Key Takeaways:

- Crypto trader “White Whale” says MEXC froze $3.1M and invited him to Malaysia for resolution, raising safety and coercion concerns.

- MEXC cited risk management policies as the reason for asset freezes but did not address the invitation or coercion claims.

- White Whale launched a $2M social media campaign with a $1M bounty to pressure MEXC, echoing previous complaints of similar freezes.

A crypto trader known as “White Whale” claims $3.1 million of his funds remain frozen on exchange MEXC, and that he was invited to travel to Malaysia in person to resolve the issue – an offer he rejected.

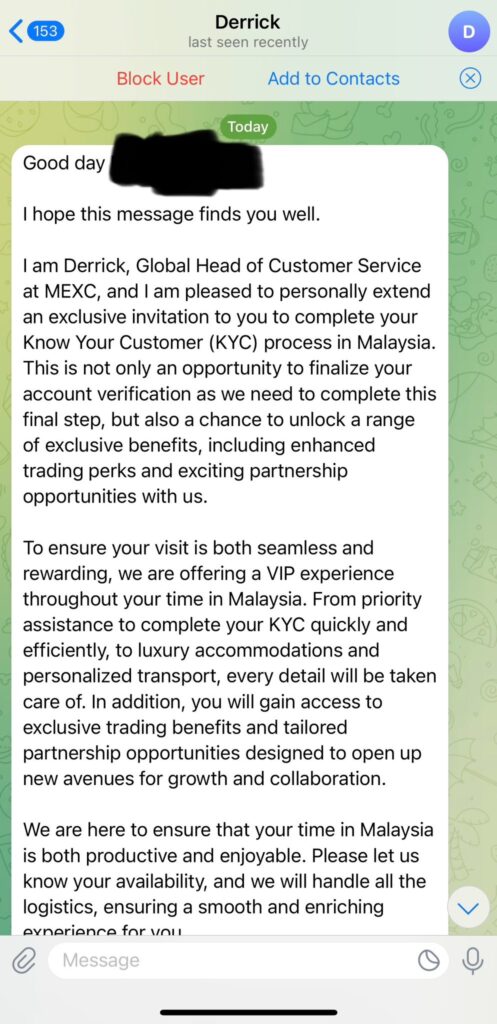

Screenshots show MEXC’s global head of customer service extending the invitation for talks with leadership, despite Know Your Customer (KYC) procedures normally being handled online.

Oh yeah – this is crypto. You fellow degens love receipts. You go you. pic.twitter.com/yw4Uk3QogO

— The White Whale (@TheWhiteWhaleHL) August 25, 2025

White Whale argued the request was coercive and unsafe, citing the rising risk of crypto-related kidnappings.

He said he had already completed standard KYC checks, including identity, residence, and phone verification, and noted that MEXC’s Terms of Service do not mandate in-person meetings.

MEXC responded that it only freezes funds for valid reasons such as price manipulation, wash trading, self-trading, front-running, or fraudulent activity, but did not address the Malaysia invitation claim.

To escalate pressure, White Whale launched a $2 million social media campaign, urging users to mint free NFTs and push the hashtag #FreeTheWhiteWhale, offering a $1 million bounty to participants if his funds are released.

MEXC has faced similar complaints, including past cases of long-term account freezes.