Embarking on the adventure of trading cryptocurrencies requires choosing a reliable exchange platform. In this comparison, we analyse two well-known crypto exchanges: Kraken and Gemini.

Each offers distinct advantages and operates within the fast-paced domain of digital assets. We’ll delve into their histories, fee structures, features, ease of use, and customer support, concluding with a thoughtful comparison of their security measures.

At a glance

| Category | Kraken Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. | Gemini Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. |

|---|---|---|

| Headquarters Location | International | New York, USA |

| Fiat Currencies Supported | USD, AUD, GBP, CAD, EUR + 1 other | USD, AUD, GBP, CAD, EUR + 2 others |

| Total Supported Cryptocurrencies | 438+ | 78+ |

| Trading Fees | 0.08% - 0.40% | 0.05% - 0.15% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay, PayID, Osko | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay, FAST, xPULSE, Plaid |

| Support | Facebook, Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket | Facebook, Twitter, Instagram, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android | Yes - iOS, Android |

| Our Rating | ||

| Review | Read full Kraken review | Read full Gemini review |

| Visit | Visit Kraken

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. |

Visit Gemini |

About Kraken Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

Kraken, hailing from San Francisco, has cemented its place as a stalwart in the crypto exchange landscape. Since its inception in 2011, Kraken has been a go-to platform for both novice and advanced traders.

It’s known for its commitment to security and a wide selection of cryptocurrencies, including popular coins like Bitcoin and Ethereum. Kraken’s heritage in the crypto community and its reputation for resilience in the face of market turbulence have made it a trusted platform for traders around the globe. The roots of Kraken are deeply embedded in the history of the cryptocurrency movement, dating back to a time when the industry was in its infancy.

Its resilience and adaptability have been tested through various market cycles, regulatory changes, and the evolving needs of traders. Kraken’s leadership in the space has been marked by a series of strategic partnerships and expansions that have broadened its influence beyond just an exchange to a respected voice in advocating for the growth and regulation of the industry.

This journey has seen the platform not only expand its digital currency offerings but also introduce innovative features that cater to the needs of a diverse client base, from beginners to professional traders.

Kraken Pros & Cons

Pros

Cons

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

About Gemini Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

Gemini, co-founded by the Winklevoss twins, the notable figures in the crypto sphere and once associated with Mark Zuckerberg, entered the market in 2015. It operates out of the United States and functions as both a cryptocurrency exchange and a custodian.

Gemini Trust Company, LLC is regulated by the New York State Department of Financial Services (NYSDFS) and emphasises regulatory compliance. Offering a variety of cryptocurrencies for trading, Gemini has built a reputation for appealing to both beginner investors and institutional traders. In the years since its launch, Gemini has witnessed the transformation of the cryptocurrency market from a niche interest to a mainstream financial force.

Its regulatory-first approach has distinguished it from peers, often becoming a bridge for traditional investors and institutional entities looking to venture into digital assets. The platform’s growth trajectory has been shaped by a commitment to trust and security, which has resonated with users in an industry often marred by uncertainty.

As it forges partnerships and expands its services, Gemini remains focused on providing a secure and compliant gateway into the crypto economy, reflecting the evolving requirements of a global investor base.

Gemini Pros & Cons

Pros

Cons

Kraken vs Gemini: Supported Cryptocurrencies

In terms of total cryptocurrencies available, Kraken users have access to more cryptocurrencies. Kraken offers 438 cryptocurrencies whereas Gemini supports 78 cryptocurrencies.

For those interested in trading high market cap cryptocurrencies, Kraken supports 23 of the top 30, compared to Gemini which supports 17 of the top 30.

Kraken supports a significantly higher number of cryptocurrencies compared to Gemini. With this in mind, Kraken definitely has the edge for people looking to trade a wider range of cryptocurrencies.

Kraken vs Gemini: Fees

| Fee Type | Kraken Fees | Gemini Fees |

|---|---|---|

| Deposit Fee (Bank Transfer) | $0 USD - $5 USD | 0% |

| Deposit Fee (Credit Card/Debit Card) | Not Listed | 3.49% |

| Trading Fee | 0.08% - 0.40% | 0.05% - 0.15% |

| Withdrawal Fee (Bank Transfer) | $0 USD - $35 USD | 0% - $25 USD |

When comparing Kraken and Gemini, the fee structures play a significant role for many users. Kraken offers a maker-taker fee model, encouraging liquidity on the platform, whereas Gemini’s fee schedule can be more complex, influenced by various factors such as 30-day trading volume and the type of trade executed.

