Pros

Cons

Quick Summary

| Headquarters Location | Switzerland |

|---|---|

| Total Supported Cryptocurrencies | 244+ |

| Trading Fees | 0.04% |

| Deposit Methods | Cryptocurrency |

| Support | Help Center Articles |

| Mobile App | Has no mobile app. |

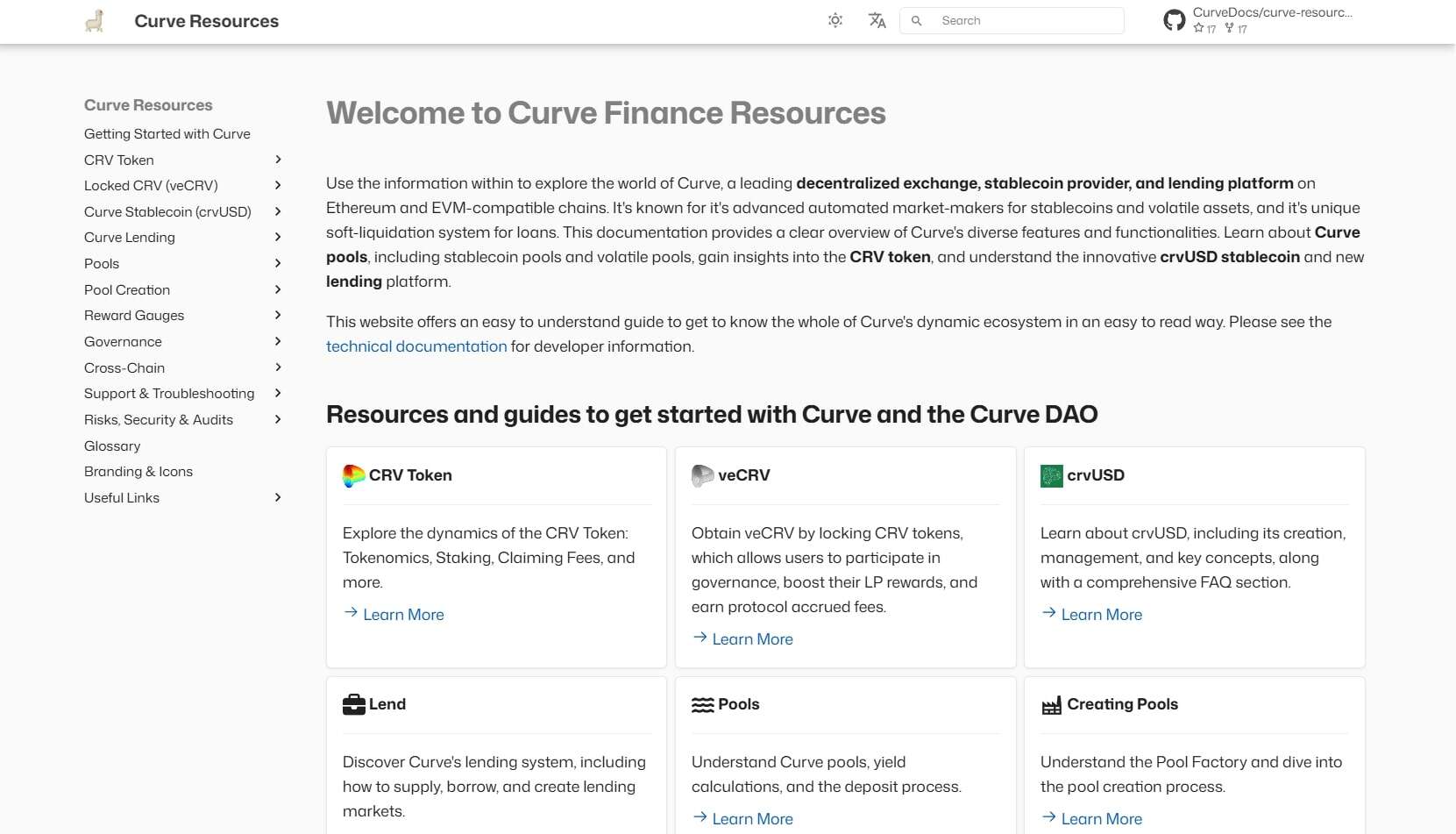

Curve works as an independent application on networks such as Ethereum and Polygon, leading the way in stablecoins’ decentralized exchange. This platform appeals to those who want a solid foundation on the volatile nature of digital assets, promising opportunities for passive income.

