Pros

Cons

Quick Summary

| Headquarters Location | International |

|---|---|

| Fiat Currencies Supported | USD, AUD, GBP, CAD, EUR, NZD + 25 others |

| Total Supported Cryptocurrencies | 83+ |

| Trading Fees | No fees listed. |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay |

| Support | Facebook, Twitter, Instagram |

| Mobile App | Yes - iOS, Android |

Revolut Crypto has emerged as a unique player in the world of digital assets, offering a seamless blend of banking and cryptocurrency services. With a user-centric approach, it aims to simplify the crypto experience for its global user base.

Revolut Crypto’s emergence as a key player in the crossover between banking and digital assets is a reflection of the evolving financial landscape. The service underscores a growing demand for platforms that streamline the process of engaging with cryptocurrencies, making it accessible for individuals who may not have a technical background.

Its mission goes beyond mere transactions; it symbolises the broader financial industry’s shift towards embracing the versatility and innovation that cryptocurrencies bring to the table. This endeavour to demystify digital currencies and make them more approachable is a testament to Revolut’s commitment to financial inclusivity.

About Revolut Crypto

Revolut, a fintech company that started in 2015, has rapidly expanded its portfolio to include cryptocurrency services. The platform, which began as a way to facilitate better currency exchange rates for travelers, has grown into a comprehensive financial service provider.

Alongside traditional banking features, Revolut Crypto allows users to buy, hold, and exchange a variety of cryptocurrencies directly within the app, revolutionizing the way users interact with digital assets.

Revolut’s trajectory in the financial sector encapsulates a remarkable response to the dynamic nature of global finance. The inception of Revolut Crypto was a strategic move in anticipation of the burgeoning digital economy.

As the cryptocurrency market matured, Revolut discerned the potential in offering crypto services, and its expansion reflects the fintech’s agility in adapting to user needs. The integration of cryptocurrencies into its suite of services was a natural progression, propelled by the company’s ethos of innovation and customer empowerment.

This decision has been shaped by a climate where traditional financial institutions are continually challenged to evolve, and Revolut has risen to the occasion by staying at the forefront of this transformation.

Revolut Crypto has a number of active social profiles including Facebook, Twitter, Instagram, LinkedIn, Reddit, TikTok and YouTube.

Revolut Crypto has a mobile app on both the Apple App Store and Google Play.

Revolut Crypto Supported Cryptocurrencies

Revolut Crypto supports trading on over 83 cryptocurrencies on their platform. This exchange currently supports 10 of the top 30 market cap cryptocurrencies.

View all cryptocurrencies Revolut Crypto supports

- ACH

- AGLD

- ALGO

- ALICE

- AMP

- APE

- APT

- ARB

- ARPA

- ATOM

- AUDIO

- AXS

- BCH

- BICO

- BLUR

- BLZ

- BOBA

- BTC

- C98

- CELO

- CELR

- CHZ

- CLV

- CRO

- CTSI

- CVC

- DASH

- DYDX

- ENJ

- ENS

- EOS

- ETC

- FET

- FIL

- FLOW

- FLR

- FORTH

- GAL

- GALA

- GHST

- GMT

- GODS

- GST

- GTC

- HBAR

- ILV

- IMX

- IOTX

- JASMY

- KSM

- LCX

- LPT

- LTC

- MANA

- MASK

- MINA

- NEAR

- NKN

- OP

- OSMO

- OXT

- PLA

- POWR

- PYR

- QNT

- RAD

- RARE

- RNDR

- SAND

- SEI

- SKL

- SOL

- SPELL

- STORJ

- SUI

- SUPER

- SYN

- T

- TIA

- TRX

- TVK

- XCN

- XLM

Trading Experience

Trading on Revolut Crypto is designed to be intuitive and user-friendly, targeting both new and experienced traders. The platform features a streamlined interface for trading a variety of cryptocurrencies, with additional features aimed at enhancing the trading experience.

The trading experience on Revolut Crypto is sculpted with the intent of making investment and trading activities as streamlined as possible. It recognises that the journey of trading cryptocurrencies should be as rewarding as the potential gains.

To this end, Revolut has crafted a user experience that caters to the varying skills and interests of its users, ensuring that seasoned crypto traders and newcomers alike can navigate the platform with ease. Behind the sleek interface lies a robust trading engine designed to handle the intricate and rapid movements characteristic of the cryptocurrency markets.

