Quick Answer:

Cryptocurrency mining is a critical process for generating new coins and verifying transactions on a blockchain network. It involves solving cryptographic puzzles using specialized hardware to earn rewards in the form of digital currency and transaction fees.

As the number of miners grows, mining becomes increasingly difficult, necessitating powerful and energy-efficient hardware. Miners must consider factors such as hash rate, power consumption, and energy efficiency when choosing mining equipment.

Bitcoin mining uses the SHA-256 hash function and requires ASIC miners due to the high difficulty level. Mining difficulty adjusts every 2,016 blocks to ensure a consistent block generation time.

Ethereum mining is done with GPUs as it uses the Ethash algorithm, which was initially ASIC-resistant, allowing for more accessible participation in the mining process. Litecoin mining, faster than Bitcoin’s, uses the Scrypt function and can be performed with CPUs, GPUs, and ASICs, though ASICs offer a significant advantage.

Popular mining hardware includes the Halong DragonMint T1, Bitmain Antminer S9 for Bitcoin, and Antminer L3+ for Litecoin. Additional equipment like power supply units, cooling fans, and backup generators are also essential for efficient mining operations.

USB Bitcoin miners are an accessible but less profitable option for enthusiasts. The mining landscape is ever-evolving, with new technologies emerging and miners sharing experiences in online communities. It’s crucial to stay informed about market trends, hardware capabilities, and the overall profitability of the mining venture before investing time and resources.

People are more convinced than ever that cryptocurrencies are here to stay. This is visible in the growing number of buyers purchasing cryptos, merchants accepting them as a regular payment method, investors trading the assets online, and computer engineers making sure the industry is advancing in the right direction.

In order for the crypto industry to keep running full steam, digital coins have to be issued and remain in circulation. The cryptocurrency mining is done by people who want to earn a profit while supporting the crypto network and keeping it secure at the same time. If a lot of people verify a bitcoin transaction, for example, it will ensure that the network remains impenetrable.

In our guide, we’re going to explain what crypto mining actually is and what factors you need to consider before getting involved in this business. We’ll talk about the differences in mining the three most popular coins: Bitcoin, Ethereum, and Litecoin. You’ll read about the available mining hardware today, together with some advice on how to choose the one that suits you best.

Mining Explained

What Is Cryptocurrency Mining?

“So important are the processes of mining—assembling a block of transactions, spending some resources, solving the problem, reaching consensus, maintaining a copy of the full ledger—that some have called the bitcoin blockchain a public utility like the Internet, a utility that requires public support.” (Don & Alex Tapscott. 2016. Blockchain Revolution: How the Technology Behind Bitcoin Is Changing Money, Business, and the World)

In a way, cryptocurrencies are not that different from gold since they both require mining. Depending on which digital coin you’re interested in, there will be different mining rules but regardless of the asset, the mining job is always done online, on the blockchain peer-to-peer network.

The blockchain is basically a decentralized digital ledger which means there’s no assigned third-party authority to monitor and filter the incoming transactions. As a result, there’s no way for us to know whether the newly mined coins are genuine or not. Cryptocurrency mining addresses both of these network issues.

The whole mining process consists of two parts – generating authentic cryptocurrencies to circulate on the network, and verifying the incoming transactions that would then be stored on the blockchain. The people who do this job are called “miners”, and they work using special mining hardware.

The Mining Process

Upon joining the network, miners get a hashed electronic address. This is their “label” on the digital ledger and it allows the system to keep track of how much work they have done on the network. Their mining includes a cryptographic process in which a complex mathematical problem has to be solved with a hash function.

Once a miner comes up with a solution, they broadcast it to the whole network for the other miners to check and verify it (this is a much easier task once they have the code).

When a large number of miners accept the solution, the transaction is approved and enters the new forming block of data. These blocks are simply ledger files that permanently record the transactions.

The miners compete for the right solution because they get rewarded for this power and time-consuming process that not only keeps the whole network running but it also makes it more secure. There’s no way for a change in block data to go unnoticed on their radar! As a reward, miners earn cryptocurrencies and a small transaction fee.

