When it comes to navigating the bustling lanes of the crypto space, traders and investors are often faced with a plethora of choices. Among the various cryptocurrency exchanges, two names that frequently crop up are Poloniex and Coinbase.

Each platform brings its unique flavour to the table, offering a blend of services, features, and user experiences that cater to diverse needs. In this comparison, we delve into the nuances of both exchanges to help you understand how they measure up against each other.

At a glance

| Category | Poloniex Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. | Coinbase Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. |

|---|---|---|

| Headquarters Location | Boston, Massachusetts, USA | International |

| Fiat Currencies Supported | USD, AUD, GBP, CAD, EUR, NZD + 86 others (through third party apps) | USD, AUD, GBP, CAD, EUR, NZD + 50 others |

| Total Supported Cryptocurrencies | 471+ | 302+ |

| Trading Fees | -0.005% - 0.2% | 0.00% - 0.60% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Apple Pay, Google Pay, Mercuryo, Simplex | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay |

| Support | Twitter, Help Center Articles, Support Ticket | Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android | Yes - iOS, Android |

| Our Rating | ||

| Review | Read full Poloniex review | Read full Coinbase review |

| Visit | Visit Poloniex | Visit Coinbase |

About Poloniex Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

Poloniex has carved a niche for itself in the realm of digital assets exchange. Established in 2014, Poloniex, also known as Polo Digital Assets, Ltd., has been a part of the dynamic ebb and flow of the crypto market.

As a platform, it offers traders a medley of tokens and has been known for its variety of assets and trading pairs. Its journey through the years, including changes in ownership and corporate structure, most notably its acquisition by Circle and later transition to an independent subsidiary, has shaped its offerings and market stance.

Delving into the fabric of the cryptocurrency exchange landscape, one cannot overlook the ripples caused by strategic shifts and evolutions. The exchange under consideration has been at the forefront of embracing the multifaceted nature of digital assets.

From its inception, the exchange has navigated through a sea of regulatory shifts and technological advancements, placing it in a unique position. It has sought to capitalize on the dramatic surges in cryptocurrency interest, while also weathering the downturns and market corrections that are commonplace in the volatile blockchain economy.

Poloniex Pros & Cons

Pros

Cons

About Coinbase Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

Coinbase, on the other hand, is often hailed as a gateway for many into the world of cryptocurrency. Launched in 2012 and based in the United States, this financial service company has grown to become one of the leading platforms with a significant market share.

Coinbase’s user-friendly interface and a strong focus on compliance and regulation have positioned it as a stalwart in the finance sector, especially for those new to the digital currency sphere.

Similarly, the journey of this other key player in the exchange arena has been marked by significant milestones. Its evolution is a testament to the blockchain industry’s maturation as it transitioned from a niche interest to a mainstream financial contender.

The exchange has adeptly expanded its services to encompass a range of digital asset businesses, cementing its role in the digital finance narrative. Its expansion into various forms of money, including the integration of stablecoins and its foray into the derivatives market, underscores its commitment to providing a full spectrum of services to the modern investor.

Coinbase Pros & Cons

Pros

Cons

Poloniex vs Coinbase: Supported Cryptocurrencies

In terms of total cryptocurrencies available, Poloniex users have access to more cryptocurrencies. Poloniex offers 471 cryptocurrencies whereas Coinbase supports 302 cryptocurrencies.

For those interested in trading high market cap cryptocurrencies, Poloniex supports 23 of the top 30, compared to Coinbase which supports 21 of the top 30.

Poloniex supports quite a lot more cryptocurrencies than Coinbase. With this in mind, Poloniex has a slight edge for people looking to trade a wider range of coins.

Poloniex vs Coinbase: Fees

| Fee Type | Poloniex Fees | Coinbase Fees |

|---|---|---|

| Deposit Fee (Bank Transfer) | 3.95% | $0 - $10 |

| Deposit Fee (Credit Card/Debit Card) | 3.50% - 5% | $0 - $10 |

| Trading Fee | -0.005% - 0.2% | 0.00% - 0.60% |

| Withdrawal Fee (Bank Transfer) | 1% | $0 - $25 |

Fee structures are a pivotal aspect when considering a crypto exchange. Poloniex and Coinbase operate on different fee tiers, which are influenced by factors like trading volume and the type of transaction.

Generally, Poloniex focuses on offering competitive trading fees while providing a tiered structure that rewards users with higher trading volumes. Coinbase, in contrast, is known for its simple and straightforward fee system, though some users might find it on the higher side compared to other exchanges.

Both companies strive to balance the dynamic of providing value to users and maintaining the sustainability of their platforms.

