When navigating the bustling world of digital finance, two giant beacons stand out, guiding a myriad of traders and investors through their crypto journey: Binance and Coinbase. Both exchanges have carved out significant niches in the cryptocurrency market, offering a plethora of services tailored to a broad audience, from novice to advanced users.

This comparison aims to dissect and evaluate the core aspects of each platform, providing insight into their offerings, user experiences, and how they stack up against each other.

At a glance

| Category | Binance Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. | Coinbase Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information. |

|---|---|---|

| Headquarters Location | International | International |

| Fiat Currencies Supported | USD, GBP, CAD, EUR, NZD + 75 others (some through third party apps) | USD, AUD, GBP, CAD, EUR, NZD + 50 others |

| Total Supported Cryptocurrencies | 418+ | 309+ |

| Trading Fees | 0.0110% - 0.1000% | 0.00% - 0.60% |

| Deposit Methods | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay, Banxa, Alchemy Pay, Mercuryo, Simplex, Wise, Skrill, Zelle | Bank Transfer, Debit Card, Credit Card, Cryptocurrency, Paypal, Apple Pay, Google Pay |

| Support | Facebook, Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket | Twitter, Instagram, Live Chat, Help Center Articles, Support Ticket |

| Mobile App | Yes - iOS, Android | Yes - iOS, Android |

| Our Rating | ||

| Review | Read full Binance review | Read full Coinbase review |

| Visit | Visit Binance | Visit Coinbase |

About Binance Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

Please note: Binance has had regulatory challenges in the U.S. and EU. Binance was fined $4b on 21st Nov 2023 by a coordinated effort between the Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) and Office of Foreign Assets Control (OFAC) and the U.S. Commodity Futures Trading Commission (CFTC). Binance still remains the most used exchange in the world, but we would proceed with caution.

Binance, recognised as the largest cryptocurrency exchange in terms of trading volume, began its operations in 2017. Founded by Changpeng Zhao, often known as “CZ,” Binance rapidly ascended the ranks to become a central hub for a wide range of digital assets.

Renowned for its extensive features, Binance caters to an international clientele, offering hundreds of cryptocurrencies for trading. The platform includes Binance Coin (BNB), its native token, which is used to facilitate transactions within the Binance ecosystem.

Not limited to just trading, Binance has expanded into other areas such as storage through Trust Wallet, educational resources via Binance Academy, and even into the realm of Decentralized Finance.

In addition to its high trading volume and the creation of Binance Coin, Binance has been a pioneer in the integration of blockchain technology with its launch of the Binance Smart Chain. This move not only diversified its service offerings but also positioned Binance as a major player in the DeFi space.

Its agility in embracing market trends and the evolving needs of crypto traders has significantly influenced its growth trajectory. Furthermore, Binance’s reach extends beyond exchange services, as it also operates as a crypto company, offering various tools and platforms for blockchain developers and entrepreneurs.

Binance Pros & Cons

Pros

Cons

About Coinbase Our review is based on the spot trading platform. Please check our methodology on how we rate exchanges for further information.

Coinbase, founded in 2012 by Brian Armstrong and Fred Ehrsam, is lauded as one of the most accessible cryptocurrency platforms, particularly popular in the United States. Initially conceived as a Bitcoin wallet service, Coinbase has evolved into a comprehensive custodial cryptocurrency exchange.

It serves a wide audience, from beginners with its user-friendly interface to advanced users through Coinbase Pro and Coinbase Advanced Trade. With a commitment to regulatory compliance, Coinbase has even secured backing from prestigious institutions like J.P.

Morgan and Goldman Sachs, cementing its reputation as a reliable and secure crypto platform.

Coinbase’s journey reflects its mission to make cryptocurrency accessible to the average person. Its emphasis on regulatory compliance has fostered trust among retail investors and brought cryptocurrency into the mainstream consciousness.

The company’s direct listing on the NASDAQ in April 2021 was a landmark moment, signalling the growing acceptance of cryptocurrencies as a legitimate asset class. This milestone, coupled with educational initiatives like Coinbase Earn, showcases its dedication to not only providing a service but also equipping users with the knowledge to navigate the crypto space confidently.

Coinbase Pros & Cons

Pros

Cons

Binance vs Coinbase: Supported Cryptocurrencies

In terms of total cryptocurrencies available, Binance users have access to more cryptocurrencies. Binance offers 418 cryptocurrencies whereas Coinbase supports 309 cryptocurrencies.

For those interested in trading high market cap cryptocurrencies, Binance supports 24 of the top 30, compared to Coinbase which supports 21 of the top 30.

Binance provides access to a wider range of cryptocurrencies, making it a potential go-to for traders seeking a diverse range. However, Coinbase remains a strong competitor with its offerings.