Why Is Mining Becoming More Difficult?

As time goes by, and more and more people are taking up crypto mining, it will get increasingly difficult and time-consuming to mine digital coins and add new blocks on the blockchain.

This is how the network protects itself from higher mining rates than those preferred because we can’t have unreasonable amounts of digital coins in circulation.

On the one hand, this is necessary for the network security but on the other, it makes miners’ lives a living hell. To mine the most popular coins they need extra time and enormous computing power but their work pays off well. If they opt for lesser-known coins, they’ll probably earn less, unless the coin in question becomes mainstream in the long run.

What to Look Out For

You can’t just make up your mind one day that you’re interested in mining cryptos and start doing it right away using your personal computer. That’s not how it works. This task is getting increasingly difficult and you need special mining hardware to do the job.

Before we go into the different types of mining hardware, you need to know what to pay attention to and how to evaluate the hardware performance. The following list contains the factors that should influence your choice the most:

Hash Rate

Hash rate is the primary mining factor and refers to the amount of processing power the miner needs in order to solve the algorithmic puzzle on the blockchain network and mine the new block.

The hash rate measures how many times per second the miner attempts to perform a hash to solve the equation.

Over the last decade, the Bitcoin network has evolved to compute quintillions of hashes per second! Quinta what? Well, first we have kH/s (one thousand or ‘kilo’ hashes per second), MH/s (one million or ‘mega’ hashes per second), GH/s (one billion or ‘giga’ hashes per second), TH/s (one trillion or ‘tera’ hashes per second), PH/s (one quadrillion or ‘peta’ hashes per second), and finally EH/s (one quintillion or ‘quinta’ hashes per second).

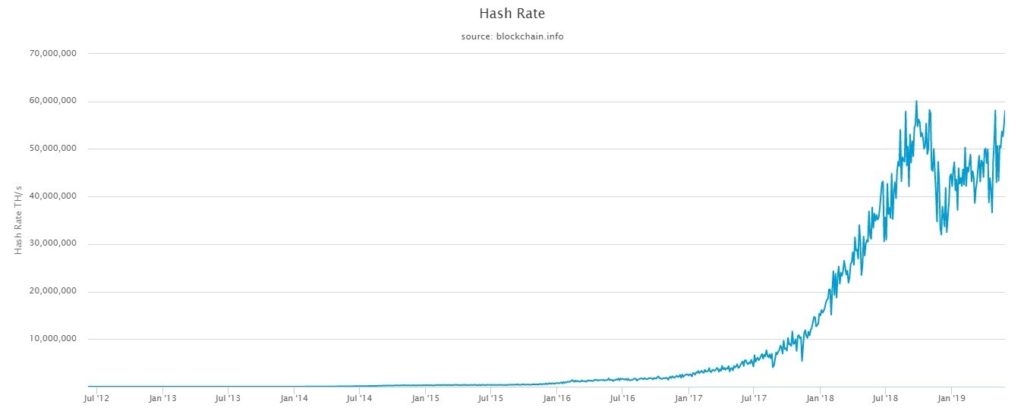

In the hash rate statistics above, taken from Blockchain, you can notice how Bitcoin’s hash rate skyrocketed in 2017 after an overwhelming surge of new network users. Preceded by a sudden nosedive towards the end of 2018, the hash rate went back on an upward track until it hit its all-time high of 102 EH/s on September 19th, 2019. This was followed by another unexpected slump on September 23rd.

You can see that more clearly in the picture below:

The current Bitcoin hash rate stands at around 100 quintillion hashes.

Power Consumption

Power consumption refers to the electrical energy per unit time that we need to operate a certain device. It’s directly connected to the hash rate factor because the higher the hash rate, the greater the power consumption your mining hardware will utilize to unlock new digital coins.

The use of electricity makes up 90-95% of the costs to mine cryptocurrencies, costing approximately $200 in electricity (including cooling power) to mine a single coin!