Curve first came under the name StableSwap, focusing initially on reducing slippage during decentralized exchanges involving stablecoins. The platform has since evolved into an Automated Market Maker (AMM) that caters primarily to assets that parallel secure currencies (like stablecoins). It gives users access to algorithms that reduce transaction fees and impermanent loss risks.

The platform’s standout features include economical transactions via its exchange function and governance mechanisms that give users voting privileges in decision-making processes.

About Curve Finance

Michael Egorov, a Russian physicist, is the driving force behind Curve. He aimed to forge a decentralized platform that excels in stablecoin trading and outperforms other exchanges. With his initiative, Curve has become an important player in the DeFi space.

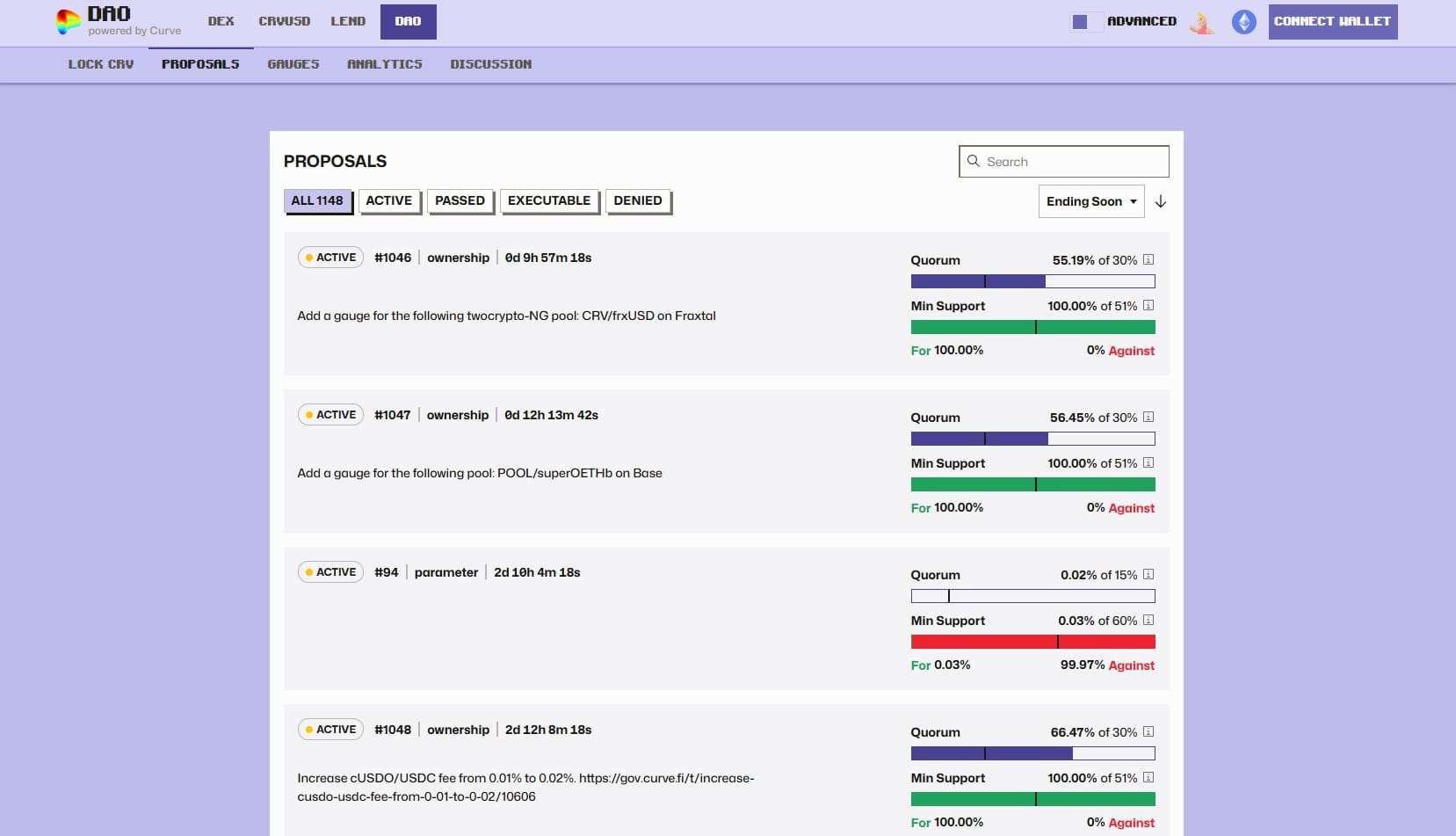

The Curve DAO is a prime example of decentralization in action. Holders of the Curve DAO token have influential voting power over the platform’s development. As a governance token, it gives CRV holders voting rights and ties their stake to Curve’s prosperity.

