Key Takeaways:

- The SEC has sued 17 individuals for their involvement in a Ponzi scheme that scammed $300 million from over 40,000 people, predominantly targeting the Latino community across 10 U.S. states and two countries.

- Two of the accused have settled with the SEC, which vows to prosecute not only the scheme’s leaders but also those who aided in victim solicitation.

- The legal actions continue from an emergency operation last October against the scheme’s principal figures, with further investigations revealing ongoing fraudulent activities.

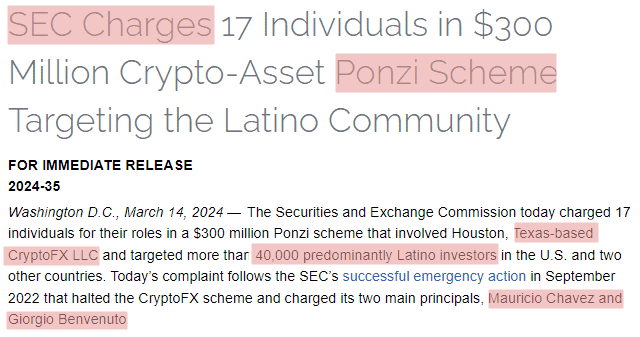

The U.S. Securities and Exchange Commission (SEC) has taken legal action against 17 individuals associated with a fraudulent operation that duped over 40,000 people out of $300 million.

This group specifically preyed upon the Latino community across 10 states in the U.S. and in two additional countries, misleading investors with promises of crypto and other asset investments that never materialized.

Today we charged 17 individuals for their roles in a $300 million Ponzi scheme that involved Houston-based CryptoFX LLC and targeted the Latino community.

— U.S. Securities and Exchange Commission (@SECGov) March 14, 2024

More: https://t.co/YWfCy0p6aw pic.twitter.com/c1YqSLl0HR

Of the 17 accused, two have already reached a settlement with the SEC.

The agency’s Enforcement Director, Gurbir Grewal, remarked that the fraud promised its victims substantial financial gain, but the only certainty was the extensive trail of detriment it left behind, affecting thousands in numerous states and abroad.

Grewal emphasized the SEC’s commitment to prosecuting not only the scheme’s masterminds but also those who played a part in perpetuating the fraud.

This legal action follows an emergency intervention last October against Mauricio Chavez and Giorgio Benvenut, identified as the orchestrators of the scam.

The latest legal move broadens the scope of the investigation, highlighting continued solicitation activities by Gabriel and Dulce Ochoa, even after initial charges were laid out.