Key Takeaways:

- Bitcoin soared above $73,000 for the first time, then faced a near 6% drop before recovering slightly, showcasing the cryptocurrency market’s volatility.

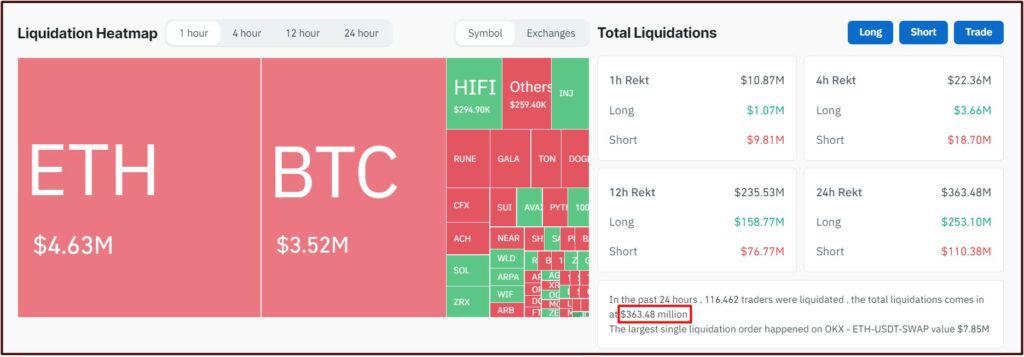

- Amidst the market’s fluctuations, over $360 million in leveraged derivatives positions were liquidated, predominantly affecting bullish bets.

- Analysis by Matrixport highlighted a potential slowdown in Bitcoin’s rally, noting a divergence between high prices and a declining Relative Strength Index (RSI), suggesting a period of consolidation might be ahead.

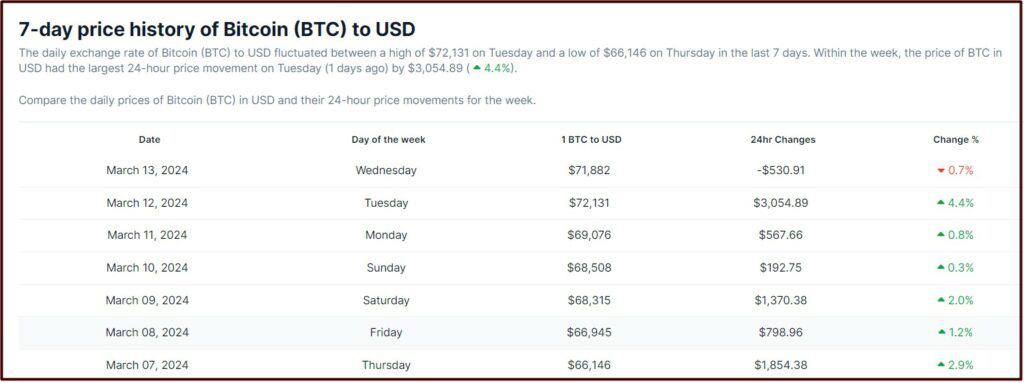

The crypto market experienced a whirlwind of activity on Tuesday, with Bitcoin (BTC) breaking through the $73,000 barrier for the first time, only to dip nearly 6% from that peak, and then finding its footing once again. At the time of reporting, Bitcoin is trading at $71,882, marking around 2% decrease over the last day.

Ether (ETH) managed to limit its losses to 2%, while other cryptocurrencies like Ripple (XRP), Dogecoin, and Litecoin (LTC) faced sharper declines, ranging from 6% to 8%. In contrast, AVAX (Avalanche’s native token) emerged as a standout, climbing 15% for the day amidst the market’s ups and downs.

This bout of market turbulence led to the liquidation of over $360 million in leveraged derivatives positions across the cryptocurrency spectrum, predominantly affecting bullish investors. According to CoinGlass data, this represented the most significant purge of long positions since the correction on March 5.

Matrixport, a crypto investment service provider, indicated in its latest market analysis that Bitcoin’s recent upward trajectory might be losing steam. The firm pointed out a divergence between Bitcoin’s high price levels and a declining Relative Strength Index (RSI), a key indicator used to evaluate the momentum of price movements.

“While we’ve been optimistic about Bitcoin since late January, our risk-reward assessment now leans towards a period of consolidation,” Matrixport’s analysts observed. They believe the bull market is not over, but suggest that Bitcoin may need to stabilize before it can mount another rally.

The report also identified the $69,000 mark as a pivotal support level for Bitcoin, reminiscent of its peak during the 2021 bull run.

In other economic news, U.S. inflation data for February indicated a hotter-than-expected rise in the Consumer Price Index (CPI) at 3.2%, exceeding analyst forecasts. Persistent inflation could deter the Federal Reserve from reducing interest rates, a scenario closely watched by market participants.

However, Nansen.ai’s principal research analyst, Aurelie Barthere, views the inflation figures as a minor hiccup for cryptocurrencies in the short term, unlikely to derail the ongoing bull market.

“The crypto sector remains buoyed by strong bullish momentum,” Barthere commented. She anticipates a market adjustment to Federal Reserve rate cut expectations but doesn’t foresee a significant crypto sell-off, noting that similar adjustments in the past have not challenged the bull market’s integrity.

This intense period in the crypto market, characterized by record highs, sudden declines, and swift recoveries, highlights the volatile nature of digital currencies and the broader economic factors influencing their trajectories.