experience on Coinmama and Coinbase reveals a strategic emphasis on distinctive features that meet specific user demands. Coinmama’s notable feature of instant purchases speaks to those who prioritise speed, while Coinbase’s more extensive array of services caters to users seeking a multifaceted platform.

Both exchanges are constantly iterating their feature sets, striving to create an optimal balance between innovation and user satisfaction within the competitive landscape of digital asset trading.

Final Thoughts

Closing Thoughts on Coinmama vs. Coinbase The choice between Coinmama and Coinbase ultimately depends on user preferences and requirements.

Coinmama’s speed and simple purchasing process are appealing for those looking to acquire cryptocurrency promptly, while Coinbase’s comprehensive platform suits users seeking a more robust trading experience and a wider range of services. Crypto exchanges like Coinmama and Coinbase are gateways to digital finance, each contributing to the ecosystem with their distinct operating philosophies. As the industry looks ahead, the potential for innovation in this space is abundant.

Factors such as emerging technologies, regulation harmonisation, and the increasing integration of cryptocurrencies into traditional finance could shape the strategies these platforms adopt. In this dynamic environment, exchanges will likely continue to refine their offerings to align with the evolving landscape of digital finance.

Coinmama vs Coinbase: FAQs

- Reputation: Coinmama has a decent reputation in the crypto community. It’s been around since 2013, which gives it a fairly long track record.

- Security Measures: Like many reputable exchanges, Coinmama employs standard security measures such as SSL encryption to protect its website and user data.

- Regulatory Compliance: It complies with KYC (Know Your Customer) regulations, which is a sign of a responsible exchange.

- Limitations: However, it’s important to note that Coinmama doesn’t hold your coins, meaning you’ll need your own wallet. This can be seen as a security feature since you’re not leaving your assets on the exchange.

- User Responsibility: As with any platform, the safety of your investments also depends on your personal security practices, like using strong passwords and enabling two-factor authentication.

- It Depends: “Better” can be subjective and depends on your specific needs, like fees, user interface, coin selection, or security features.

- Alternatives:

- Binance: Known for its low fees and wide selection of cryptocurrencies. Good for both beginners and advanced traders.

- Kraken: Praised for its security features and lower fees than Coinbase.

- Bitstamp: One of the oldest exchanges, known for its reliability and regulatory compliance.

- Gemini: Offers a clean, user-friendly experience and strong regulatory compliance.

- LocalBitcoins: A different approach, as it’s a peer-to-peer exchange. Useful for those looking to trade directly with other individuals.

- Considerations: When comparing to Coinbase, consider factors like fees, ease of use, customer service, and the variety of available cryptocurrencies.

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.