Binance vs Coinbase: Fees

| Fee Type | Binance Fees | Coinbase Fees |

|---|---|---|

| Deposit Fee (Bank Transfer) | 0% - 2% | $0 - $10 |

| Deposit Fee (Credit Card/Debit Card) | 0% - 2% | $0 - $10 |

| Trading Fee | 0.0110% - 0.1000% | 0.00% - 0.60% |

| Withdrawal Fee (Bank Transfer) | 0% - 1% | $0 - $25 |

Exploring the fee structures of Binance and Coinbase unveils a contrast in their approaches. Binance operates on a maker-taker fee schedule, incentivising high-volume traders with lower fees per transaction.

It’s also known for having one of the more competitive fee structures in the crypto space. Conversely, Coinbase’s fees are typically higher, particularly for credit card purchases and fiat currency transactions.

While fees can significantly impact the overall cost of trading, both exchanges offer ways to reduce them, such as utilising their respective native tokens.

While both exchanges implement a tiered fee system that rewards users for higher trading volumes, it’s their strategic partnerships and product offerings that also influence fee incentives. By using Binance USD or transacting on a separate platform for advanced trading options, users may find different fee dynamics at play.

Similarly, Coinbase users can utilise the Coinbase Wallet for potentially different fee structures on transactions. It’s important for users to consider the overall cost of their trading activities, including any potential fee reductions they can leverage through various exchange-specific tools and options.

Binance vs Coinbase: Security

Security remains a paramount concern in the crypto exchange domain. Binance and Coinbase employ rigorous security measures including two-factor authentication (2FA), address whitelisting, and insurance policies to safeguard customer funds.

Coinbase, in addition, boasts FDIC insurance for USD balances and a secure cold storage system for a portion of user funds. Binance, while not providing FDIC insurance, has a Secure Asset Fund for Users (SAFU) to protect a share of their assets.

Security features of exchanges like Binance and Coinbase are continually being fortified to address emerging threats. With advancements like biometric fingerprint logins and device management systems, they aim to provide users with peace of mind when engaging in crypto transactions.

Both companies are proactive in addressing security concerns, which is crucial in an industry where the threat landscape evolves as rapidly as the technology itself. For instance, Binance has a rapid response protocol for fraudulent withdrawals, and Coinbase has a vault service for additional layers of security on stored assets.

However, it continues to implement advanced security features. Thus, both exchanges stand out for different reasons in terms of security, making it a tie depending on individual preferences and geographical location.

Binance vs Coinbase: Ease of use

Both Binance and Coinbase pride themselves on providing an intuitive interface for their users. Coinbase is often favoured by those new to the crypto space, offering a straightforward onboarding process and simple purchase options.

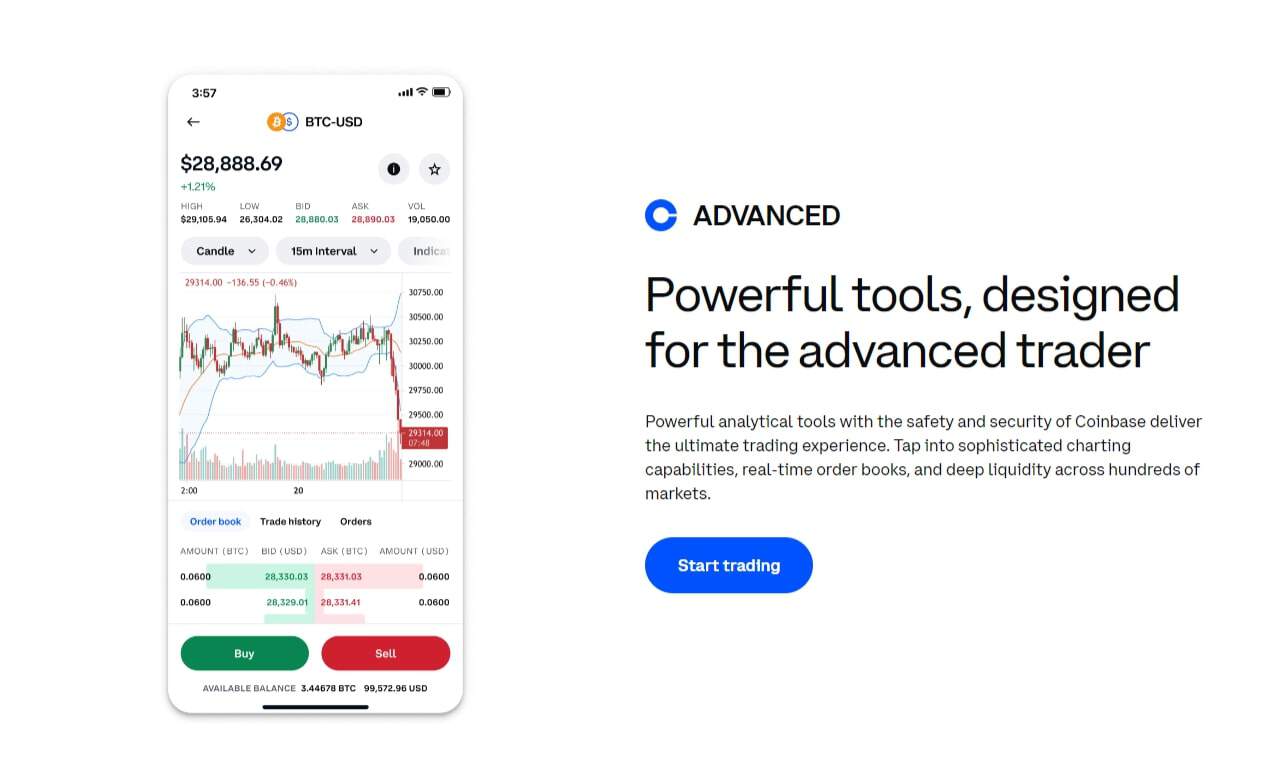

Binance, with its comprehensive charting options and advanced trading platform, may appear daunting but caters well to experienced users. Each platform has invested in mobile apps, ensuring that trading can be as portable as it is dynamic.

