Key Takeaways:

- Bitcoin nears its all-time high of $69,000, with its current price at $68,300, showing a significant 7% increase in the last 24 hours.

- Historical patterns reveal Bitcoin’s potential for rapid growth post-achieving new highs, with instances of doubling its value in short periods.

- The anticipation around the upcoming Bitcoin halving in April 2024 is expected to trigger a significant price surge, similar to past trends.

- The Crypto Fear & Greed Index indicates a sentiment of “Extreme Greed” among investors, signaling high optimism but also cautioning against potential market corrections.

- The introduction of spot Bitcoin ETFs in the U.S. has led to substantial inflows, highlighting increasing institutional interest and demand for Bitcoin.

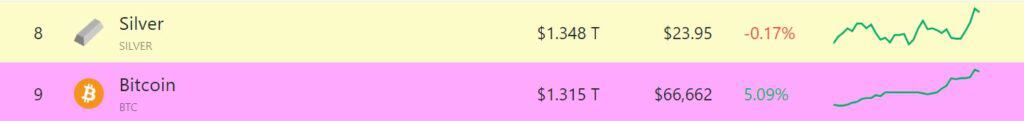

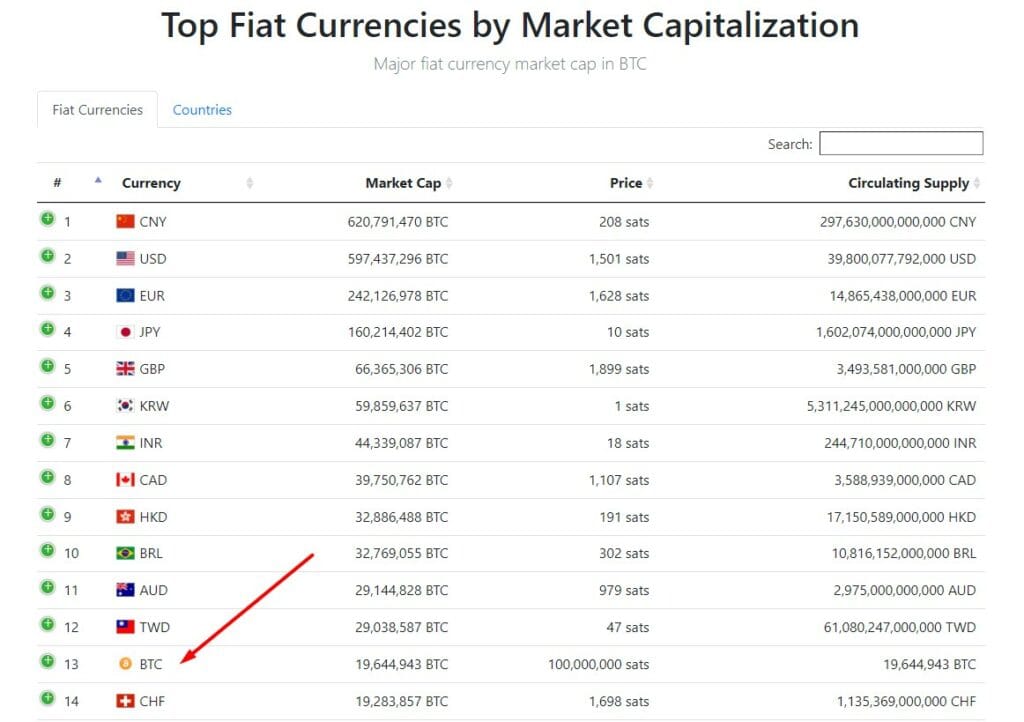

- Bitcoin’s market capitalization is on the rise, nearing the market cap of Silver and surpassing the value of the Swiss franc, marking its growing influence in the financial world.

Bitcoin enthusiasts are riding a wave of optimism as the cryptocurrency’s price nears its all-time peak of $69,000, with its current valuation at $68,300. This upward trend, marking a 7% increase in just 24 hours according to CoinGecko, has sparked a flurry of bullish forecasts on social media platform X.

Historic Rallies Fuel Bullish Predictions

Notably, Bitcoin has a history of remarkable rallies following new highs. For instance, in March 2013, it soared 158% in a month, including a 10-day period where its value doubled.

Similar patterns were observed in November 2013 and December 2020, where Bitcoin swiftly doubled its value after surpassing previous highs, highlighting its potential for rapid growth.

The time it took $BTC to double after previous breaks of ATHs:

— Dylan LeClair 🟠 (@DylanLeClair_) March 4, 2024

Dec 2020: 18 days

March 2017: 84 days

Nov 2013: 10 days

March 2013: 18 days

Anticipation Builds Ahead of Bitcoin Halving

The upcoming Bitcoin halving in April 2024 has further fueled anticipations of a significant price surge. Jaran Mellerud of HashLabs Mining suggests a substantial run could follow the halving, reminiscent of the late 2020 surge aided by the previous halving.

Market Sentiment Hits “Extreme Greed”

The Crypto Fear & Greed Index has skyrocketed to 90 out of 100, indicating a sentiment of “Extreme Greed” among investors, paralleled by a surge in “Bitcoin” Google searches.

This optimism, however, comes with cautionary advice that excessive greed could signal a looming market correction.

ETFs Amplify Bitcoin Demand

A new factor in this bull market is the influence of spot Bitcoin ETFs in the United States, which have seen significant inflows since their introduction.

With BlackRock’s iShares Bitcoin Trust (IBIT) rapidly hitting the $10 billion asset milestone, predictions suggest ETF inflows could reach $150 billion by 2025, underscoring a growing institutional interest in Bitcoin.

[1/4] Bitcoin ETF Flow – 01 March 2024

— BitMEX Research (@BitMEXResearch) March 2, 2024

Almost all data in, just missing Invesco

$139.5m net outflow on 1st March, due to large $492m GBTC outflow pic.twitter.com/6dSkQ8ZNNG

Bitcoin’s Market Position Strengthens

Bitcoin’s market capitalization continues to climb, positioning it close to overtaking Silver and surpassing the Swiss franc in value.

This growth underscores Bitcoin’s increasing significance in both the crypto and traditional financial markets, suggesting a bullish outlook for its future.