Key Takeaways:

- Bitcoin experienced a 13% drop from its record high, attributed to a “pre-halving retrace,” with the Bitcoin halving event approximately 30 days away.

- Analysis by an analytics firm suggests Bitcoin’s bullish trend will continue, supported by the modest share of investments from new, short-term holders and key price valuation indicators not yet reaching previous peak levels.

- The upcoming Bitcoin halving event, reducing miner block rewards by half, is expected to significantly influence Bitcoin’s value, historically linked to price increases and preceding major bull markets.

In the last two days, Bitcoin’s price saw a 13% fall from its record high of $73,835, dipping to near $60,000. This drop is attributed to market overheat, described as a “pre-halving retrace,” with the anticipated Bitcoin halving event just around the corner, roughly 30 days out.

Despite the recent downturn, a study by an analytics firm highlights that Bitcoin’s bullish trend is likely to continue.

This optimism stems from the observation that a modest share of Bitcoin investments comes from new, short-term holders and that key price valuation indicators remain below those recorded at previous market peaks.

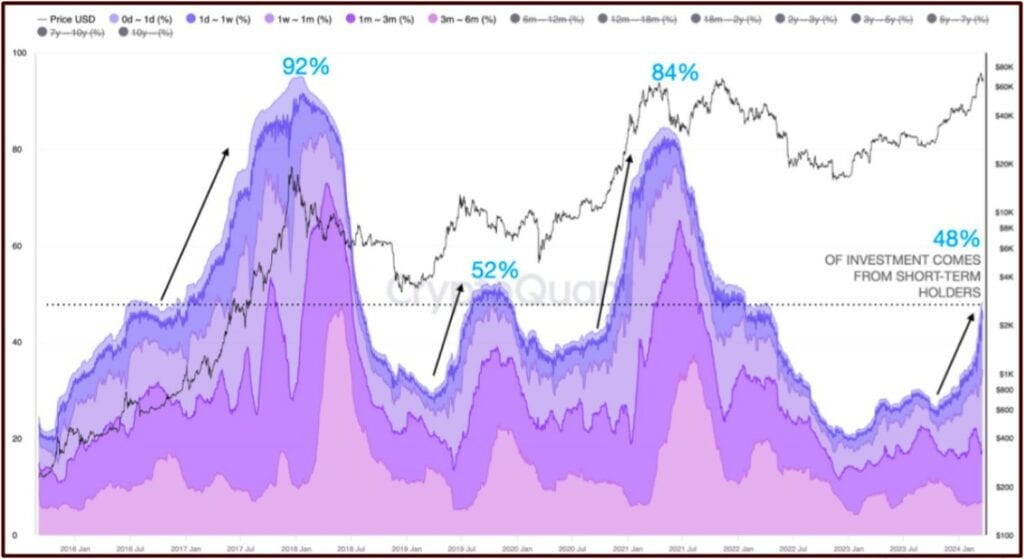

According to the firm’s Weekly Crypto Report, short-term investors currently account for 48% of Bitcoin investments.

Historical data suggests that bull cycles tend to conclude when this figure hits between 84%-92%. The analysis points out, “The Bitcoin bull cycle is still far from over,” citing the subdued influx of new investment as evidence.

The report also touches on valuation metrics, noting they haven’t reached the highs associated with past market zeniths. Its Profit and Loss (PnL) Index, which tracks the profitability of Bitcoin through three on-chain indicators, suggests that, while the crypto market is expected to enter a bullish phase in 2024, current levels are just shy of those seen at the climax of previous bull runs in 2013, 2017, and 2021.

The impending Bitcoin halving event is another factor anticipated to significantly influence the cryptocurrency’s value.

This event, which reduces miner block rewards by half, is historically linked to price increases and precedes major bull markets.

This analysis, while optimistic, is part of a broader narrative that sees the Bitcoin halving event as a critical catalyst for future price movements, underscoring the significant impact of market mechanics and investor sentiment on the cryptocurrency’s value.

With the halving set to occur on April 20, reducing the block reward from 6.25 BTC to 3.125 BTC, market observers are closely watching for its impact on Bitcoin’s price trajectory.