Within the intricate web of decision-making criteria, the cost of doing business on each platform emerges as a key consideration. While remaining mindful of not divulging specific numbers, it is paramount to acknowledge that the fee strategies adopted by exchanges are not merely about the bottom line; they are a delicate balancing act.

This act involves fostering a welcoming environment for newcomers to the digital space, while also ensuring the feasibility and longevity of the platforms for seasoned traders. It’s this strategic balancing that defines the fee structures, reflecting both the vision of the exchanges and the expectations of their active users.

Poloniex vs Coinbase: Security

Security is paramount in the crypto exchange landscape. Poloniex and Coinbase have both adopted robust security measures to protect user assets.

Coinbase, with its storied history in the United States, adheres to strict regulatory standards and offers a suite of security features, including FDIC insurance for its customers’ cash balances. Poloniex also takes security seriously, employing advanced technologies to safeguard users’ funds and personal information.

Each exchange brings its own approach to fortifying user trust and maintaining a secure trading environment.

The fortress of user confidence in an exchange is built on the foundation of security protocols and the fortress must remain impregnable. It’s not solely about employing the latest in blockchain technology provider services, such as Multi-Party Computation security, but also about establishing a reputation of trust and resilience.

While one exchange may pride itself on a track record free from a single security incident, the other emphasizes its compliance with stringent regulatory demands and the protective layers around custodial assets. Both convey a deep understanding that the protection of assets goes beyond mere deposit storage; it is about creating a secure user experience that instills unwavering trust.

Poloniex vs Coinbase: Ease of use

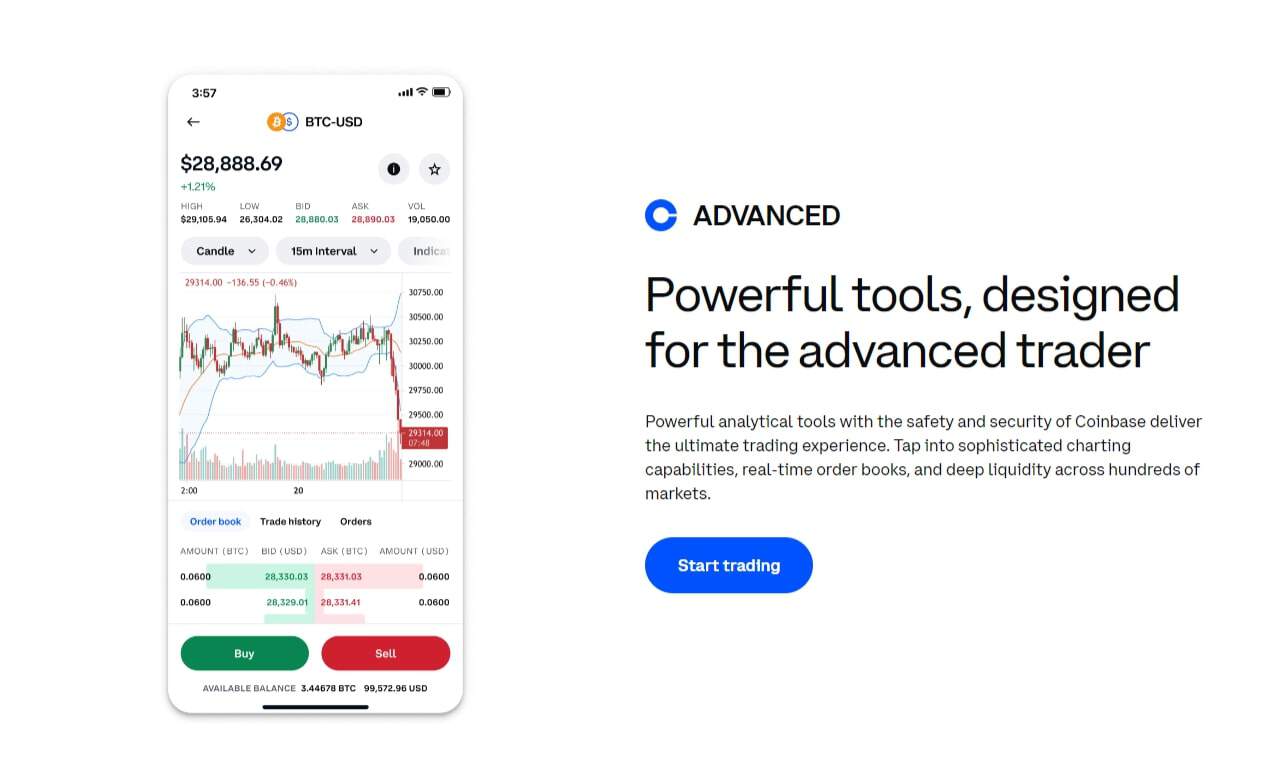

When it comes to ease of use, Coinbase often receives praise for its intuitive design and user-friendly platform, making it an excellent choice for newcomers to the cryptocurrency market. Poloniex, while being user-friendly, offers a more complex platform that caters to experienced traders seeking advanced trading tools and functionalities.

