Pros

Cons

Quick Summary

| Headquarters Location | San Francisco, California |

|---|---|

| Total Supported Cryptocurrencies | 5+ |

| Trading Fees | 0.03% - -0.005% (rebate) |

| Deposit Methods | Cryptocurrency |

| Support | Twitter, Help Center Articles |

| Mobile App | Has no mobile app. |

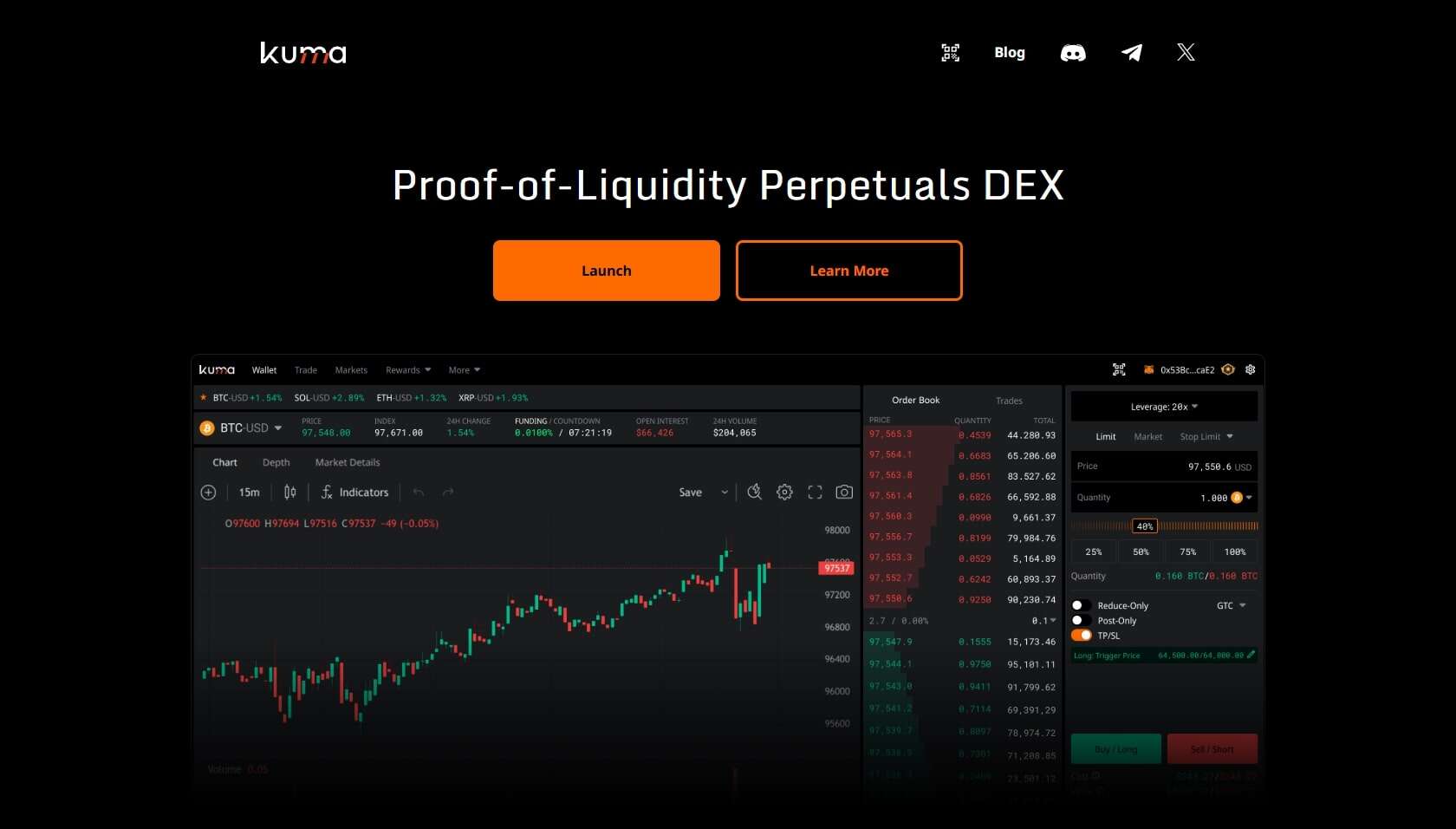

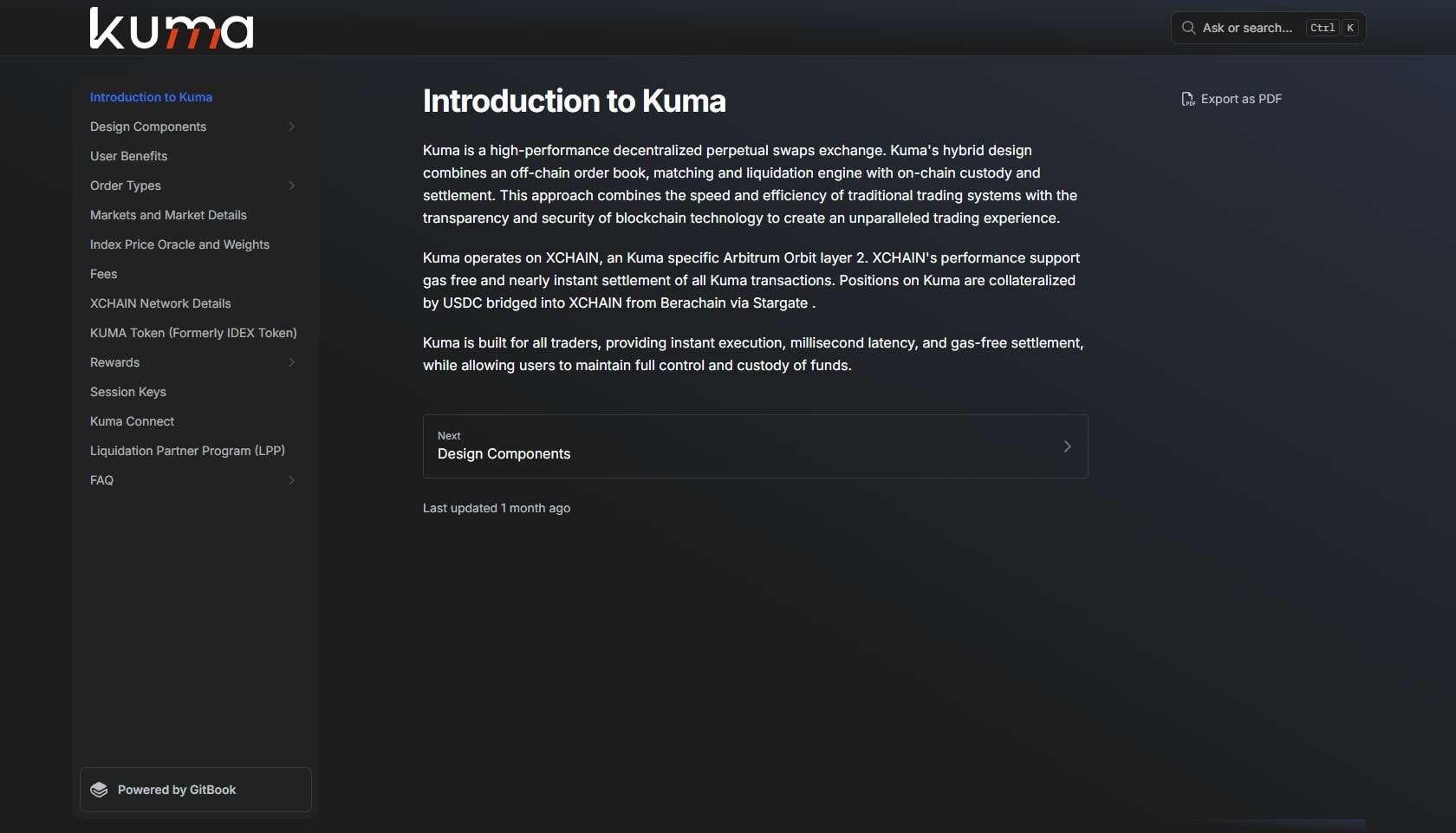

As a decentralized perpetuals trading platform, Kuma Exchange represents a major evolution in DEX infrastructure. Launched by the creators of IDEX, Kuma departs from spot trading to focus entirely on non-custodial, high-speed futures. It uses an off-chain trading engine for performance and a custom Layer 2 chain (XCHAIN) for secure settlement—eliminating gas costs and latency.

