Key Takeaways:

- The SEC has mandated First Trust Advisors and SkyBridge Capital to classify their Bitcoin ETF application as abandoned, highlighting regulatory hurdles in the crypto ETF space.

- Despite their early initiative, First Trust and SkyBridge did not re-apply for the ETF after an initial rejection, contrasting with the subsequent approval of BlackRock’s Bitcoin ETF by the SEC.

- The situation underscores the complexities and uncertainties facing firms in the crypto market, balancing innovation with the evolving regulatory environment.

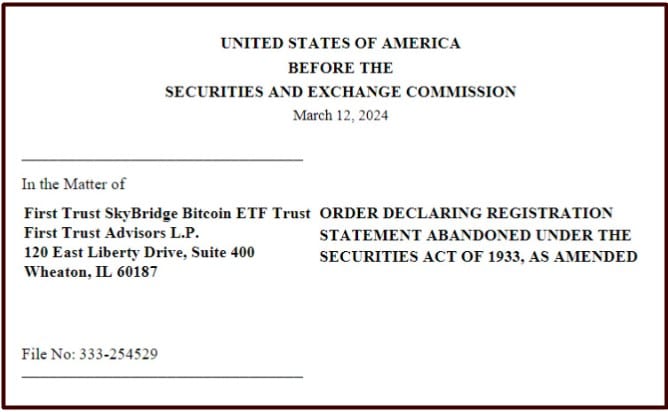

First Trust Advisors and SkyBridge Capital, a hedge fund led by Anthony Scaramucci, who previously served as White House Communications Director, faced a setback in their cryptocurrency ambitions. The Securities and Exchange Commission (SEC) has mandated that their application for a Bitcoin ETF be classified as abandoned.

This decision came after the SEC pointed out that the First Trust SkyBridge Bitcoin ETF did not address prior communications from the commission, leading to this conclusive step.

The journey for First Trust and SkyBridge began in March 2021 when they first proposed a Bitcoin ETF, aspiring to bridge the gap between traditional financial markets and the burgeoning field of digital assets.

Despite the initial enthusiasm, their application was part of a larger wave of rejections in January 2022, when the SEC turned down several Bitcoin ETF proposals, signaling stringent regulatory scrutiny in the evolving crypto market landscape.

Interestingly, the rejection came despite the SEC later approving BlackRock’s Bitcoin ETF application, which had undergone several revisions before getting the green light. This approval marked a significant milestone in the integration of Bitcoin into the regulated financial system, contrasting sharply with the fate of the First Trust and SkyBridge application.

The refusal to re-apply after BlackRock’s success left many market analysts puzzled, including Bloomberg ETF analyst Eric Balchunas, who expressed uncertainty over the duo’s strategy in the rapidly changing crypto environment.

The SEC is ordering (in all caps) First Trust SkyBridge Bitcoin ETF to declare their filing "abandoned" today. FT was one of the filers who never jumped back in to the post-BLK race, not sure why. Had they launched prob add 15% to the flows prob as First Trust is a sales MACHINE pic.twitter.com/ruEbFvyFxC

— Eric Balchunas (@EricBalchunas) March 12, 2024

At a time when Bitcoin’s value hovers around $72,000, and the broader digital asset market shows resilience, the decision not to pursue the ETF application anew highlights the challenges and uncertainties that firms face in navigating the regulatory and market dynamics of the cryptocurrency sector.

This development underscores the ongoing tension between innovation in the digital asset space and the regulatory frameworks designed to oversee traditional financial products and services, reflecting the complex interplay between evolving technological landscapes and established regulatory principles.