Revolut Crypto Fees

The fee structure at Revolut Crypto is designed to be transparent and competitive within the market. Fees are incurred for various services related to cryptocurrency transactions.

Pricing varies and users should consult the latest fee schedule for the most current information.

The fee model adopted by Revolut Crypto is crafted to align with the needs of its diverse clientele, ensuring that it remains an attractive option for many. The dynamic nature of the cryptocurrency market necessitates a fee structure that can accommodate the ever-changing landscape, and Revolut Crypto’s approach aims to meet this requirement.

Fees are an inevitable aspect of cryptocurrency transactions; however, by focusing on maintaining a competitive edge, Revolut ensures that users are not deterred by high costs, but rather see value in the service provided. The company’s commitment to transparency in this area reassures users that they can engage with the service without encountering hidden charges.

| Type | Fee |

|---|---|

| Deposit Fee (Bank Transfer) | 0% |

| Deposit Fee (Credit/Debit Card) | 1% - 3% |

| Trading Fee | No fees listed. |

| Withdrawal Fee (Bank Transfer) | Not Listed |

Security - Is Revolut Crypto Safe?

Revolut takes security and regulation seriously, implementing robust measures to protect users’ assets. It adheres to various compliance standards across the countries it operates in, ensuring a safe and regulated environment for trading and holding crypto assets.

In an age where digital threats are a constant concern, Revolut’s security framework is meticulously designed to safeguard its users’ interests. The platform employs a range of sophisticated security protocols to ensure the integrity of users’ holdings.

Recognizing that the strength of a financial platform lies as much in its security measures as in its financial services, Revolut invests in technology and protocols that are at the cutting edge of digital asset protection. The security landscape is ever-evolving, and Revolut’s commitment to keeping pace with this change is crucial to maintaining the trust and confidence of its users.