A set system ensures that stakeholders with a minimum veCRV are granted the privilege to make investment decisions and suggest governance motions. This setup promotes long-term dedication, which translates into increased voting authority.

Curve Finance has a number of active social profiles including Twitter, Discord, Telegram and YouTube.

Curve Finance Supported Cryptocurrencies

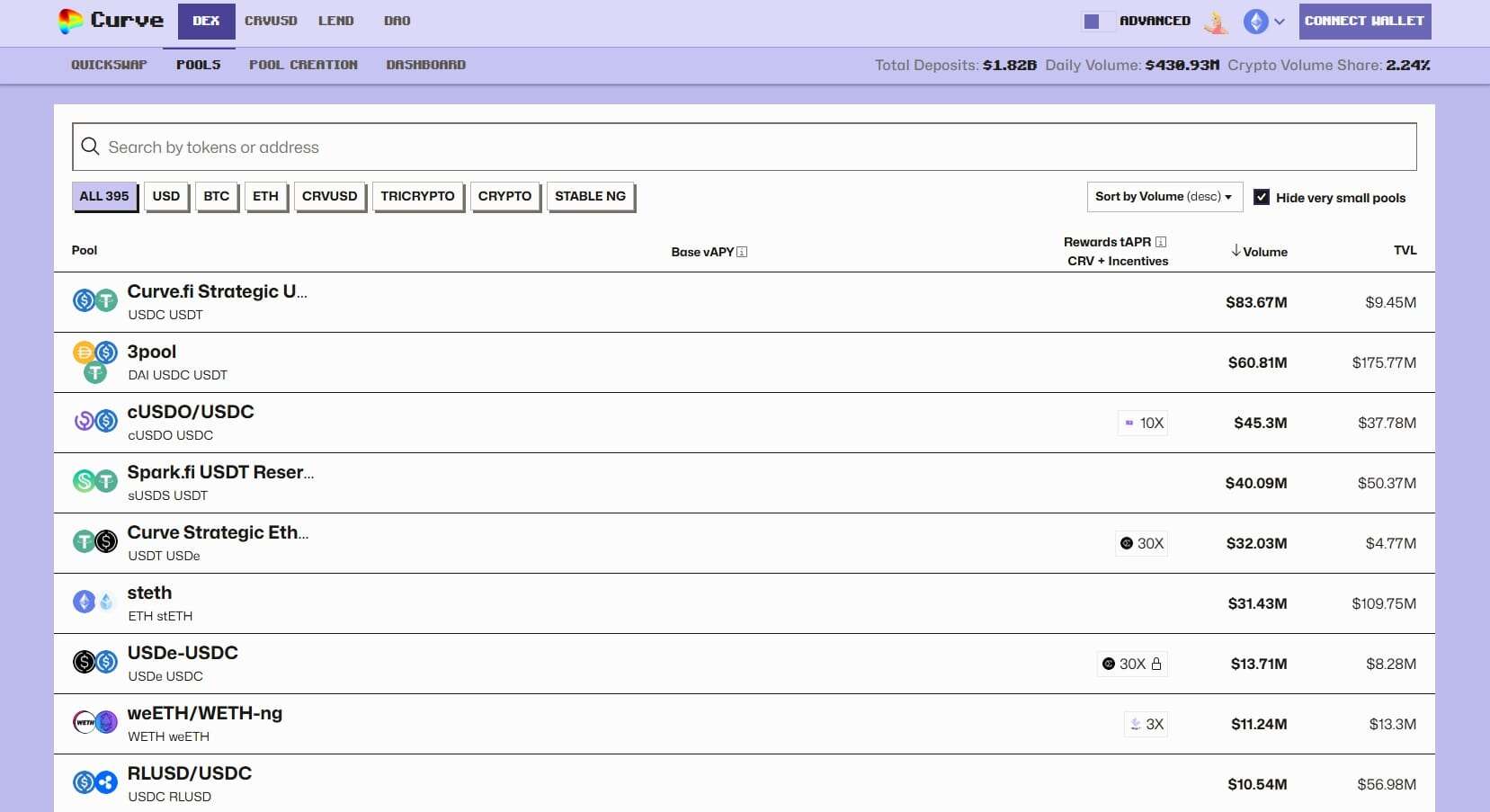

Curve Finance supports trading on over 244 cryptocurrencies on their platform. This exchange currently supports 3 of the top 30 market cap cryptocurrencies.

