Key Takeaways:

- FDUSD briefly depegged to $0.9878 after Justin Sun alleged its issuer, First Digital, was insolvent.

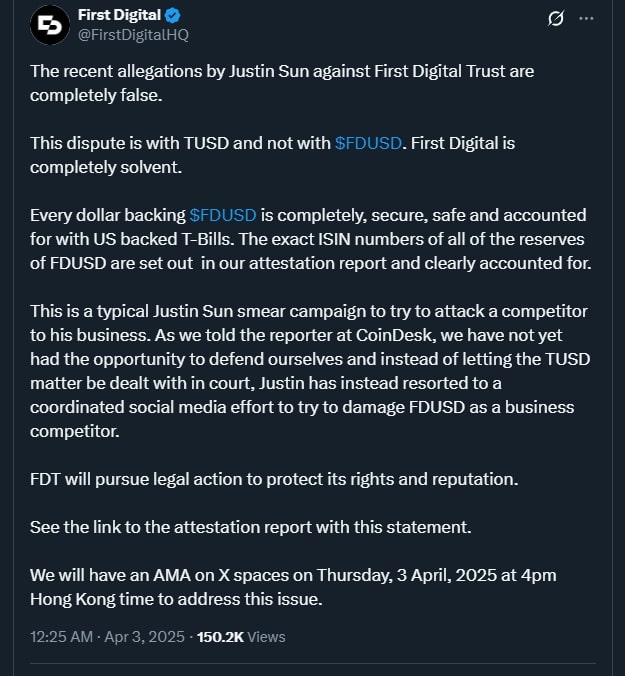

- First Digital denied the claims, asserting FDUSD is fully backed by U.S. Treasury Bills and calling the allegations a “smear campaign.”

- Legal action against Justin Sun is being considered over what First Digital labels as baseless and harmful accusations.

On April 2, the U.S. dollar-pegged stablecoin FDUSD briefly fell below its $1 peg after Tron founder Justin Sun alleged that its issuer, First Digital, was insolvent.

In response, First Digital strongly denied the claims, calling them a baseless smear campaign aimed at disrupting competition in the stablecoin market.

The company reaffirmed that FDUSD is fully backed by U.S. Treasury Bills and remains redeemable 1:1 with the U.S. dollar.

First Digital emphasized the transparency of its reserves, citing a public attestation report listing the ISIN numbers of all assets backing FDUSD.

Protect users and protect HK

— H.E. Justin Sun 🍌 (@justinsuntron) April 2, 2025

First Digital Trust (FDT) is effectively insolvent and unable to fulfill client fund redemptions. I strongly recommend that users take immediate action to secure their assets. There are significant loopholes in both the trust licensing process in…

The firm clarified that the dispute does not concern FDUSD itself, but rather another stablecoin, TrueUSD (TUSD).

It accused Justin Sun of intentionally spreading misinformation to damage FDUSD’s standing and stated it is considering legal action against him.

During the controversy, FDUSD briefly dipped to around $0.9878, reflecting a temporary loss of confidence.

The incident underscores the fragility of market trust and the intensifying rivalry in the stablecoin ecosystem.