Key Takeaways:

- HK Asia Holdings’ stock surged 93% after announcing the purchase of just 1 Bitcoin for $96,150.

- The firm cited Bitcoin as a “dependable store of value” amid economic uncertainty and fiat currency depreciation.

- Despite larger BTC purchases, companies like Ming Shing saw no similar stock boost, highlighting varied market reactions.

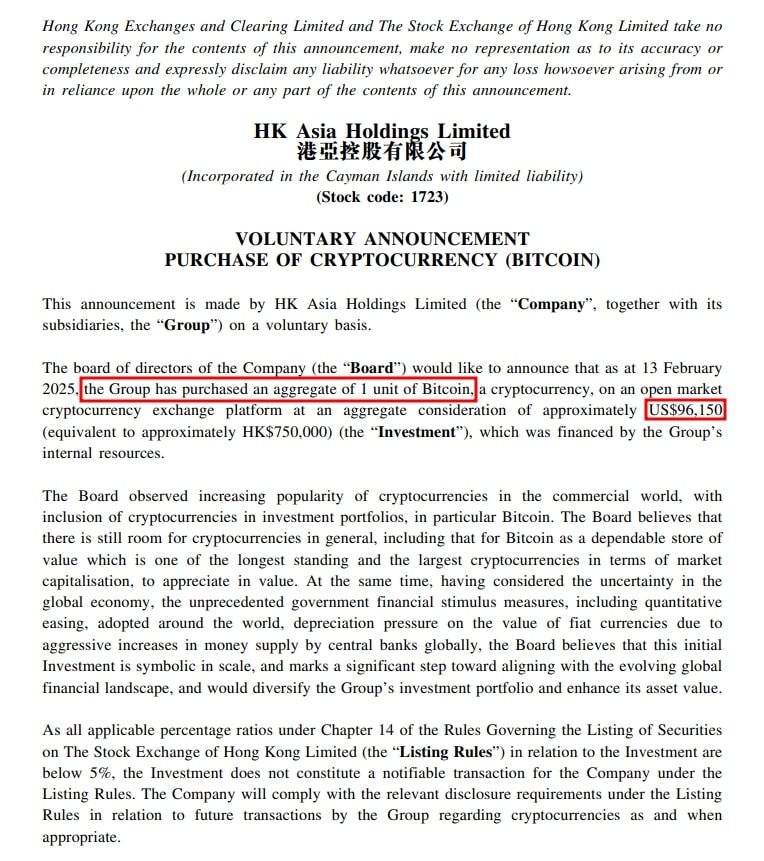

HK Asia Holdings Limited, a Hong Kong-based investment firm, saw its stock price nearly double after announcing the purchase of just one Bitcoin.

On February 16, the company revealed it had acquired the cryptocurrency for approximately $96,150 using internal funds.

Following the news, HK Asia’s stock soared 93% on February 17, closing at 5.50 Hong Kong dollars (71 cents), up from around 40 cents earlier in the day.

Despite the small scale of the purchase, HK Asia justified the move by citing Bitcoin’s growing popularity and its role as a “dependable store of value” amid economic uncertainty.

The company acknowledged that government stimulus measures and an expanding money supply could lead to fiat currency depreciation, making Bitcoin an attractive asset.

💥BREAKING:

— Crypto Rover (@rovercrc) February 18, 2025

HONG KONG'S HK ASIA HOLDINGS SURGES 93% AFTER DISCLOSING ITS PURCHASE OF JUST 1 #BITCOIN!

ASIA IS BULLISH ON BITCOIN!🚀 pic.twitter.com/AJ7BkCnCKv

This sharp stock price increase contrasts with other firms making larger Bitcoin investments.

Hong Kong’s Ming Shing saw no market reaction after its subsidiary bought 500 BTC, while Japan’s Metaplanet has experienced a 3,900% stock surge since beginning Bitcoin purchases in April 2023.

Although HK Asia’s Bitcoin acquisition is largely symbolic, it signals the company’s intent to explore cryptocurrency as part of its financial strategy, reflecting broader corporate interest in digital assets.