Both platforms provide mobile apps and web interfaces designed to simplify the trading experience, though the learning curve may vary between them.

The threshold for entering the world of crypto trading should be inviting, a principle both exchanges seem to appreciate. The innate complexity of blockchain-related products is distilled into user interfaces that aim to be as clear as they are efficient.

For the crypto company with an eye on the newcomer, simplifying the initiation into crypto trading while providing a path towards smarter cryptocurrency trading strategies is key. Its counterpart, meanwhile, offers the tools and analytics necessary for the seasoned trader to navigate the vast ocean of liquid tokens and complex trading options.

Poloniex vs Coinbase: Support

Customer support is a critical component of any service-oriented business. Both Poloniex and Coinbase have implemented support systems to assist their users.

Poloniex offers support through various channels, including a comprehensive FAQ section and a ticketing system for more personalized assistance. Coinbase, understanding the importance of user support, has made strides in providing timely aid through email, phone support, and a detailed knowledge base for self-help.

Both exchanges understand the value of addressing user concerns promptly to ensure a smoother trading experience.

The lifelines of exchanges are their support structures, which function as the first responders to user queries and concerns. As the daily trading volume ebbs and flows, the ability of an exchange to provide prompt and precise assistance becomes a reflection of its dedication to service.

One exchange might extend its hand through a web of FAQs and ticket systems, offering personalized solutions where needed. The other builds its support network with a mix of traditional and tech-savvy methods, ensuring responses are not only timely but also informative, equipping users with the knowledge to steer through future queries independently.

Poloniex vs Coinbase: Features

Feature comparison between Poloniex and Coinbase reveals a landscape rich with trading possibilities. Poloniex thrives on offering a wide array of trading features, including spot trading and a suite of decentralized finance options.

Coinbase, while it may not match Poloniex in the sheer number of features, provides a solid foundation with its own set of trading services, educational resources, and user-friendly tools to engage with the digital asset market. Each exchange continually evolves its features to keep pace with the ever-changing market conditions.

Features are the bricks and mortar of any crypto trading app today, dictating the shape of user experience in profound ways. While one exchange might be likened to a Swiss Army knife, packing a plethora of tools and features catering to the adventurous trader, its peer streamlines the essentials to offer solid ground to both newcomers and experienced traders alike.

We observe a landscape where features are not static but rather evolve in response to the pulsing rhythm of the market and its participants. The constant here is not the tools themselves, but the commitment to innovation.

Final Thoughts

Deciphering the intricate details between Poloniex and Coinbase can be quite the art form. Both exchanges have their merits, with Poloniex appealing to those who seek a variety of trading options and assets, and Coinbase attracting users for its ease of use and strong regulatory standing.

The choice between the two will ultimately rest upon individual preferences, trading styles, and priorities in terms of features and financial services.

In the grand tapestry of the blockchain accessible world, exchanges like these are more than mere marketplaces; they are gateways to the future of money. They navigate the complexities of public policy, international bank relations, and the technological demands of providing a secure wallet experience.

As the blockchain ecosystem continues to evolve, these platforms are poised to adapt and possibly redefine the ways in which we engage with digital currencies and assets.

Poloniex vs Coinbase: FAQs

Coinbase is widely regarded as one of the more secure cryptocurrency exchanges. It employs robust security measures such as two-factor authentication, cold storage for the majority of funds, and insurance in case of a breach. However, labeling it as the “most secure” can be subjective since security levels can vary and are influenced by numerous factors, including user behavior.

It’s also important to remember that no exchange is completely immune to risks.

Poloniex has been known as a popular cryptocurrency exchange, offering a wide range of crypto assets for trading. It’s appreciated for its user-friendly interface and has a reputation for providing a decent trading experience.

However, its standing may differ based on user preferences, regional availability, and specific needs like trading pairs, fees, and customer support.

Yes, Poloniex experienced a significant hack in 2014, where around 12.3% of its Bitcoin holdings were stolen. Since then, they have reportedly improved their security measures.

However, this historical incident serves as a reminder that exchanges can be vulnerable and it’s crucial for users to exercise caution, such as using two-factor authentication and not storing large amounts of cryptocurrencies on exchanges for long periods.

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.