Download full list of cryptocurrencies Curve Finance supports

Trading Experience

Trading on Curve will show you that the platform is optimized for transactions with stablecoins. It’s also designed to minimize price differences and presents an active and scalable market capitalization that benefits traders and those providing liquidity.

Low Slippage Trading

Curve is known for its commitment to low slippage trading. The platform specializes in exchanging cryptocurrencies that maintain equivalent values, like stablecoins. This specialization allows Curve to offer traders the ability to conduct large trades with very little impact on price.

While Curve’s structure greatly minimizes slippage concerns, it doesn’t completely eradicate them. Slippage can still occur, particularly when there are fluctuations from the anchored value prices at which these assets typically trade.

High Liquidity Pools

The DeFi environment greatly benefits from Curve’s liquidity pools, filled with stablecoins and different versions of wrapped Bitcoin.

When volatility spikes, the fee system implemented in Curve’s version 2 follows conventional market makers by adjusting fees to ensure that liquidity providers are fairly compensated.

Curve has integrated smart contracts with asset pools to guarantee a persistent flow of funds on its platform. This setup helps traders execute their trades efficiently and rewards individuals for contributing liquidity to these asset pools.

Reduced Impermanent Loss

Curve’s Automated Market Maker is made to reduce slippage and protect liquidity providers from impermanent loss. Including cTokens and yTokens drawn from lending protocols plays a dual role: it safeguards returns on assets while also shielding against the potential dangers associated with impermanent loss.

The exchange prioritizes safety in facilitating passive income streams, taking measures like blocking Just-In-Time attacks to create a more secure platform.

Curve Finance Fees

Curve’s fee policy demonstrates its dedication to cost-effectiveness and efficiency. By charging a nominal swap fee of , Curve stands out as a competitive entity in the DeFi sector.

Maintaining low fees guarantees that traders and liquidity providers can participate on the platform without being burdened by high expenses.

| Type | Fee |

|---|---|

| Trading Fee | 0.04% |

Security - Is Curve Finance Safe?

Curve has faced its share of challenges, including a severe smart contract exploit due to vulnerabilities that led to a substantial loss from liquidity pools. This incident caused a significant drop in total value locked (TVL) and the CRV token price, raising concerns over the platform’s security.

In the aftermath, Curve Finance has strengthened its defenses through smart contract audits, careful testing, bug bounty programs, and multi-signature wallets. All these steps reinforce its commitment to user safety.

Curve Finance Customer Support

Curve provides a collection of technical materials on the site to help its users. Curve also offers support through live chat where users can get immediate help.

The exchange encourages self-sufficiency and a keen understanding of the risks involved in cryptocurrency. Access to a supportive team on Curve’s end also ensures users can interact with the platform’s customer support team when needed.

Curve Finance Support Channels

How to Use Curve

To fully engage with Curve, you must initiate the process by linking your chosen cryptocurrency wallet to the platform. For successful integration, having the latest firmware and using WalletConnect along with the Desktop tab on Curve’s website is important.

After creating this connection, participants can contribute ETH or stETH to liquidity pools in Curve and acquire LP tokens in return. When staked, these tokens grant access to additional incentives.

Curve facilitates an efficient experience for those who want to trade stablecoins. First, the platform participants choose the specific pair of stablecoins they want to exchange and then enter the quantity of their transaction. The trading terms, including any potential slippage or applicable charges, are then displayed.

Engaging in yield farming and providing liquidity via Curve presents a promising avenue for generating passive income. The process involves contributing tokens to the appropriate pools and collecting earnings derived from trading fees, along with extra rewards in the form of CRV and veCRV tokens. Curve provides a deposit incentive for users who supply less available tokens in certain pools, promoting an even liquidity distribution.

Upon retrieving their funds, participants can withdraw according to their stake percentage or opt for particular coins.

Curve Token (CRV) Overview

As a governance token, Curve tokens give holders the right to participate in voting processes and influence platform development decisions. Users can earn rewards by staking CRV tokens in various Curve pools. Locking these tokens in exchange for veCRV enhances yield potential for those who provide liquidity.

