Key Takeaways:

- The SEC is considering classifying Ethereum’s ether as a security, significantly impacting the industry and possibly affecting Ethereum-based ETFs.

- SEC’s inquiries into Ethereum and similar projects focus on proof-of-stake mechanisms and token reward systems, hinting at a potential classification as securities despite no official declaration yet.

- Ethereum’s situation is complex due to its governance, development activities, and historical recognition as a commodity by the CFTC, making its classification as a security controversial.

Recent reports from various media outlets have indicated that the U.S. Securities and Exchange Commission (SEC) is considering the classification of ether (ETH), the primary cryptocurrency of the Ethereum blockchain, as a security. This decision could significantly impact the cryptocurrency industry, potentially affecting the future of an Ethereum-based spot exchange-traded fund (ETF).

According to sources, the SEC has issued subpoenas to several American companies seeking information on their interactions with the Ethereum Foundation, a Switzerland-based non-profit responsible for Ethereum’s inception.

This action follows the introduction of ether staking through Ethereum’s transition to a proof-of-stake mechanism in 2022.

SEC Chair Gary Gensler has previously suggested that cryptocurrencies operating under proof-of-stake mechanisms could be viewed as securities due to their token reward systems for staking. Although Gensler has not explicitly named ETH, his administration has pursued legal action against various crypto exchanges, alleging unregistered security sales, including cryptocurrencies like ADA and SOL.

Despite the ongoing scrutiny, Ethereum’s classification as a security has not been officially declared in any SEC enforcement action. Crypto lawyer Ignacio Ferrer-Bonsoms points out the inconsistency in the SEC’s approach, comparing Ethereum’s situation with that of Cardano.

Both projects have conducted token sales to finance network development, are overseen by foundations in Switzerland, and have mechanisms in place that could potentially increase the value of their tokens. Ethereum’s unique burn mechanism, for instance, occasionally leads to a deflationary supply, hinting at an investment expectation for token holders.

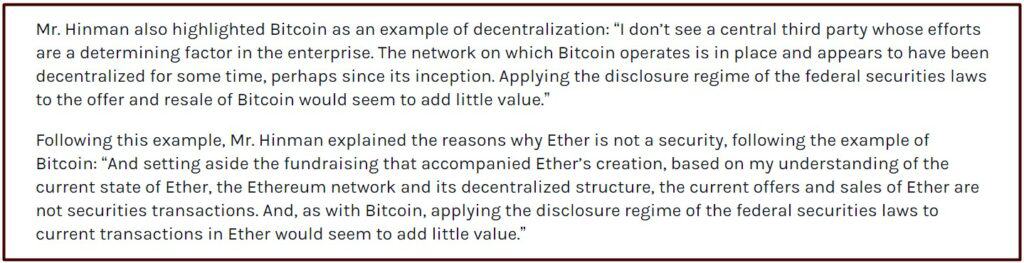

The Ethereum Foundation’s active involvement in the network, including contributions from key figures like Vitalik Buterin and Joseph Lubin, further complicates Ethereum’s classification. Unlike Bitcoin, which is widely recognized as a commodity in the U.S., Ethereum’s governance and development activities suggest a degree of centralized control that could challenge its status.

However, the argument against Ethereum’s classification as a security is strong. The Commodities Futures Trading Commission (CFTC) has permitted ETH futures trading for years, implicitly recognizing it as a commodity.

A sudden shift in Ethereum’s classification by the SEC could disrupt U.S. businesses and investors heavily invested in Ethereum, including those involved in ETH futures trading on major exchanges.

Some industry experts argue that Ethereum’s historical non-security status and the potential market disruption from a reclassification warrant maintaining its current classification. The SEC’s acknowledgment of ETH futures ETFs trading on regulated securities exchanges as non-securities suggests a recognition of Ethereum’s unique status.

Amid these discussions, the broader crypto community expresses frustration with the SEC’s aggressive regulatory stance, which some view as an overreach. Critics argue that focusing on actual fraudulent activities rather than challenging the decentralized nature of cryptocurrencies could be a more effective regulatory approach.

The potential for the Supreme Court to review and possibly narrow the SEC’s broad regulatory authority remains a pivotal point in the ongoing debate over Ethereum’s classification as a security.