Featured In

Pros

Cons

Quick Summary

| Headquarters Location | International |

|---|---|

| Fiat Currencies Supported | USD, AUD, GBP, CAD, EUR, NZD + 50 others |

| Total Supported Cryptocurrencies | 243+ |

| Trading Fees | 0% - 0.60% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay |

| Support | Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android |

Coinbase has long been one of the leading names in cryptocurrency trading, attracting novice and experienced traders looking for an accessible platform.

In this review, we delve deep into various aspects of Coinbase, assessing its offerings and where it stands in comparison with competing services.

Coinbase has quickly become the go-to platform for exploring the cryptocurrency scene, providing users access to digital finance. Thanks to their dedication to simplifying buying and selling cryptocurrency transactions, Coinbase has attracted an extensive worldwide user base eager to participate in digital currency.

As the exchange grows, its goal is to balance user-friendliness and sophisticated features for experienced market participants.

About Coinbase

Coinbase was launched by Brian Armstrong and Fred Ehrsam in 2012 as one of the largest cryptocurrency exchanges worldwide. Their mission to make digital currency more accessible has reverberated throughout the market.

Over time, Coinbase has expanded to offer services for a range of digital assets – including major cryptocurrencies like Bitcoin and Ethereum as well as ERC-20 tokens and lesser-known crypto coins.

Coinbase’s trajectory has been significantly shaped by major events in the cryptocurrency space, such as 2017’s Bitcoin boom and increased interest in decentralised finance platforms (DeFi). These industry milestones had a major effect on Coinbase, expanding asset offerings and scaling infrastructure to meet growing demand.

Coinbase’s journey is also an illustration of the evolving regulatory environment; they have successfully navigated an ever-evolving regulatory framework to remain compliant and respected within their market niche.

Coinbase has a number of active social profiles including Facebook, Twitter, Instagram, LinkedIn, Reddit, TikTok and YouTube.

Coinbase has a mobile app on both the Apple App Store and Google Play.

Coinbase Supported Cryptocurrencies

Coinbase supports trading on over 243 cryptocurrencies on their platform. This exchange currently supports 24 of the top 30 market cap cryptocurrencies.

