Key Takeaways:

- BTC exceeds $67K, nearing its record high and approaching the $1.4 trillion market cap of silver.

- Bitcoin’s market cap surpasses $1.3 trillion, challenging silver’s market cap and previously exceeding that of Meta Platforms.

- Over $120 million in bitcoin short positions liquidated, indicating strong market momentum.

- Strong trading volume for Bitcoin ETFs, with BlackRock’s iShares Bitcoin Trust marking a significant trading day.

- Analysts predict Bitcoin might hit new all-time highs soon, driven by expanded demand and ETF inflows.

- Large investor demand for BTC and ETH, alongside a growing interest in meme coins, fuels the current crypto rally.

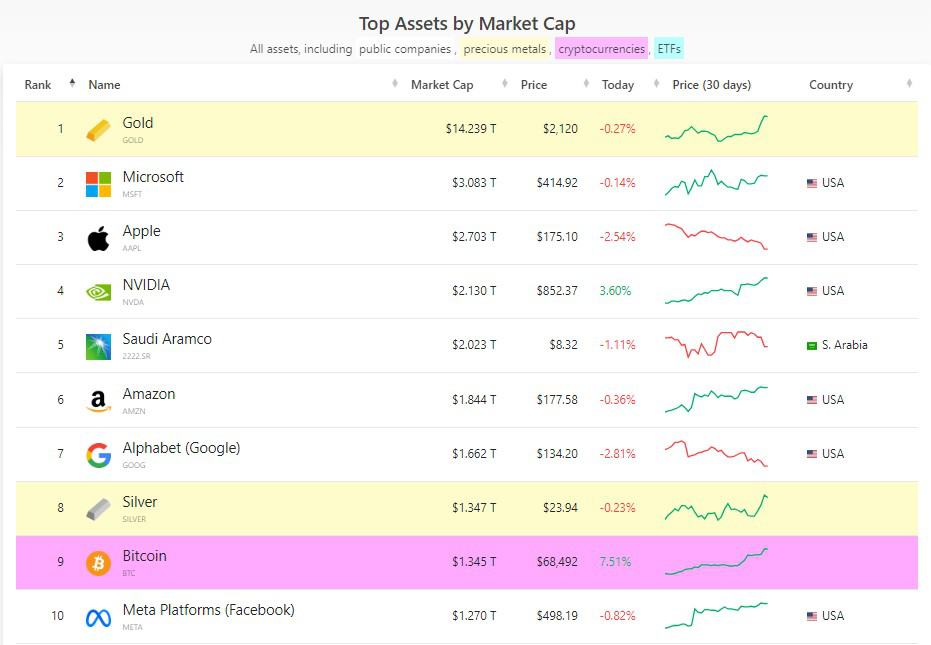

Bitcoin (BTC) has once again breached new milestones, this time soaring past $67,000 and inching closer not only to its previous peak of $69,000 but also to the nearly $1.4 trillion market cap of silver.

Breaking free from a week of sideways movement below $64,000, BTC achieved a notable $67,500 during the U.S. trading hours, marking a 7% increase over 24 hours and surpassing the broader CoinDesk 20 Index’s (CD20) 5% gain.

This surge reflects Bitcoin’s significant growth this year, elevating it among the world’s largest assets with a market cap surpassing $1.3 trillion. It’s now on the verge of overtaking silver’s $1.4 trillion market cap, based on CompaniesMarketCap data, after previously surpassing the market cap of Meta Platforms (META).

The rally also impacted bitcoin short sellers, triggering over $120 million in liquidated leveraged positions, mainly shorts, according to CoinGlass. Meanwhile, Ether (ETH) climbed above $3,600, marking its first such rise since 2022, though its growth at 3.5% was less pronounced than BTC’s.

Meme coins have also seen remarkable performance, with Dogecoin (DOGE) and Shiba Inu (SHIB) leading the CD20 gains at 15% and 54%, respectively. Additionally, the enthusiasm for Bitcoin ETFs remains strong, with BlackRock’s iShares Bitcoin Trust (IBIT) experiencing its third-highest trading volume day, even surpassing the SPDR Gold Shares (GLD) in daily volume.

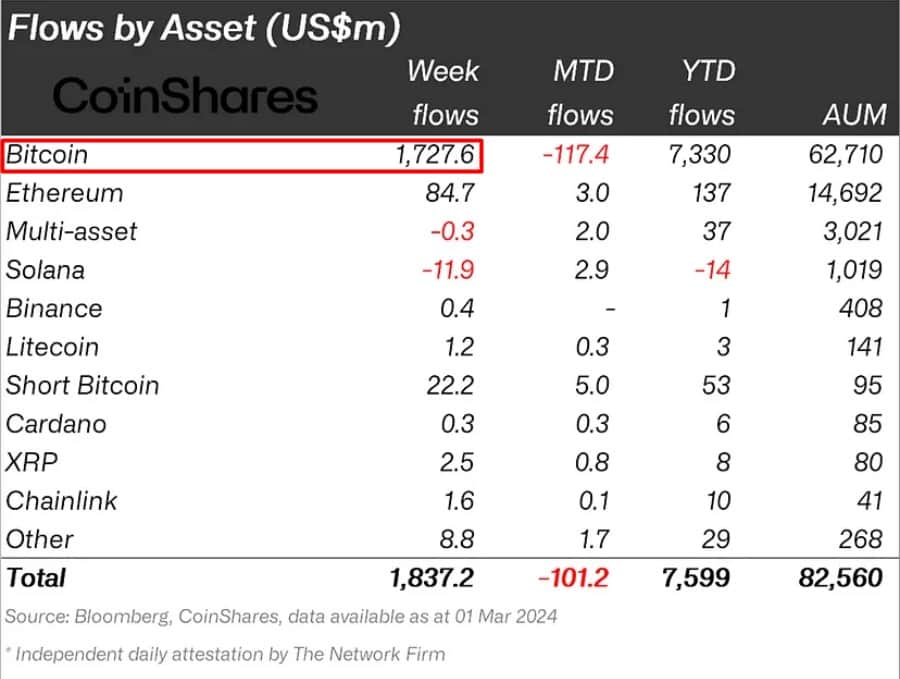

The previous week witnessed significant inflows into bitcoin-focused exchange-traded products, totaling $1.73 billion, marking the second-largest week for such inflows as reported by CoinShares. Ether-focused funds also saw a notable $85 million in net inflows.

Experts like Markus Thielen of 10xResearch anticipate a potential new all-time high for Bitcoin this week, driven by increasing demand and strong ETF inflows. Bitcoin’s performance is also notably outpacing the Nasdaq 100 Index (NDX), with analysts like Caleb Franzen highlighting its promising trajectory.

#Bitcoin is about to enter price discovery (again) and people are somehow bearish?

— Caleb Franzen (@CalebFranzen) March 4, 2024

couldn't be me.

Swissblock’s market update underscores Bitcoin’s robust momentum and the entrance of new investors into the market. The current rally is attributed to large investors’ demand for BTC and ETH, a weakening in U.S. regional banks, and a growing interest in meme coins fueled by FOMO.

Swissblock even suggests a short-term target of $70,000 for Bitcoin, hinting at surpassing its November 2021 all-time high.