Both exchanges have fee frameworks that may favour certain types of trades or trading volumes, so it’s crucial for traders to understand the nuances to maximise cost efficiency. Navigating the fee structures of crypto exchanges can be akin to a strategic game, where understanding the rules can lead to significant savings. Both Kraken and Gemini have designed their fee models to incentivise certain behaviours, such as providing liquidity or trading in higher volumes.

Beyond the surface, these models reflect the philosophy of each platform regarding accessibility and market participation. As users strategise to minimise costs, they must weigh the impact of these fees within the broader context of their trading habits and desired outcomes on the exchange.

Kraken vs Gemini: Security

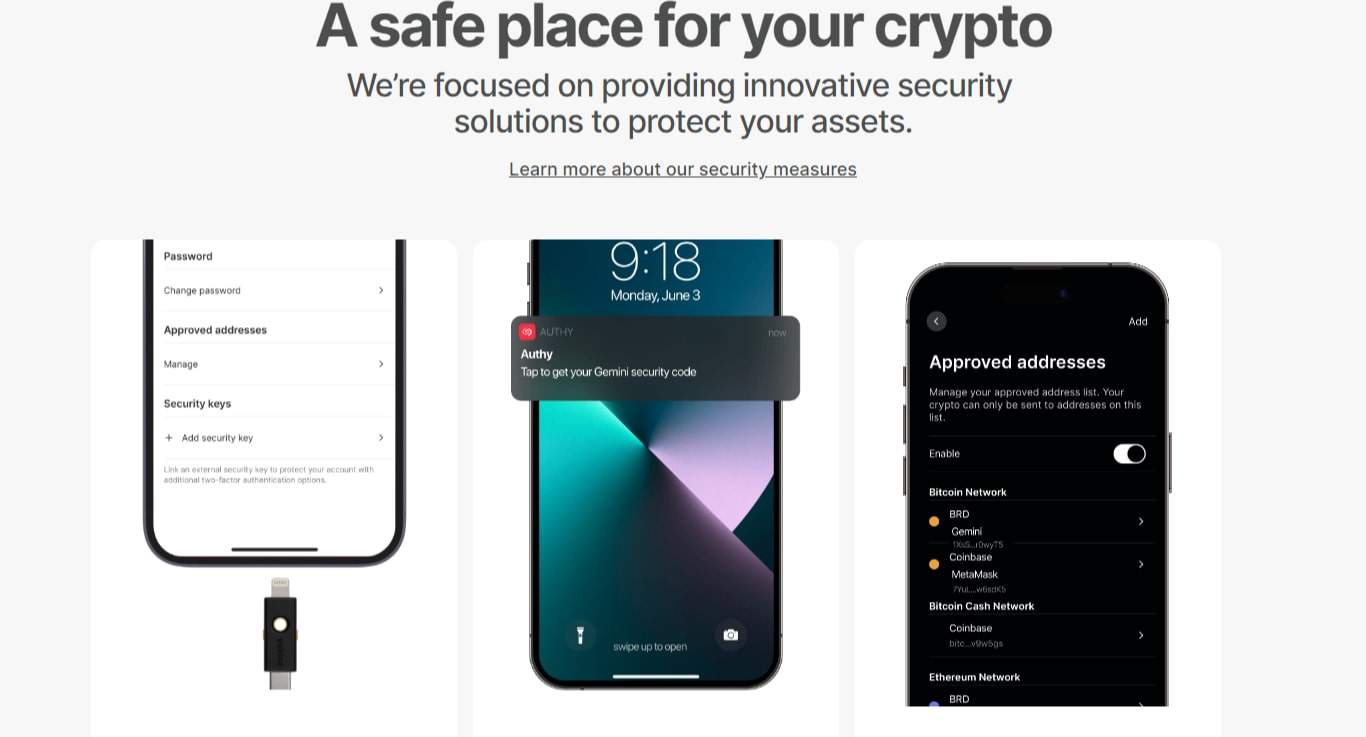

Security is paramount in the world of digital assets. Kraken boasts an impressive array of security measures, including two-factor authentication, cold storage of the majority of funds, and stringent surveillance.