View all cryptocurrencies Coinbase supports

- 1INCH

- AAVE

- ABT

- ACH

- ACS

- ADA

- AERGO

- AGLD

- AIOZ

- ALCX

- ALEPH

- ALGO

- ALICE

- AMP

- ANKR

- ANT

- APE

- API3

- APT

- ARB

- ARPA

- ASM

- AST

- ATA

- ATOM

- AUCTION

- AUDIO

- AURORA

- AVAX

- AVT

- AXL

- AXS

- BADGER

- BAL

- BAND

- BAT

- BCH

- BICO

- BIT

- BLUR

- BLZ

- BNT

- BOBA

- BOND

- BTC

- BTRST

- C98

- CBETH

- CELR

- CGLD

- CHZ

- CLV

- COMP

- COTI

- COVAL

- CRO

- CRPT

- CRV

- CTSI

- CTX

- CVC

- CVX

- DAI

- DAR

- DASH

- DDX

- DESO

- DEXT

- DIA

- DIMO

- DNT

- DOGE

- DOT

- DREP

- DYP

- EGLD

- ELA

- ENJ

- ENS

- EOS

- ERN

- ETC

- ETH

- EUROC

- FARM

- FET

- FIDA

- FIL

- FIS

- FLOW

- FLR

- FORT

- FORTH

- FOX

- FX

- GAL

- GFI

- GHST

- GLM

- GMT

- GNO

- GODS

- GRT

- GST

- GTC

- GUSD

- GYEN

- HBAR

- HFT

- HIGH

- HNT

- HOPR

- ICP

- IDEX

- ILV

- IMX

- INDEX

- INJ

- INV

- IOTX

- JASMY

- JUP

- KAVA

- KNC

- KRL

- KSM

- LCX

- LDO

- LINK

- LIT

- LOKA

- LPT

- LQTY

- LRC

- LSETH

- LTC

- MAGIC

- MANA

- MASK

- MATH

- MATIC

- MCO2

- MDT

- MEDIA

- METIS

- MINA

- MKR

- MLN

- MNDE

- MONA

- MPL

- MSOL

- MTL

- MULTI

- MUSE

- MXC

- NCT

- NEAR

- NEST

- NKN

- NMR

- OCEAN

- OGN

- OOKI

- OP

- ORCA

- ORN

- OSMO

- OXT

- PAX

- PERP

- PLA

- PLU

- PNG

- POLS

- POLY

- POND

- POWR

- PRIME

- PRO

- PRQ

- PUNDIX

- PYR

- PYUSD

- QI

- QNT

- QSP

- QUICK

- RAD

- RAI

- RARE

- RARI

- RBN

- REN

- REQ

- RLC

- RNDR

- ROSE

- RPL

- SAND

- SEI

- SHIB

- SHPING

- SKL

- SNT

- SNX

- SOL

- SPA

- SPELL

- STORJ

- STX

- SUI

- SUKU

- SUPER

- SUSHI

- SWFTC

- SYLO

- SYN

- TIME

- TONE

- TRAC

- TRB

- TRU

- TVK

- UMA

- UNFI

- UNI

- USDC

- USDT

- VGX

- VOXEL

- WAMPL

- WBTC

- WCFG

- XCN

- XLM

- XRP

- XTZ

- XYO

- YFI

- ZEC

- ZEN

- ZRX

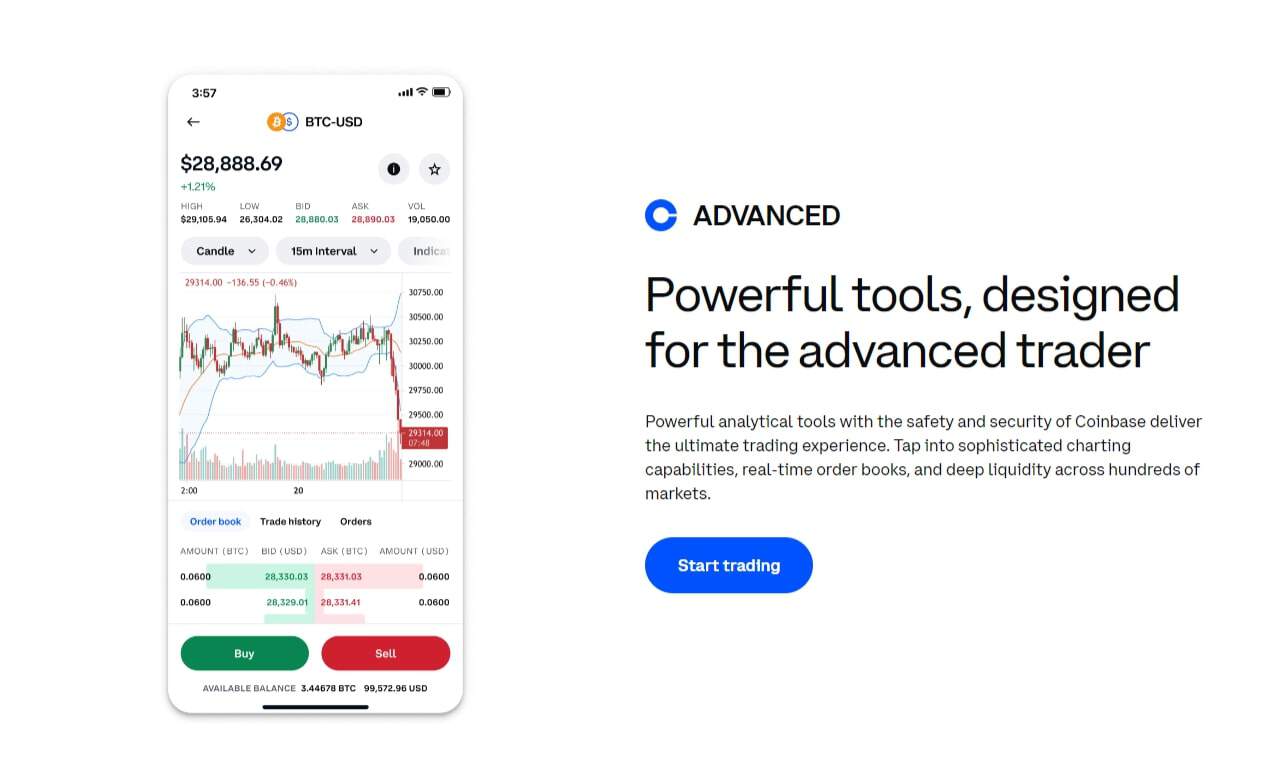

Trading Experience

Coinbase was designed to offer investors an easy and smooth trading experience, from straightforward trades to advanced options on Coinbase Advanced Trade. Every level of investor is catered for here!

The platform is continually enhanced to keep up with market conditions and user expectations, including features such as real-time market updates and educational resources to assist traders in making trading decisions.

Coinbase’s trading experience is tailored to suit the needs of investors from diverse investor profiles. Tools are tailored for novice and advanced users, allowing a seamless transition between simple transactions and advanced trading strategies.

The continued addition of new features and analytical tools shows the platform’s commitment to increasing user engagement and satisfaction.

Coinbase Fees

Understanding the fee structure of cryptocurrency exchanges such as Coinbase is paramount. Their pricing model adapts according to factors like user location, transaction size, and payment method, including user location, transaction size, and payment method.

Although Coinbase may not always be the cheapest solution, its fee schedule has been designed to be transparent so customers know exactly what their transaction fees will be before it takes place.

Transparent and predictable costs are crucial when engaging in cryptocurrency trading. Coinbase’s fee model was carefully developed to reflect the ever-evolving cryptocurrency market with an eye toward accommodating changing supply, demand, and network congestion conditions.

