Key Takeaways:

- Over $1 billion in crypto liquidations occurred as trade war concerns triggered a market downturn, with 87% of liquidations from long positions.

- Bitcoin dropped to $82,000 from $93,000, while ETH and SOL saw steep declines of 12% and 20%, respectively.

- Tariff fears overshadowed bullish sentiment from Trump’s proposed U.S. crypto reserve, highlighting macroeconomic risks in crypto markets.

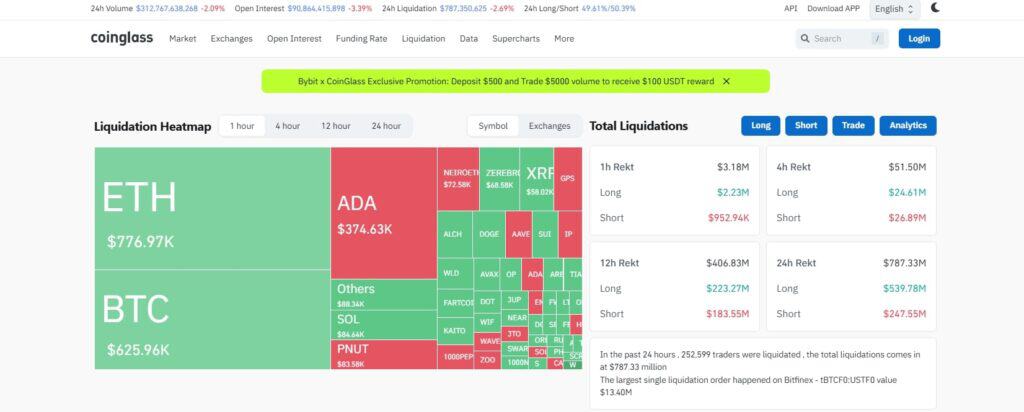

Crypto markets suffered over $1 billion in liquidations as trade war fears escalated, according to CoinGlass.

More than 87% of liquidations came from long positions, as major cryptocurrencies plunged on March 4, reversing recent gains.

Bitcoin (BTC) dropped to $82,000 from a high of $93,000 the day before, while Ether (ETH) and Solana (SOL) saw losses of 12% and 20%, respectively.

The sell-off followed former U.S. President Donald Trump’s decision to impose 25% tariffs on Canada and Mexico, which rattled financial markets.

The S&P 500 fell nearly 2% in early trading, further contributing to investor uncertainty.

This downturn came just days after Trump had fueled optimism in the crypto market by suggesting the creation of a U.S. crypto reserve, which would include BTC, ETH, XRP, and Cardano (ADA).

Bitcoin longs saw the highest liquidation volume, surpassing $300 million, while SOL, XRP, and ADA liquidations exceeded $150 million collectively.

The sell-off highlights the impact of macroeconomic events on crypto markets, as trade tensions and economic uncertainty overshadowed bullish crypto news, such as the SEC dropping lawsuits against crypto firms.

The market’s reaction underscores its vulnerability to broader financial instability.