Conversely, Gemini also prioritises robust security protocols like AES-256 digital wallet encryption and compliance with strict anti-money laundering (AML) regulations. Both exchanges have fostered trust among users by emphasising the safety and integrity of their platforms. In an industry where the digital nature of assets makes them a target for sophisticated threats, each security breach serves as a lesson for exchanges like Kraken and Gemini.

They both invest heavily in state-of-the-art security measures to protect their user bases. Kraken’s security culture is built on a foundation of regular audits and a security-first mindset, while Gemini’s adherence to regulatory frameworks brings a level of oversight that is reassuring to many users.

The pursuit of impenetrable security is endless, and both platforms constantly evolve their defences in response to new and emerging threats in the cryptosphere.

Kraken vs Gemini: Ease of use

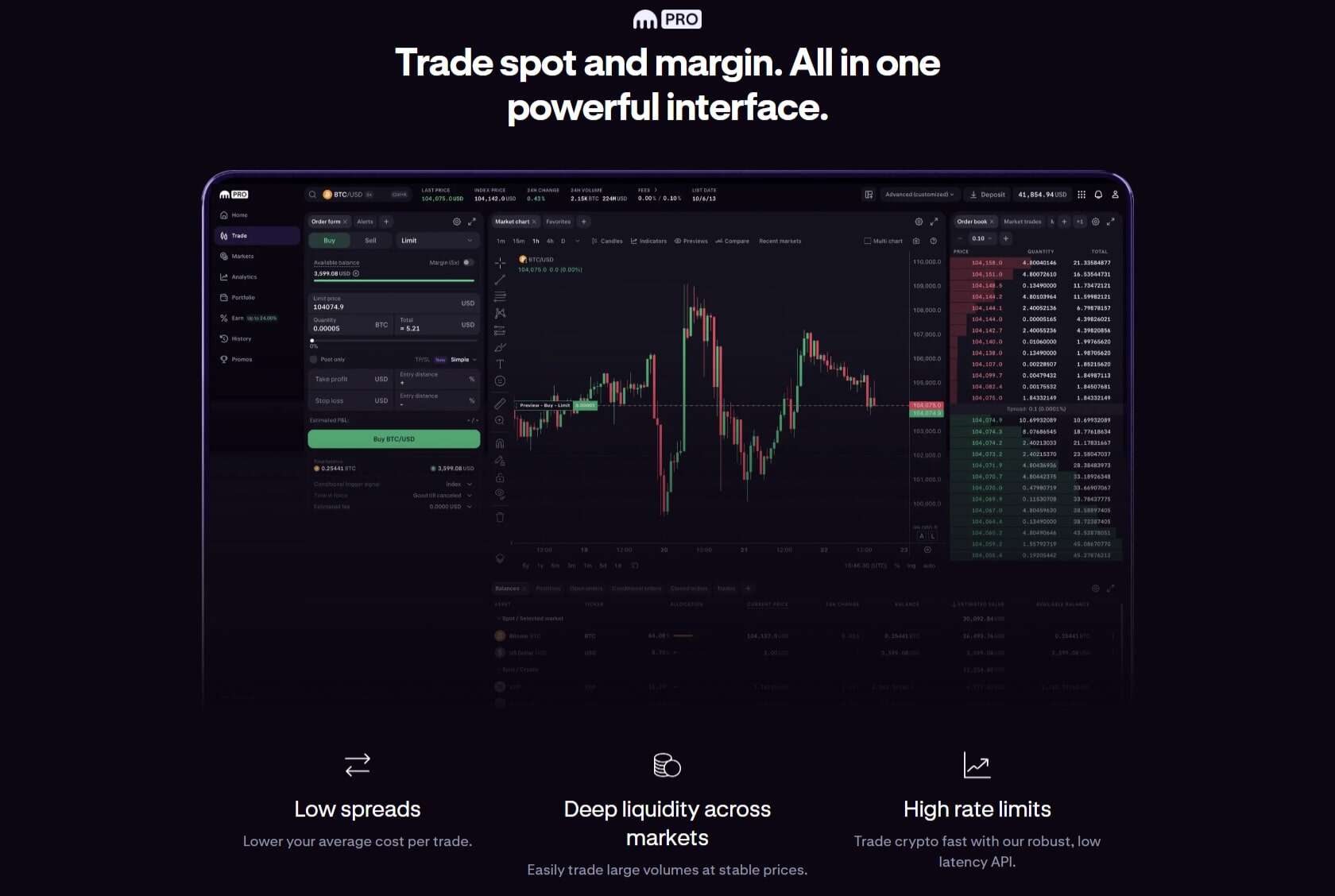

Ease of use can make or break a trader’s experience. Kraken offers a simple user interface for beginners, with an advanced interface available for more seasoned traders.