Acquiring and Storing CRV Tokens

CRV tokens can be purchased from crypto exchanges, both centralized and decentralized platforms. Secure storage of CRV tokens is important once they’re in your possession. Due to their ERC-20 compatibility, they can be stored in any wallet that supports Ethereum. One may also opt for hardware wallets such as Ledger or Trezor.

How to Sign Up on Curve Finance

- Create Account - Visit the Curve Finance website and fill out the create account form. You'll need to include a valid email, set your password and type in other details like your phone number and name.

- Verify Account - Confirm your email, you should get an email asking you to verify your account creation.

- Transferring Funds - Once your account has been verified you'll be able to deposit using a range of different cryptocurrencies, remember that this exchange only supports cryptocurrency.

- Start Trading Crypto - That's it! You should now have everything in place to start trading.

Deposit Methods

Curve Finance Alternatives

1inch

Total Supported Cryptocurrencies

1000+

Trading Fees

0%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR + 40 others

OKX

Total Supported Cryptocurrencies

312+

Trading Fees

-0.005% - 0.10%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 85 others

Bancor

Total Supported Cryptocurrencies

81+

Trading Fees

0.1%

Fiat Currencies Supported

USD, AUD, GBP, CAD, EUR, NZD + 70 others

Final Thoughts

Curve’s commitment to stablecoin efficiency, innovative AMM design, low fees, and secure governance model positions it as a strong contender in the DeFi space.

While the journey through Curve’s offerings reveals opportunities and risks, the platform’s continuous evolution and user empowerment speak volumes about its potential to remain a mainstay in the DeFi industry.

Curve Finance FAQs

Curve is a financial technology company that aims to provide a secure platform for its users. It operates under the regulatory requirements set out by the respective financial authorities in the regions it serves.

Trust in Curve typically stems from its adherence to these regulations, the security measures it implements, such as encryption and fraud protection, and the user reviews and experiences shared publicly. As with any financial service, users must research and consider the service’s credibility before using it.

The worth of a Curve subscription depends on how much value you feel you’re getting from the service’s features relative to its cost. Curve offers different tiers of subscriptions, each with its own benefits, such as cashback rewards, foreign exchange advantages, and insurance products.

Evaluating the worth of a Curve subscription involves assessing whether the benefits provided align with your spending habits, travel frequency, and financial management preferences.

Whether Revolut or Curve is better depends on individual needs and preferences. Revolut offers a range of financial services, including banking, currency exchange, and cryptocurrency exposure, while Curve focuses on consolidating multiple bank cards into a single card and app, along with offering features like cashback and anti-embarrassment mode.

Comparing their fees, features, and user experience can help determine which better aligns with your personal financial requirements.

Using Curve does not directly affect your credit score as it is not a credit card but a payment card that links to your existing credit and debit cards. Curve does not extend credit, so the use of the Curve card is not reported to credit bureaus.

However, the financial activity on the underlying cards linked to Curve, such as payment history and credit utilization, will continue to impact your credit score as usual.

Yes, Curve offers a free tier that allows users to access basic features without a monthly subscription fee. This includes linking multiple payment cards to the Curve card and app, making it convenient to switch between cards when making payments.

However, certain features, like the number of fee-free foreign exchange transactions or cashback rewards, may be limited in comparison to paid subscription tiers.

Yes, you can cancel your Curve subscription. If you are on a paid tier and wish to downgrade to the free version or cancel your account entirely, you should review the terms and conditions for canceling, as there might be specific steps or notice periods to follow.

It’s also advisable to check for any charges for canceling your subscription, especially if you are within a contract period.

The benefits of using Curve include the convenience of carrying a single card instead of multiple debit and credit cards, the ability to switch payment sources retroactively with the Go Back in Time feature, and the ability to earn cashback from selected retailers. Also, there are no foreign transaction fees up to a certain limit, enhanced security with real-time transaction notifications, and the ability to freeze the card through the app instantly.

The Curve card simplifies financial management by combining multiple bank and credit cards into one smart card and app. This can make tracking spending, managing expenses, and earning rewards across all linked cards easier.

Curve also provides additional features, such as the ability to change the card charged after a transaction, rewards programs, and foreign transaction fee benefits, depending on the subscription level you choose.

Curve Finance User Reviews

0.0 out of 5.0

0 reviews

No reviews yet for Curve Finance - be the first to review!

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.