Key Takeaways:

- Coinbase aims to raise $1 billion through a convertible bond sale, adopting a strategy that mirrors Michael Saylor’s MicroStrategy, but with added measures to protect stock investors from dilution.

- This financial strategy includes “negotiated capped call transactions,” a novel approach intended to minimize equity dilution when the debt converts, reflecting Coinbase’s commitment to balancing capital raising with shareholder interests.

- The initiative is timed with a notable bitcoin rally, leveraging market momentum for strategic growth funding, while also signaling a shift in Wall Street’s perception towards a more favorable view of Coinbase’s stock.

Coinbase is gearing up to generate $1 billion via a convertible bond sale, a strategic move mirroring Michael Saylor’s MicroStrategy, but designed to benefit its stockholders uniquely. This innovative fundraising effort includes “negotiated capped call transactions” to mitigate equity dilution upon conversion, showcasing a strategic approach to capital raising without compromising shareholder interests.

This initiative is set against a backdrop of changing attitudes on Wall Street, where analysts are revising their previously cautious perspectives on Coinbase’s stock.

As the only publicly traded crypto exchange in the U.S., Coinbase aims to leverage the ongoing surge in digital asset values, aligning its fundraising methods with those proven by MicroStrategy under Saylor’s leadership. MicroStrategy has famously amassed 205,000 bitcoins, now valued at approximately $15 billion, funded largely through over $2 billion in convertible note sales, including a recent $700 million issuance that exceeded initial expectations.

Coinbase’s decision to offer unsecured convertible senior notes in a private offering marks a clear preference for debt financing over equity sales, which could dilute existing shareholders’ stakes. These bonds, set for conversion in 2030, allow investors to convert their holdings into shares or cash, reflecting a prudent balance between fundraising needs and shareholder equity preservation.

Moreover, Coinbase’s introduction of “negotiated capped call transactions” with this bond offering underscores its commitment to minimizing dilution effects, a consideration not mirrored in MicroStrategy’s latest dealings. Such strategic hedges are employed to safeguard existing shareholders’ interests, even as share prices potentially exceed the bonds’ conversion threshold.

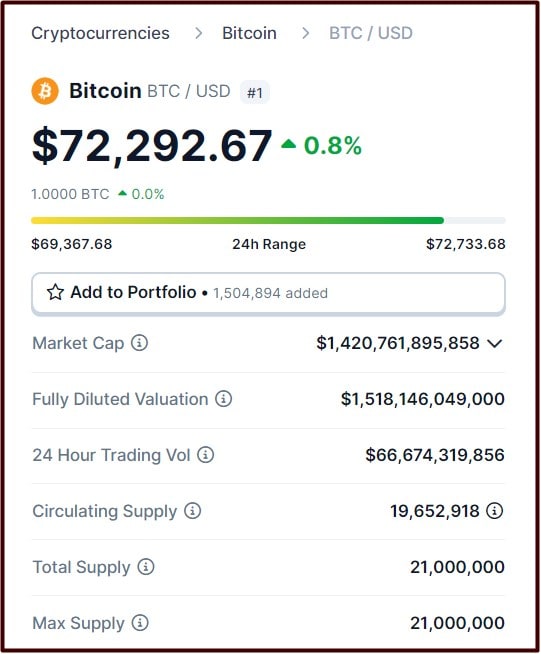

The announcement arrives amid a significant bitcoin rally, propelling the cryptocurrency to new heights above $72,000 and marking a 67% increase this year.

Concurrently, Coinbase’s stock has witnessed a 48% uptick, reflecting robust market confidence. This financial maneuver is poised not only to strengthen Coinbase’s balance sheet but also to enable strategic initiatives such as debt repayment, funding for capped call transactions, and potential acquisitions.

Coinbase’s bold move to secure $1 billion through convertible bonds, accentuated with shareholder-friendly provisions, illustrates a savvy navigation of the financial markets, leveraging bullish sentiment in the digital asset space to fuel its growth ambitions without undermining shareholder value.