Power consumption is measured in Watts, so when looking for the right hardware aim for one that uses a lower number of Watts. If you want to make a profit out of crypto mining, make sure the electricity bill doesn’t surpass your set cash goal.

Here’s an explanation from Martin Quest, author of Cryptocurrency Master Bundle (2018): “Utilizing the consumption of energy and hash rate in numbers will help you figure out the number of hashes that you receive for each watt expended by your hardware. For achieving the numbers, you can divide the hash rate by the watts. Here’s an example: Assume that the hash rate of your hardware is 4,000 MH/s with a requirement of 30 watts, so the consumption of energy will be 133,333 MH/s per watt.”

Energy Efficiency

Energy efficiency is measured in Joules, and calculated using power consumption and hash rates as shown above. The lower the amount of energy used by your mining hardware (i.e. the number of Joules), the better. If the numbers are low, this suggests that the miner utilizes less power but still ends up producing the same work. For a mining machine, it’s not only preferable to be powerful but to be energy efficient as well.

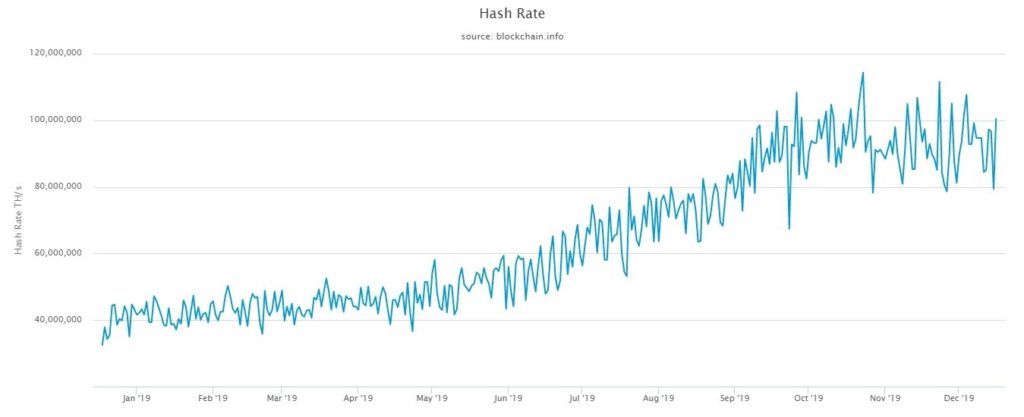

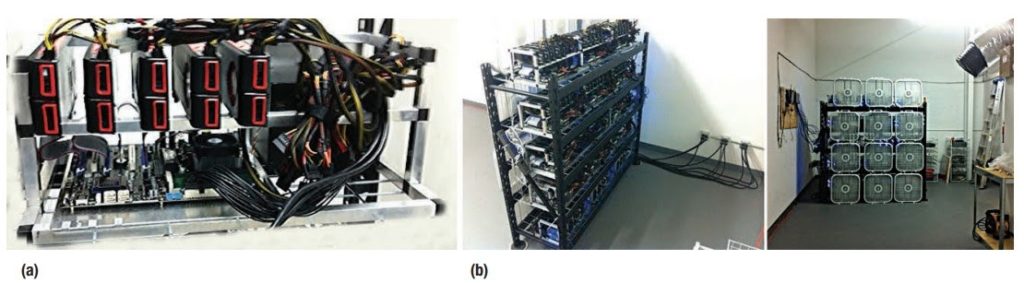

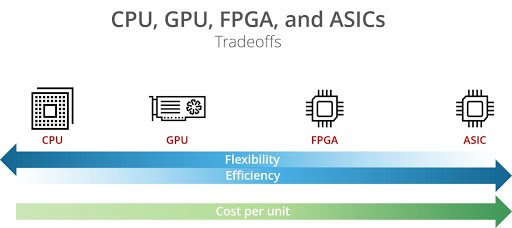

Bitcoin mining energy efficiency over time. The y-axis represents bitcoin mining energy efficiency in units of Watts per GH/s on a logarithmic scale. The x-axis represents time, beginning with the introduction of Bitcoin in 2009. Mining technology regimes are indicated as well.

