Key Takeaways:

- Tether froze $12.3 million in USDT on the Tron blockchain amid suspected sanctions or AML violations.

- The move reflects Tether’s enforcement of U.S. Treasury OFAC guidelines, targeting illicit activities like money laundering and terrorist financing.

- Tether’s freezing powers, though controversial, have disrupted criminal crypto flows, including action against Garantex and the Lazarus Group.

Tether, issuer of the world’s largest stablecoin USDT, has frozen over $12.3 million on the Tron blockchain due to suspected sanctions violations or Anti-Money Laundering (AML) concerns.

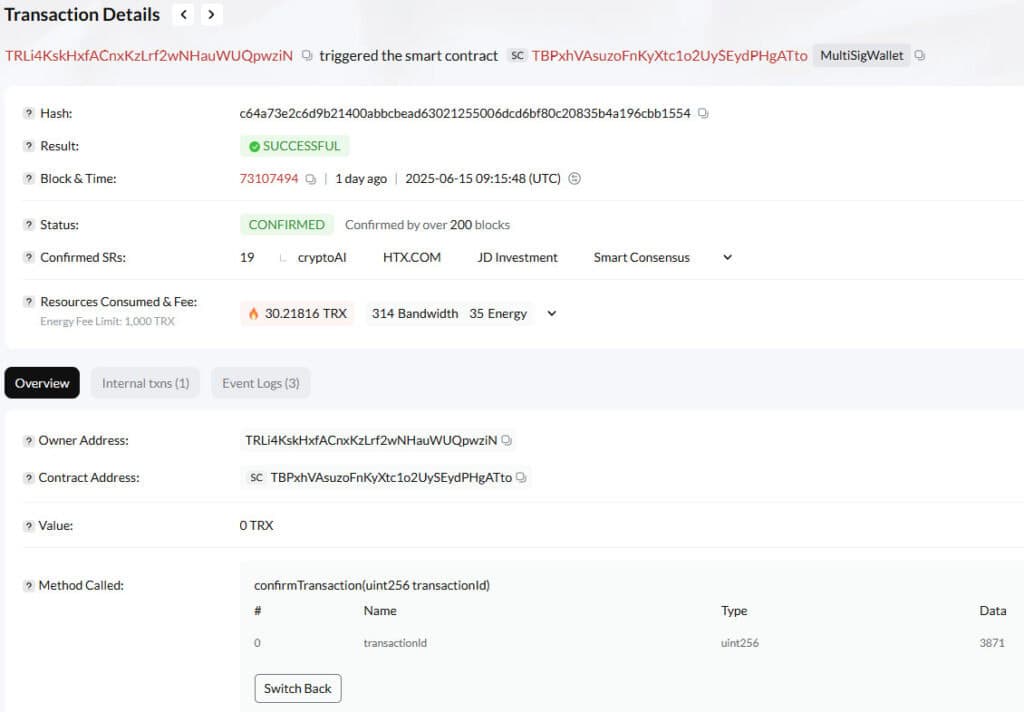

The freeze occurred at 9:15 am UTC on June 15, according to Tronscan data, although Tether has not issued a public statement.

The company follows a strict wallet-freezing policy aligned with the U.S. Treasury’s Office of Foreign Assets Control (OFAC) and its Specially Designated Nationals (SDN) List.

This move reflects Tether’s ongoing efforts to combat illicit activity, including money laundering and terrorist financing.

Earlier this year, on March 6, Tether froze $27 million in USDT linked to the sanctioned Garantex exchange, which has since halted operations.

Despite sanctions, blockchain analytics firm Global Ledger noted that over $15 million remained active with Garantex as of June 5.

Tether’s asset-freezing capability has sparked debate in the crypto community.

While critics view it as a centralization risk, others highlight its role in disrupting crime.

For example, Tether froze $374,000 in stolen funds, while other stablecoin issuers blocked $3.4 million tied to the Lazarus Group.