Built with traders in mind, Kuma combines advanced order types, instant execution, and automated reward systems, creating a CEX-like experience with full DeFi transparency.

About Kuma

Kuma is built for pro-level traders and liquidity providers who need speed, security, and flexibility. Key architectural elements include:

- Off-chain Order Book + Matching Engine

Trade orders are executed instantly and only settle on-chain after completion, avoiding congestion or gas spikes. - XCHAIN Layer 2 (Arbitrum Orbit)

A Kuma-specific L2 chain with sub-penny settlement costs and zero gas fees for users. - Smart Contract Custody & Escrow

Ensures funds are held securely until trade settlement is confirmed—removing risks found in traditional CEXs. - Session Key Security Model

Secure, wallet-linked session keys allow seamless trading without constant signature prompts. Wallets supported include MetaMask, TrustWallet, Coinbase Wallet, and WalletConnect. Session keys allow users to stay logged in securely for 30 days.

Kuma has a number of active social profiles including Twitter, Discord and Telegram.

Kuma Supported Cryptocurrencies

Kuma supports trading on over 5 cryptocurrencies on their platform. This exchange currently supports 4 of the top 30 market cap cryptocurrencies.

Download full list of cryptocurrencies Kuma supports

Kuma Exchange supports a select lineup of major cryptocurrencies through its perpetual futures markets. While users don’t hold the underlying assets directly, they can open long or short positions against them using USDC as collateral.

The supported cryptocurrencies currently include:

5+

These markets are quoted in USD and include leverage options—up to 50x on select pairs. Kuma ensures reliable execution and price integrity by sourcing data from high-volume exchanges and using verified oracles.

This streamlined approach offers exposure to popular assets while minimizing trading costs and maintaining a seamless experience across all listed markets.

Trading Experience

Kuma offers a trading experience tailored for power users:

- Millisecond latency and 10,000+ orders per second

- Advanced order types:

- Market, Limit, Stop-loss, Take-profit

- Post-only, Fill-or-Kill (FOK), Immediate-or-Cancel (IOC), Good-till-Cancelled (GTC)

- Reduce-only and conditional orders for automated entries/exits

- Delegated Keys enable real-time trading without hardware wallets

- Gas-free order placement and cancellation

Combined with a sleek UI and deep TradingView integration, Kuma feels like a CEX—with none of the custody trade-offs.

Kuma Fees

Kuma Exchange takes a transparent and trader-focused approach to fees. Rather than hiding costs behind complex structures, it offers a simple and consistent fee model designed to incentivize both active traders and liquidity providers.

Users trading on Kuma are subject to 0.03% - -0.005% (rebate), which apply to each order execution. Notably, market makers receive a rebate, helping to deepen liquidity and tighten spreads across available markets.

What sets Kuma apart is its gasless architecture—built on its custom Layer 2 network, XCHAIN. This eliminates traditional network transaction fees, making trading significantly more cost-effective compared to other decentralized exchanges.

By removing gas costs and offering fee rebates, Kuma positions itself as a compelling option for high-frequency traders, market makers, and those looking to maximize capital efficiency within DeFi.

| Type | Fee |

|---|---|

| Trading Fee | 0.03% - -0.005% (rebate) |

Kuma supports a range of different cryptocurrencies with varying withdrawal fees. When looking at Bitcoin, they don't charge anything above the standard Bitcoin network fee. Across all the crypto exchanges we've reviewed, the average Bitcoin transaction fee charged is 0.000210 BTC compared to the actual network fee of 0.000007 BTC. This means you are saving 96.85% on Bitcoin transactions by using Kuma instead of other exchanges.