Types of Mining Hardware

CPUs

In the beginning, back in 2008 when blockchain was first invented, cryptocurrency mining started on standard computers with little above-average processors, i.e. computer processing units (CPUs).

For example, the first block header – the foundation block that’s hashed repeatedly – was generated on a regular computer, the Intel Core i7 990x, which had a performance of only 33 MH/s.

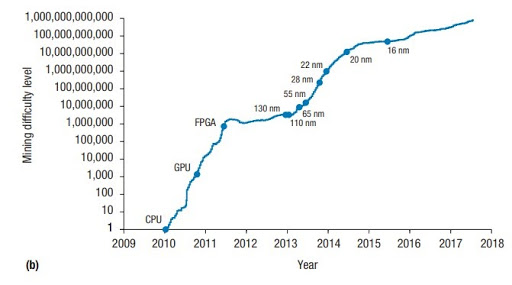

The growth of the Bitcoin network brought about more miners competing to increase their hash rates and be the ones to solve the mathematical puzzle. This required greater computational power than CPUs could ever produce.

GPUs

Graphic Processing Units (GPUs) are electronic circuits or chips specialized for display functions on an electronic device. The GPUs are responsible for the visuals in videos and computer games.

Rendering graphics requires a lot of processing power which is one of the advantages of this hardware together with the ability to perform multiple cryptographic computations simultaneously. This made it perfect for crypto mining! In the past few years, the biggest GPU manufacturers for miners have been Nvidia Corp (NVDA) and Advanced Micro Devices Inc. (AMD) – the more powerful out of the two, offering up to 2.5 GH/s.

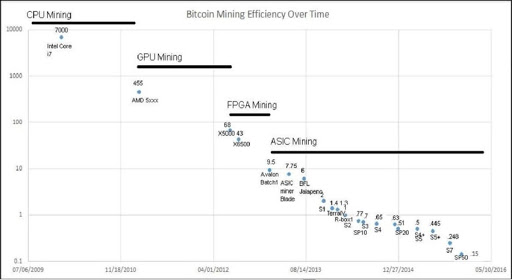

“GPU Bitcoin miners. (a) Open-air rig with five GPUs suspended above the motherboards and connected via PCI Express extender cables and a single high-wattage power supply. (b) Homebrew 69-GPU mining datacenter. Note the ample power cabling (left) and cooling system, consisting of box fans and an air duct (right).” Source: Michael B. Taylor. (2017). The Evolution of Bitcoin Hardware. University of Washington

GPU mining is considered a better option for newbie miners who want to give crypto mining a try. The best thing is that even if you change your mind, you can easily sell the hardware since they’re always in great demand.

FPGA

The next step forward in the revolution of mining hardware was the emergence of FPGA-based miners in 2011. A Field Programmable Gate Array is a chip, a piece of hardware, which can be programmed to perform a task.

These were less cost-effective in regards to hash rate but operated on moderate energy consumption compared to GPUs, and almost supplanted them completely until ASICs came around. Plus, in the long run, GPUs still had a better resale value once exhausted.

ASICs

Application-Specific Integrated Circuits (ASIC) miners are designed for the purpose of mining digital coins exclusively. You can think of them as being similar to the microprocessors or RAM chips on your computer with the only difference that instead of performing general functions they perform their one specific mining duty. As a result, they do the job faster than previously used miners.

Each of these miners is suitable for one cryptocurrency only. Nowadays, Bitcoin mining is unimaginable without ASICs, where every newly designed device outperforms the one before. However, there’re some digital coins such as Zcash that are resistant to ASIC hardware.

The superiority of ASICs can be seen in the hash rate they offer – up to 20 TH/s! – and the fact that they consume far less energy than GPUs. Another one of their upsides is the easy setup as most of the companies send pre-configured hardware to which the software has already been installed.