Gemini prides itself on a clean, intuitive platform with features like price alerts and a mobile app. Both aim to provide a seamless trading experience, although the more complex instruments and options on Kraken might be overwhelming for newcomers to crypto trading. The design philosophy of an exchange is a reflection of its commitment to user engagement.

Both Kraken and Gemini strive to strike a balance between functionality and simplicity. The former’s tiered interface caters to a gradient of expertise, growing with the user as they become more adept at navigating the crypto waters.

Gemini, on the other hand, focuses on delivering a frictionless experience that does not intimidate the novice while still providing the tools necessary for the seasoned investor. The ease of use is a silent yet powerful factor that shapes long-term user satisfaction and loyalty.

Kraken vs Gemini: Support

Customer support is crucial, especially in an industry where time-sensitive issues can be costly. Kraken provides extensive support through live chat and email, with a comprehensive help center.

Gemini also offers a strong support system, with its user-friendly help center and dedicated customer service team. Access to customer service is a key consideration for users who may require assistance navigating the complexities of crypto trading. A responsive and knowledgeable customer support team can be the anchor for users in the tempestuous seas of cryptocurrency trading.

Kraken’s commitment to supporting its user base is evident through multiple channels of assistance, prepared to address an array of concerns. Gemini matches this dedication with its own robust support infrastructure.

The importance of reliable customer support cannot be overstated, as it not only resolves immediate issues but also builds a foundation of confidence and trust that is crucial for long-term engagement with the platform.

Kraken vs Gemini: Features

Delving into the trading features, Kraken provides tools for futures trading and margin trading, catering to experienced traders looking for advanced options. Gemini, while not as focused on these advanced trading methods, offers unique features such as Gemini Earn for earning interest on cryptocurrencies and the Gemini Credit Card.

Each exchange has its standout features, tailored to specific trader profiles and investment strategies. Like skilled craftsmen, Kraken and Gemini have honed their feature sets to appeal to their target audiences. Kraken’s embrace of complex financial instruments such as futures and leverage appeals to a demographic looking for dynamic trading opportunities.

Meanwhile, Gemini’s distinctive offerings like Gemini Earn cater to users seeking to grow their holdings passively. The juxtaposition of these features highlights the diversity of user goals within the cryptocurrency community, and the way each exchange has tailored its service suite is a testament to its understanding of user needs.

Final Thoughts

In summary, Kraken and Gemini present two robust options for engaging with cryptocurrency trades. The decision between the two will often come down to personal preferences regarding features, fee structures, and particular services offered.

Whether you prioritise a user-friendly experience or a plethora of advanced trading options, both platforms have their merits and cater to a spectrum of traders’ needs. The cryptocurrency landscape is dynamic, with each exchange carving out its niche within the ecosystem. Kraken and Gemini, while serving the same market, offer contrasting experiences tailored to different user profiles.

This speaks to the broader theme within the industry: the quest for platforms to balance sophistication with accessibility, ensuring that the gateway to cryptocurrency investment is open to a wide audience. As the market matures, these exchanges will continue to adapt, potentially setting new benchmarks for user experience and service offerings.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Kraken vs Gemini: FAQs

Whether Gemini or Kraken is the better platform depends on the specific needs and preferences of the user. Gemini is known for its strong security measures, user-friendly interface, and regulatory compliance as a New York trust company, which might appeal to both individual and institutional investors focused on safety.

It offers a unique suite of products including the Gemini Credit Card and Gemini Custody for digital assets.

Kraken, with its headquarters in San Francisco, is considered one of the oldest cryptocurrency exchanges and is well-regarded among experienced traders for its wide range of cryptocurrencies and advanced trading features like margin and futures trading, as well as detailed trading charts and tools.