Security - Is Kuma Safe?

Yes. Kuma uses non-custodial smart contracts to handle all user funds and settlements. Key safeguards include:

- XCHAIN L2 for fast, reliable settlement

- Delegated Keys & Session Key expiration

- No private keys stored or used for execution

- Wallet signature required for deposits/withdrawals

This layered model balances CEX-speed execution with DeFi-level transparency and user control.

Kuma Customer Support

Support is offered through:

- Live Chat

- Help Center Articles

- Twitter / Discord / Telegram

- Official Kuma Docs

The support team is active and responsive, especially around staking, reward claims, and referral issues.

Kuma Support Channels

Referral Program

Kuma’s referral system pays:

- 10% of trading fees from each referred user (in USDC)

- Referred users also get 5% off trading fees

- Commissions are claimable anytime (minimum $1) and are gas-free

Each wallet has a unique referral code and URL, easily accessible through the dashboard.

Rewards System (BGT + Points)

Kuma’s BGT Emissions program rewards:

- Trading volume (maker or taker)

- Referral activity

Rewards are streamed daily based on user scores (volume, referrals) and are claimable as often as desired.

KRT (Kuma Rewards Token) ensures on-chain BGT emission distribution reflects actual activity levels.

The KUMA Token

KUMA token (formerly IDEX token) is launching in H2 2025. Key elements:

- Staking rewards: 40% of all protocol fees distributed to KUMA stakers

- Protocol-owned liquidity and buybacks via fee allocation

- No deadline for IDEX → KUMA migration

- Pre-launch points program lets users earn KUMA ahead of TGE

This staking model ties the protocol’s growth to trader and token holder incentives.

Market Maker Program

Designed for pros, Kuma’s Market Maker Program rewards liquidity providers based on:

- Order depth, uptime, and spread

- Qualified maker volume

- Weekly “epochs” with scoring via snapshots

- 2.5% of total KUMA supply allocated to MM rewards

Kuma Connect (Mobile Trading)

Kuma Connect allows mobile users to securely trade using a QR code + delegated keys.

- Full trading functionality (no gas, real-time)

- Deposits/withdrawals require full wallet signature (for safety)

- Keys auto-expire after 30 days

- Offers a smooth, CEX-like UX—without compromising security

Common Issues & Considerations

- Requires understanding of perpetuals (not beginner-friendly)

- Limited markets at launch (BTC, ETH, SOL)

- No fiat onboarding

- Uses advanced trading language (e.g., IOC, FOK) that may confuse newer users

However, the UI, docs, and Help Center help bridge the gap quickly for serious traders.

How to Sign Up on Kuma

- Create Account - Visit the Kuma website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified you'll be able to deposit using a range of different cryptocurrencies, remember that this exchange only supports cryptocurrency.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

Kuma Alternatives

1inch

Total Supported Cryptocurrencies

1000+

Trading Fees

0%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 40 others

OKX

Total Supported Cryptocurrencies

293+

Trading Fees

-0.005% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Bancor

Total Supported Cryptocurrencies

80+

Trading Fees

0.1%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 70 others

Final Thoughts

Kuma Exchange redefines decentralized derivatives trading. With its hybrid architecture, zero gas model, and suite of pro trading tools, it brings CEX-level speed and polish to a fully non-custodial environment.

Add in incentives like KUMA staking, BGT rewards, and referral payouts, and Kuma clearly positions itself as a major DeFi player for perpetual traders—whether you’re building algos, making markets, or trading actively.

Kuma FAQs

Yes. It uses smart contracts, non-custodial wallets, and its own L2 (XCHAIN) to maintain security and transparency.

Yes. Kuma is built by the IDEX team but is a completely new platform, focused on perpetuals instead of spot trading.

Yes. The KUMA token will launch in H2 2025 and replaces the former IDEX token. Staking and rewards are built into the ecosystem.

Kuma User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for Kuma - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.