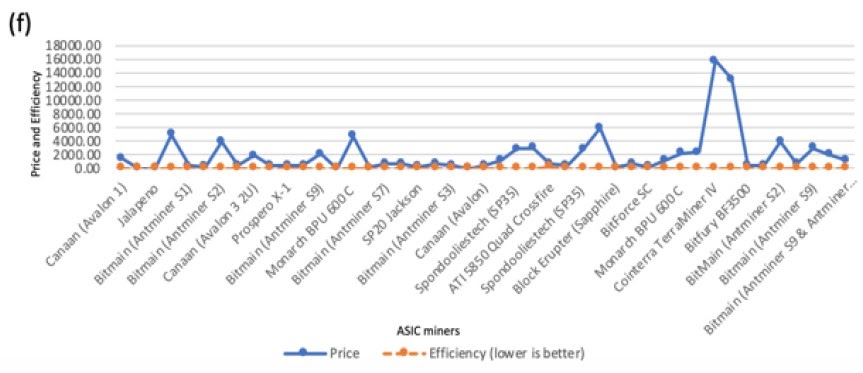

The market has hundreds of ASIC miners on offer for beginners and experienced miners alike. Their price can range anywhere from $20 to more than $5,000, calculated in accordance with the hashing power and energy consumption. Anyway, there’s a catch to all this. The more people use ASCs for mining, the harder the process gets. This can greatly affect your expected profit so before you decide to make such an investment, make sure you conduct an extensive cost-benefit analysis.

Bitcoin Mining

We explained that part of the mining process is verifying transactions to avoid the double-spend problem. Every blockchain integrates its own consensus method to achieve that. Blockchain, as you might already know, uses the proof of work (PoW) mechanism.

To summarize the PoW system briefly, we have the miners who run the data from the pending transactions through a hash function or hash algorithm. For the Bitcoin blockchain that’s the SHA-256 which outputs a 32-byte hash value.

In other words: “Bitcoin mining is a key technical component of ensuring that the Internet has sufficient time to attain consensus on new blockchain updates. Miners must find a nonce value that makes a double SHA-256 hash of the block’s header be less than (65535 << 208)/difficulty. Because SHA-256 is designed to be noninvertible, the primary approach is to use brute force. If the difficulty value is twice as large, then it takes twice as many brute-force tries on average to find the corresponding nonce.” (Michael B. Taylor. The Evolution of Bitcoin Hardware. The University of Washington, 2017)

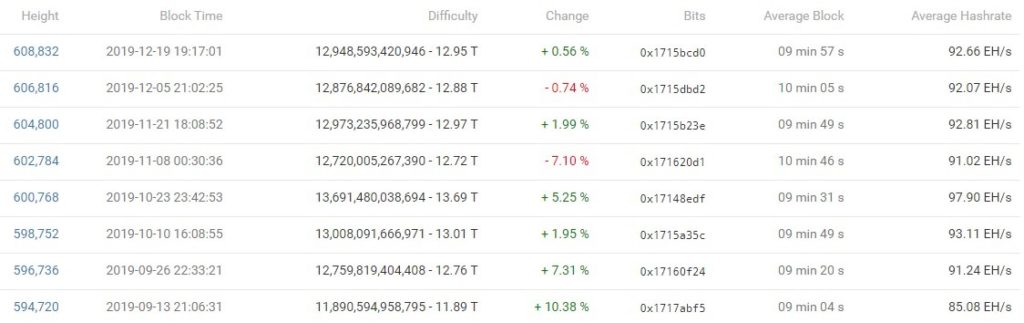

Blocks added to the Bitcoin blockchain. You can see the mining difficulty, the time it took to mine the blocks, and the average hash rate. (Source: BTC)

The difficulty value is regulated with a set limit that is recalibrated every 2,016 blocks, i.e. roughly every two weeks so that a new block is generated every 10 minutes on the Bitcoin blockchain. If the difficulty remained the same, it would take less time for a block to be mined with the rising number of miners joining the network.