The ease of use is a significant factor in an exchange’s appeal, with both companies offering varying levels of device access to cater to their target markets. While Binance provides a detailed and customisable user interface that appeals to advanced traders, Coinbase’s clean and simplified design is an excellent choice for those new to the cryptocurrency space.

This consideration of user proficiency and preference demonstrates both platforms’ commitment to offering a tailored trading experience.

Binance vs Coinbase: Support

Customer service is crucial in the fast-paced crypto market. Binance and Coinbase offer several customer support options including help centres, email support, and extensive FAQs.

While direct phone support is limited, Coinbase has the edge in user support with a more responsive service. Binance, however, is not far behind, continually working on enhancing its customer service offerings to match the growing demands of the crypto community.

In conclusion, Binance and Coinbase are titans in the crypto exchange landscape, each with unique features and services that make them attractive to different segments of the crypto user base. The choice between them should be informed by personal trading preferences, desired features, and the level of experience in the crypto sphere.

Whether you are drawn to the comprehensive offerings of Binance or the user-centric approach of Coinbase, both platforms stand as gateways to the evolving world of cryptocurrencies.

The importance of reliable customer service in the fast-paced crypto market cannot be overstated. Both Binance and Coinbase have established robust customer service frameworks to tackle the array of issues that users might encounter.

From troubleshooting access problems to addressing concerns about account security, both platforms are dedicated to providing their users with timely and effective support. The customer service landscape is a constantly evolving battleground for exchanges, as they seek to differentiate themselves by offering unparalleled user support.

Binance vs Coinbase: Features

In the arena of features, Binance boasts an extensive range, from basic transactions to advanced options such as futures and margin trading. They also offer Binance Earn for staking and earning interest, appealing to a variety of crypto investors.

Coinbase, on the other hand, focuses more on the foundational aspects of crypto trading but still provides options for expert traders with its Advanced Trade platform. Both cater to a spectrum of needs, from securing crypto loans to indulging in crypto trading courses.

When it comes to features, both Binance and Coinbase are continuously evolving to meet the needs of their diverse user bases. Binance’s multitude of trading pairs and advanced trading options offer a dynamic trading experience for seasoned investors.

Meanwhile, Coinbase’s focus on popular coins and ease of use makes it a solid platform for those looking to start their cryptocurrency investment journey. Both exchanges are also expanding their educational resources, acknowledging the importance of informed trading decisions in a complex market.

Final Thoughts

Deciding between Binance and Coinbase hinges on individual needs and preferences. Binance appeals to those seeking a vast selection of cryptocurrencies and advanced features.

Alternatively, Coinbase is ideal for users seeking a simplified, regulated, and secure entry into the cryptocurrency market. Both platforms have established themselves as leading crypto exchanges, each with their respective strengths and weaknesses.

The future of cryptocurrencies seems intertwined with the evolution of exchanges like Binance and Coinbase. As the market matures, we may see these platforms further diversify their services to cater to the burgeoning demand for digital finance solutions.

The role of crypto exchanges will likely expand beyond trading, possibly incorporating more financial education resources, seamless integration with traditional finance, and even influencing the regulatory landscape for digital assets.

Binance vs Coinbase: FAQs

Binance is one of the largest and most popular cryptocurrency exchanges in the world. It has a reputation for a high level of security, but as with any platform, “the safest” is a relative term. Binance employs a range of security features, including two-factor authentication, device management, and cold storage of assets.

However, no platform is entirely immune to risks, and the safety also depends on user practices (like using secure passwords and not sharing login details). It’s crucial to stay informed about any new developments or security breaches.

If Binance were to shut down, the impact would depend on the nature of the shutdown. In a planned closure, Binance would likely provide users with a timeframe to withdraw their funds. In an unplanned or abrupt shutdown (due to regulatory actions, financial problems, or a major security breach), the process might be more chaotic.

Users could face challenges accessing or retrieving their assets. Funds stored in cold storage or hardware wallets would remain secure, but those held on the exchange could be at risk.

This scenario underlines the importance of not storing large amounts of cryptocurrencies on any exchange for an extended period and regularly backing up critical data related to your crypto assets.

Methodology

At Crypto Head we use a rigorous research and rating process to assess each platform. Our star rating system is out of 5 stars and is designed to condense a large amount of information into an easy-to-understand format. You can read our full methodology and rating system for more details.