Key Takeaways:

- The Coinbase Ethereum layer-2 network, Base, experienced a 350% increase in daily transactions to 2 million following the Dencun upgrade, largely due to a more than 60% reduction in transaction fees.

- The Dencun upgrade, implementing Ethereum Improvement Proposal 4844, significantly cut layer-2 transaction fees by improving L2 data availability and reducing gas costs by up to 90% for certain networks.

- Despite Base’s growth, Arbitrum and Optimism continue to dominate the layer-2 ecosystem, with a combined total value locked of $23 billion, while Base has emerged as the sixth-largest network with a $1.46 billion total value locked.

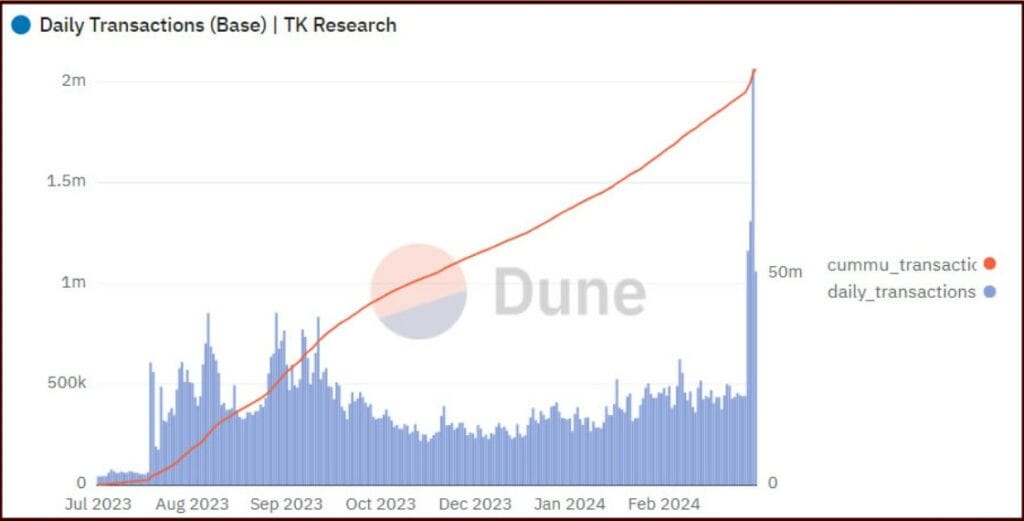

Following the remarkable Dencun upgrade, the Coinbase Ethereum layer-2 network, Base, experienced a staggering 350% increase in daily transactions, catapulting the figure to a historic 2 million on March 16.

This surge is primarily attributed to a significant decrease in transaction fees, which plummeted by over 60% post-upgrade.

In detail, Base’s transaction volume saw a monumental rise from an average of 440,000 per day to an astounding 2,064,920 on March 16, shortly after the Dencun upgrade was implemented.

This upgrade not only boosted the daily transaction volume but also attracted a record number of new users, with 666,866 joining the network on March 16 alone—a 3,200% leap from the average in the preceding days.

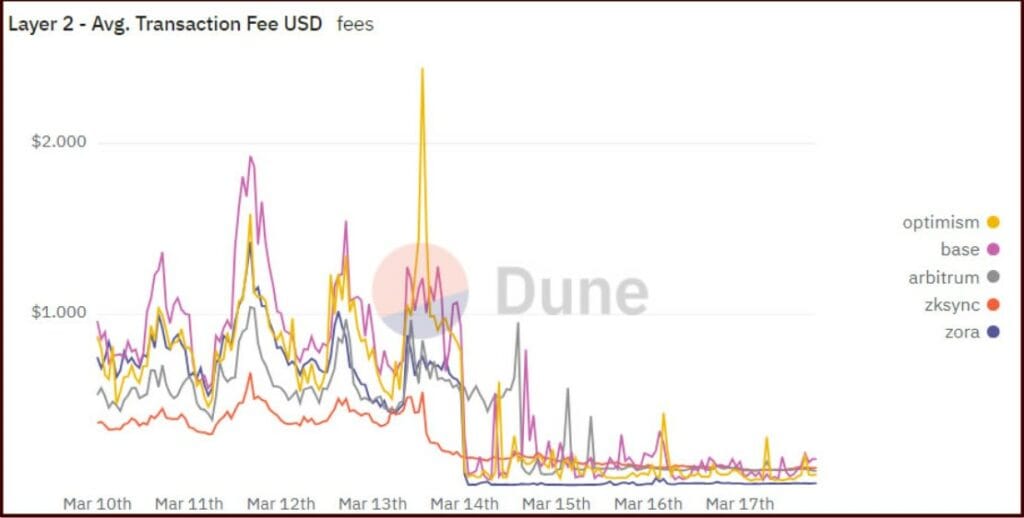

The Dencun upgrade introduced Ethereum Improvement Proposal 4844, drastically cutting layer-2 transaction fees by implementing data blobs or proto-danksharding. This innovation significantly improved L2 data availability, slashing gas costs by up to 90% for certain networks.

Post-upgrade, average transaction fees on leading layer-2 networks such as Arbitrum, Optimism, Base, zkSync, and Zora dropped between 60% and 90%, as indicated by Dune Analytics.

The fee reduction following the Dencun upgrade has played a crucial role in this growth, with average transaction costs on Base decreasing by more than 60%, as reported by Blockscout.

Launched in August by Coinbase, Base has quickly risen to become the sixth-largest network within the Ethereum layer-2 ecosystem, boasting a total value locked of $1.46 billion and holding a 4.1% market share of layer-2 solutions, as per L2beat.

Despite the impressive achievements of Base, Arbitrum and Optimism continue to lead the layer-2 ecosystem with a combined total value locked of $23 billion, commanding market shares of 42% and 23%, respectively.

Furthermore, the Dencun upgrade has led to substantially lower gas fees for token swaps on platforms like Uniswap’s Optimism deployment, with costs dipping to as low as $0.01, highlighted by protocol founder Hayden Adams.

Trading in Uniswap on Optimism now costs less than $0.01 in gas

— hayden.eth 🦄 (@haydenzadams) March 14, 2024

Let’s fucking go, we’re scaling ethereum

Huge shoutout to everyone involved in shipping Dencun pic.twitter.com/CDmWEvS8LW

As Ethereum’s layer-1 gas fees remain elevated, recently peaking with the asset’s value surpassing $4,000, the costs for Ether transfers, USD Coin transactions, and Uniswap swaps have adjusted to approximately $2.1, $5, and $16, respectively, according to Gasfees.io, marking a significant shift in the Ethereum transaction landscape following the Dencun upgrade.