At the turn of the new interval, each miner divides the expected mining time for these 2,016 blocks (2016 x 10 minutes) with the actual time he/she took to mine them.

If they spent less time, e.g. 9 minutes per block, the way to calculate that is 20160 / 18144 = 1.11. Next, each miner multiplies the current difficulty by 1.11. If the number is greater than 1, the difficulty increases, and vice versa. For the next 2,016 blocks, the miners work with this new difficulty.

“Finding a block header hash value below the target threshold—the algorithm underlying Bitcoin’s blockchain—is 850 billion times more difficult than it was originally. The approximate introduction dates of new mining technologies are indicated: CPUs, GPUs, field-programmable gate arrays (FPGAs), and application-specific integrated circuits (ASICs) in different VLSI nodes.” Source: Michael B. Taylor. (2017). The Evolution of Bitcoin Hardware. University of Washington

Mining Hardware

Higher mining difficulty means that the only cost-effective Bitcoin mining hardware nowadays is high-power ASICs. Even so, there’s a great variety of these machines that you can choose from, depending on your mining circumstances.

For example, some miners need a smaller machine to fit their bedroom, while some prefer having a whole room for a mining rig.

The same thing goes for beginners and experienced miners. Or maybe you have a tight budget and look for an affordable ASIC, as opposed to making a lifetime investment.

Let’s take a look at the most popular ASICs on the market.

Bitmain Antminer S9

Those of you who can’t endure the long DragonMint wait can turn to the second-best miner instead – Antiminer S9, developed by Bitmain, the largest Bitcoin mining organization in the world.

What makes it a close second is the 14 TH/s hash rate and energy consumption of 1,320 W which is lower than the T1 and really makes a difference in the long run.

When it comes to the cooling mechanism, the Antminer S9 has two high-speed fans, as well as custom-made heat sinks, built with a high-grade aluminum alloy.

The Antminer 9 comes at more or less the same price as the DragonMint T1, between $2,700 and $3,000. Don’t forget to include an additional $100-150 for power supply to your calculations.

Avalon 6

The company Canaan Creative has produced the Bitcoin miner Avalon 6 with beginners in mind. The miner draws 1,050 W from the wall and has a hash rate of only 3.5 TH/s.

This doesn’t make it the best miner in terms of profitability but you can always switch to a more professional one once you’ve mastered Avalon 6. The good thing about it is that it comes at a pretty reasonable price of around $650 for a new one, or $200-300 for a used one. The company only allows for bulk orders but you can buy it online on Amazon.

Bitmain Antminer R4

Similar to Avalon 6, Bitmain’s Antminer R4 is the perfect choice for home or office mining. This miner runs so quietly that no family or colleague will be disturbed by its sound. The company borrowed the design idea from silent split air conditioning units.

R4 is very energy efficient and produces only 0.098 J/GHs, and a maximum hash rate of 8.7 TH/s for a power consumption of 845 W. Its main drawback is that it’s really expensive for a less powerful miner. It costs over $1500!

Source: ASIC Miner Value

“ASIC miner hardware compared to their prices and efficiencies. Values were obtained from 30 different studies. Certain papers provided the power consumption and the hash rates. Hence, efficiency is calculated using the Efficiency = Power consumption (W) / Hash rate (GH/s) equation.”

Source: Energy Efficient Bitcoin Mining to Maximize the Mining Profit (2019), Pathirana, Syed, and Halgamuge

Mining Equipment

Apart from investing in the right mining hardware, we advise you to buy some additional Bitcoin mining equipment such as:

- Power Supply. The power supply helps your mining hardware to use electricity in an efficient manner.

- Cooling Fans. You definitely need a cooling fan to prevent your mining hardware from overheating and deal with the regular high heat output as well.

- Backup generators. Some miners require extra power for their mining, so we encourage buying proper generators that can supply enough electricity. Also, this is a great backup in case your main source of electricity goes down!