Users gain a thorough understanding of the fee framework, empowering them to make educated decisions without fear of unanticipated charges.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | $0 - $10 |

| Deposit Fee (Credit/Debit Card) | $0 - $10 |

| Trading Fee | 0% - 0.60% |

| Withdrawal Fee (Bank Transfer) | $0 - $25 |

Coinbase supports a range of different cryptocurrencies with varying withdrawal fees. When looking at Bitcoin, they don't charge anything above the standard Bitcoin network fee. Across all the crypto exchanges we've reviewed, the average Bitcoin transaction fee charged is 0.000566 BTC compared to the actual network fee of 0.000426 BTC. This means you are saving 24.64% on Bitcoin transactions by using Coinbase instead of other exchanges.

Coinbase has a maker/taker fee schedule which you can see below.

| Tier | Taker Fee | Maker Fee |

|---|---|---|

| $0K-$10K | 60bps | 40bps |

| $10K-$50K | 40bps | 25bps |

| $50K-$100K | 25bps | 15bps |

| $100K-$1M | 20bps | 10bps |

| $1M-$15M | 18bps | 8bps |

| $15M-$75M | 16bps | 6bps |

| $75M-$250M | 12bps | 3bps |

| $250M-$400M | 8bps | 0bps |

| $400M+ | 5bps | 0bps |

Security - Is Coinbase Safe?

Security is of utmost importance in any crypto exchange, and Coinbase has taken numerous measures to guarantee customer funds remain protected.

The platform adheres to rigorous regulatory compliance programs, and a significant portion of digital assets is kept in cold storage. Additionally, crime insurance protects some of those assets against any cybersecurity breaches that might occur on its platform and provides peace of mind to its users.

Coinbase has extensively tried to earn its users’ trust with stringent security protocols. Through advanced encryption and industry best practices, Coinbase strives to fortify all points of interaction—from user accounts to transaction executions—to promote peace and confidence for its users.

Security on this platform is further demonstrated through regular audits and its dedication to staying ahead of cybersecurity threats and being proactive about mitigating them.

Coinbase Customer Support

Customer support is often underestimated but is an integral component of any platform. Coinbase offers support through various channels to promptly address queries or issues raised by their users.

However, some reviews reveal instances of customer service falling below expectations, which has caused great distress among some clients.

Customer support is of utmost importance in cryptocurrency trading, and Coinbase has created a support framework designed to be responsive and comprehensive.

Customers can access resources and guidance to assist them in understanding cryptocurrency trading and confidently managing their digital assets. Feedback from the user community is integral to the exchange’s mission to deliver superior customer experiences.

Coinbase Support Channels

How to Sign Up on Coinbase

- Create Account - Visit the Coinbase website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you'll be able to deposit using the deposit methods listed below.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

Coinbase Alternatives

Binance

Total Supported Cryptocurrencies

386+

Trading Fees

0.10%

Fiat Currencies Supported

USD, GBP, CAD, EUR, NZD + 75 others

Kraken

Total Supported Cryptocurrencies

244+

Trading Fees

0.08% - 0.40%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 1 other

OKX

Total Supported Cryptocurrencies

320+

Trading Fees

0.08% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Final Thoughts

Coinbase has become an essential player in the cryptocurrency exchange ecosystem, offering user-friendly services and more advanced options to more experienced investors.

Though fees and limitations may be factors to consider, the platform continues to develop and meet the needs of its diverse user base.

Are you curious to compare Coinbase’s performance against other cryptocurrency exchanges? Check out our articles Coinbase vs CoinSpot, Coinbase vs Kraken, Coinbase vs Coinmama and Coinbase vs eToro!

Coinbase FAQs

Coinbase, as one of the largest cryptocurrency exchanges globally, has established a reputation for being a mainstream and accessible platform for buying, selling, and storing cryptocurrencies. It is important to note that it is a regulated entity in the United States, complying with various financial services and consumer protection laws.

However, like any online service, it’s prudent for users to be cautious and use strong security measures.

Generally, users can withdraw their funds from Coinbase to their bank account or other external wallets. If there are withdrawal issues, they could be due to maintenance, security checks, or account verification processes.

Users need to ensure they comply with any requested verification steps and check for any service notifications.

Making a specific amount such as $100 a day on Coinbase or any other exchange involves trading, which comes with risks. Users must conduct thorough research, understand market trends, and only invest what they can afford to lose.

It’s essential to be aware of the volatility in the cryptocurrency market.

No online platform can be considered 100% safe from all potential risks, including security breaches or system failures. Coinbase implements various security measures to protect user accounts and funds, such as two-factor authentication (2FA) and FDIC insurance for USD balances.

Still, users should take personal security measures seriously.

Coinbase uses encryption and other security protocols to protect the connection with users’ bank accounts. As with any financial service, it’s crucial for users to have strong passwords, enable 2FA, and monitor their accounts for unauthorized activity.

As of my last update, Coinbase had a subscription service called Coinbase One, which offered benefits like zero-fee trading and account protection. The fees for such services may vary and can be checked directly on the Coinbase website or through the app for the most current pricing.

Coinbase requires users to verify their identity to comply with regulatory requirements. They claim to store personal information securely and use it for verification purposes.

Users should ensure they understand the platform’s privacy policy and the measures it takes to protect personal data.

Coinbase User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for Coinbase - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.

Best Cryptocurrency Exchange for Beginners

Best Cryptocurrency Exchange for Beginners