Kraken’s fee structures, including maker-taker fees, can also be a deciding factor for frequent traders looking at lower costs for high-volume trades.

Both platforms support a variety of cryptocurrencies, including popular coins like Bitcoin and Ethereum, and offer different features that cater to various types of investors and traders, from beginners to advanced users.

Each platform’s offerings, such as trading volume, security features, and customer service, should be carefully considered against the user’s trading strategies and risk tolerance.

Yes, Gemini holds your crypto assets. When users purchase digital assets on Gemini, they are stored in a wallet provided by the exchange.

Gemini offers a combination of hot wallet (online wallet) and cold storage (offline storage) solutions to enhance the security of the digital assets held. The company employs robust security measures like two-factor authentication (2FA), AES-256 wallet encryption, and strict surveillance to protect customer funds.

For those looking for increased security, Gemini offers Gemini Custody, a regulated crypto storage service with additional security features.

Users might prefer Gemini over Coinbase for several reasons. Gemini is known for its strong security protocols, user authentication measures, and overall commitment to compliance and regulation as a New York trust company.

This can instill a greater sense of trust for users concerned about the safety of their digital assets. Additionally, Gemini provides a user-friendly platform that caters to both novice and advanced traders through features like Gemini ActiveTrader and a wide variety of supported cryptocurrencies.

Gemini’s clear fee structures, which include a maker-taker model, along with their customer service offerings, might also appeal to users looking for a platform with straightforward costs and support. Gemini’s additional features, such as the Gemini Credit Card and staking rewards, offer users more ways to engage with their digital assets.

Kraken is considered one of the reputable cryptocurrency exchanges with a solid reputation among crypto traders. It’s known for its robust security features, including two-factor authentication and strict surveillance measures.

Kraken offers a wide selection of cryptocurrencies and advanced trading options, which can be appealing for advanced and experienced traders. The platform provides a variety of trading pairs, extensive trading volume, and different types of trading options, including spot and futures trading.

Kraken’s competitive fee structures, including maker-taker fees, and its relatively low withdrawal fees can make it an attractive choice for traders looking for cost efficiency. Kraken’s commitment to security and providing a platform for advanced trading keeps it as a strong contender in the crypto exchange market.

Comparing Gemini to Crypto.com will depend on the user’s specific requirements and preferences. Gemini is recognized for its robust security measures, including the use of cold storage and hot wallets, AES-256 encryption, and compliance with regulatory standards.

Its platform is designed to cater to both active traders and institutional investors with features like Gemini ActiveTrader and Gemini Custody.

On the other hand, Crypto.com offers a different set of features, which might include a range of fiat currency support, bank transfers, and the Crypto.com Visa Card.

Each platform has its distinctive fee structures, security measures, and additional features like rewards and customer service, which users must evaluate based on their individual needs, such as the variety of cryptocurrencies offered, ease of use, and the level of customer support.

Gemini prioritizes security for its users’ digital assets and employs a combination of hot wallets and air-gapped cold storage to ensure the safety of customer funds. The exchange also uses two-factor authentication (2FA), withdrawal email confirmation, and follows strict anti-money laundering (AML) policies.

Gemini is a licensed custodian and regulated by the New York State Department of Financial Services, providing an additional layer of trust and security. However, as a general practice in the cryptocurrency industry, many users opt to use their own cold storage solutions, like physical wallets, to maintain full control over their private keys and digital assets.

At the time of writing, Gemini has not experienced a significant security breach. The exchange is known for its high level of security and has implemented robust measures to protect customer funds and personal information.

This includes the use of two-factor authentication, cold storage, and compliance with strict regulatory standards as a New York State trust company.

The safety of a cryptocurrency exchange can be subjective and depends on several factors including security measures, operational history, and regulatory compliance. Gemini is a New York trust company and is subject to rigorous regulatory oversight, providing a strong sense of trust and security for its users.

It emphasizes security with features like two-factor authentication, cold storage, and compliance with AML guidelines.

Binance, one of the world’s largest cryptocurrency exchanges by trading volume, also places a high emphasis on security, though it has faced regulatory challenges in different jurisdictions.

Users should consider their comfort with each platform’s security measures, fee structures, available cryptocurrencies, and regulatory standing when deciding which exchange feels safer for their individual use case.

Kraken Disclaimer

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.