USB Bitcoin Miners

At the height of this crypto craze, people are coming up with all sorts of innovations to make mining more accessible. That’s why we now have USB Bitcoin miners, popular for the low power consumption.

You plug one (or more) of these into your computer and they instantly increase the CPU and hashing output.

However, we have to be honest with you – USB miners don’t add to your profitability. You can see them as play toys for crypto enthusiasts who don’t want to spend thousands of dollars purchasing one of the bulky high-cost miners we mentioned. Beginners might turn to USB miners as well, at least until they learn the basics of how professional mining works.

Ethereum Mining

The blocks on the Ethereum blockchain vary in size and a new one is mined every 12 seconds. Ethereum uses different proof of work consensus called Ethash that uses a hash function known as SHA-3. From the start, Ethash was ASIC-resistant so Ethereum mining is done using GPUs instead. Another thing you need is a reliable power supply and Internet connection. The process goes like this:

- Purchase a GPU. Again, pay close attention to the hash rate, energy efficiency, and price of GPU hardware. Some miners buy a couple of GPUs and connect them together to create a mining rig. As a result, they get a higher hash rate.

- Install the software.

- Download the Ethereum blockchain. Once you download the blockchain, your node will be connected to the network. To get in touch with other nodes you can use a service such as Geth.

- Run a test mining. Using the private test network, you can run a test mining where the only miner is yourself. You can mine all the blocks and verify transactions.

- Start mining. You’re now ready to start mining and enjoy other crypto benefits on Ethereum such as deploying smart contacts, creating decentralized applications (DApps), and sending transactions yourself.

- Join a mining pool. You also have an option to join a mining pool where you connect with other miners and with joint computational power you all try to solve the puzzle more quickly. For this, you’ll also need to install a software called Ethminer.

- Collect your reward. Once you’ve successfully mined your first block, you can claim your ETH and transaction fees.

Mining Hardware

When talking about GPUs in general, we mentioned AMD and Nvidia as the two major GPU manufacturers that are literally overwhelmed with orders as the hardware popularity goes up.

The main advantage of AMD mining cards is that they’re relatively cheaper, about ⅔ of the price of Nvidia cards but the latter are more powerful and easier to use.

Litecoin Mining

Compared to the Bitcoin blockchain that allows mining a new block every 10 minutes, on the Litecoin blockchain, you need only 2.5 minutes which is four times faster! Litecoin uses yet another proof of work algorithm called the Scrypt hash function which is memory intensive and stores the hash in the RAM of the processor.

Mining Hardware

Miners can use both CPUs and GPUs to mine Litecoin but using powerful ASICs would always put them at an advantage. At first, the Scrypt-based protocol was ASIC-resistant but with the new technological advances looking to replace outdated hardware such as CPUs and GPUs, state-of-the-art ASICs for Litecoin mining have been created.

Antminer L3+

For Litecoin miners, no mining hardware can compete with Bitmain’s Antminer L3+ when it comes to speed and power. It has a hash rate of 504 MH/s for an 800 W power consumption. It’s similar in size to the Bitcoin Antminer S9, with custom-made heat skins of aluminum alloy. The cooling fans make sure the heated air is quickly replaced with a cooler one.

The used L3+ can be bought for about $300 but if you want a new one it costs $750. A word of advice: it’s definitely an investment that pays off.

Conclusion

Knowing what you now know about mining cryptocurrencies can you say whether it’s worth your time and money?

You’re right. It depends.

If you lay your hands on mining hardware for the first time it’ll certainly be difficult and confusing at first. Some hardware comes with a preconfigured setup but others don’t. Luckily for you, today we can easily type just about anything on search engines and get instant instructions and video demonstrations.

As for choosing the hardware itself, we tried to make it easier for you by offering a small selection of the best ones available. You can also join various online forums and chat rooms with crypto enthusiasts from around the world, who compare and contrast mining hardware and share their experiences.

The best advice that you can get is to follow the crypto market closely and always stay on the lookout not only for the best hardware deals but for the worth, hash rate, and mining difficulty of the digital coin you’re getting ready to mine.