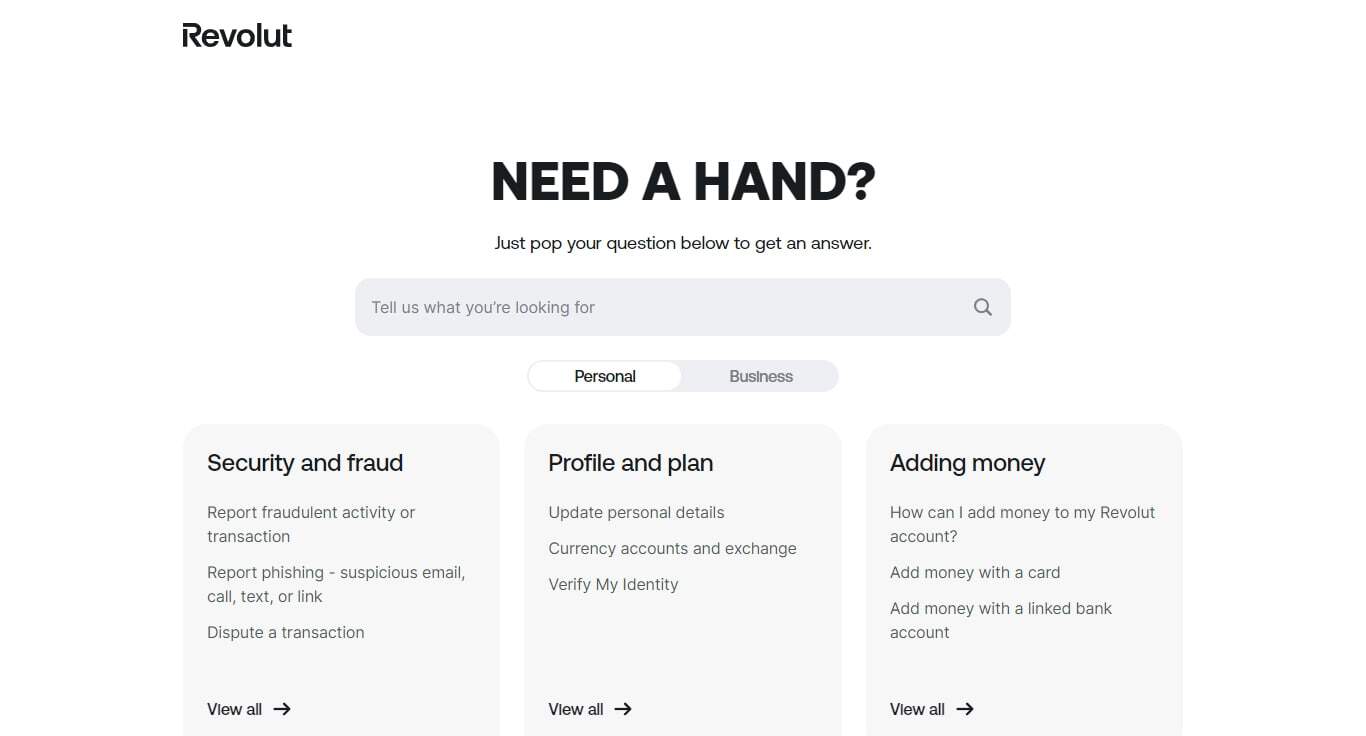

Revolut Crypto Customer Support

Customer support is a critical aspect of any financial service platform. Revolut offers support through multiple channels, ensuring users can get assistance when needed.

The app’s chat function and other customer service avenues aim to resolve issues efficiently.

Customer support serves as the backbone of any service-oriented platform, particularly in the fast-paced world of finance. Acknowledging this, Revolut has developed a customer support ecosystem that aims to be responsive and effective.

The infrastructure is designed to address the multifaceted challenges that users might encounter, from technical issues to transaction inquiries. The investment in a capable support network exemplifies Revolut’s understanding that a swift and helpful response can significantly enhance user satisfaction and contribute to the overall success of the platform.

Revolut Crypto Support Channels

How to Sign Up on Revolut Crypto

- Create Account - Visit the Revolut Crypto website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified, you'll be able to deposit using the deposit methods listed below.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

Revolut Crypto Alternatives

Binance

Total Supported Cryptocurrencies

386+

Trading Fees

0.10%

Fiat Currencies Supported

USD, GBP, CAD, EUR, NZD + 75 others

Kraken

Total Supported Cryptocurrencies

244+

Trading Fees

0.08% - 0.40%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 1 other

OKX

Total Supported Cryptocurrencies

320+

Trading Fees

0.08% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Final Thoughts

Revolut Crypto provides an integrated solution for users looking to engage with cryptocurrencies alongside their regular banking transactions. It offers the convenience of managing a diverse portfolio of financial services within a single platform.

The role of crypto exchanges is pivotal in the digital era, serving as the infrastructure that supports the growing ecosystem of digital assets. As the industry continues to mature, these platforms are not only expected to provide a gateway to cryptocurrencies but to also innovate and introduce features that enhance user experience.

Observers note the potential for these exchanges to significantly influence both the perception and utilisation of digital finance. With the integration of cryptocurrencies becoming increasingly mainstream, the evolution of these platforms will likely mirror the changing demands and expectations of consumers who seek comprehensive, efficient, and secure financial services.

Revolut Crypto FAQs

Revolut utilizes standard security measures, such as strong encryption and customer verification protocols, to protect its users’ transactions and personal information. As with any platform, users should ensure they follow good security practices, like using strong passwords and enabling two-factor authentication.

To convert cryptocurrency to cash on Revolut, you can sell your crypto holdings within the app. The amount in fiat currency you receive from the sale will be credited to your Revolut account balance, which you can then withdraw to your linked bank account or use for other transactions.

Revolut allows you to exchange Bitcoin for fiat currencies within their platform, but they do not offer the capability to send Bitcoin to external wallets. The functionality of cryptocurrencies on Revolut is somewhat limited when compared to dedicated cryptocurrency exchanges.

Revolut supports a range of cryptocurrencies for its users to buy, sell, and hold within its app. The selection includes popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and others.

Availability may vary by region and over time.

Revolut does not currently allow users to transfer cryptocurrencies directly to external wallets or exchanges like Binance. You would need to convert your crypto to fiat currency within Revolut, withdraw that to your bank account, and then deposit the fiat currency into Binance to purchase cryptocurrency there.

Revolut, as a financial app, does not offer traditional cryptocurrency staking services within its platform. Users looking to engage in staking would need to use specialized exchanges or wallets that provide this feature.

There is no product or service called “blockchain Revolut.” However, Revolut does use blockchain technology as the underlying infrastructure for its cryptocurrency transactions. Blockchain is the decentralized ledger that records all transactions across a network of computers.

Revolut offers various cryptocurrencies, which may include Ripple (XRP), depending on the user’s location and the current availability on the platform. It’s important to note that the offerings can change, so users should check the app for the most up-to-date information.

Revolut Crypto User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for Revolut Crypto - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.