Key Takeaways:

- Bitcoin withdrawals from exchanges are at their highest rate since mid-2021, indicating a potential new record in dollar terms.

- Approximately $2 billion was withdrawn from exchanges on March 1, marking one of the largest outflows in over five years.

- The decrease in Bitcoin reserves on exchanges to the lowest level since March 2018 suggests a significant shift in market dynamics.

- Significant contributions to the withdrawal volume include U.S. spot Bitcoin ETFs and large outflows from major exchanges like Binance and Coinbase.

- The influx of new investors and the reactivation of previously dormant coins hint at a growing market interest and the potential for an upcoming bull market.

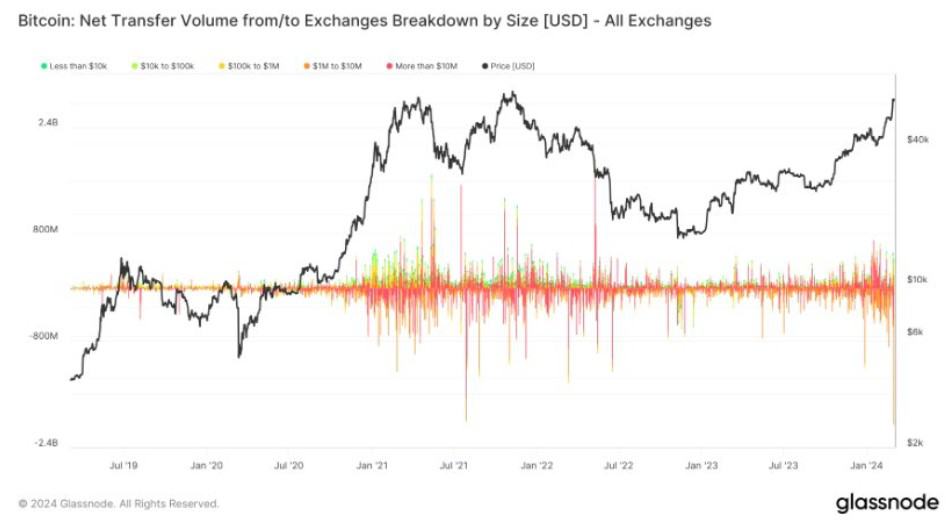

Bitcoin is witnessing its most rapid exchange departures since the middle of 2021, with the potential to surpass previous records in terms of the value of withdrawals in U.S. dollars.

As Bitcoin’s price aims for new heights, exchanges are experiencing the swiftest outflow of BTC in recent years. James Van Straten, a research and data analyst at CryptoSlate, highlighted significant BTC withdrawal activities in a recent X post.

I don’t think I’ve quite seen anything like this before.

— James Van Straten (@jvs_btc) March 3, 2024

All in all on the Friday, just over $2.3B worth of #Bitcoin left exchanges. One of the biggest withdrawals in over 5 years.

(Roughly $200M of this was sent to Coinbase Prime) so let’s call it $2B.

Binance saw about… https://t.co/QkSumLzDrn pic.twitter.com/XrrXp9vF20

Despite a lack of mainstream investor return to cryptocurrency, Bitcoin reserves on exchanges are diminishing. Van Straten shared Glassnode data indicating that on March 1, exchanges saw about $2 billion in withdrawals.

He remarked on the uniqueness of this event, noting that over $2.3 billion in Bitcoin was withdrawn on a single day, marking one of the largest outflows in over five years.

Glassnode’s data suggests that the daily Bitcoin outflows are comparable to the record withdrawals seen on June 28–29, 2021. Van Straten pointed out the influence of U.S. spot Bitcoin exchange-traded funds (ETFs), excluding around $200 million that went to Coinbase Pro for custody.

He observed significant withdrawals from Binance, around $400 million, and mentioned continuous sizable outflows, with Coinbase experiencing the majority. The outflows from Binance were particularly notable as they were unrelated to ETF activities.

According to Glassnode, the total Bitcoin holdings on major exchanges dropped to 2,286,347 BTC ($142.5 billion) by March 2, reaching its lowest level since March 2018, when Bitcoin’s price was around $8,000.

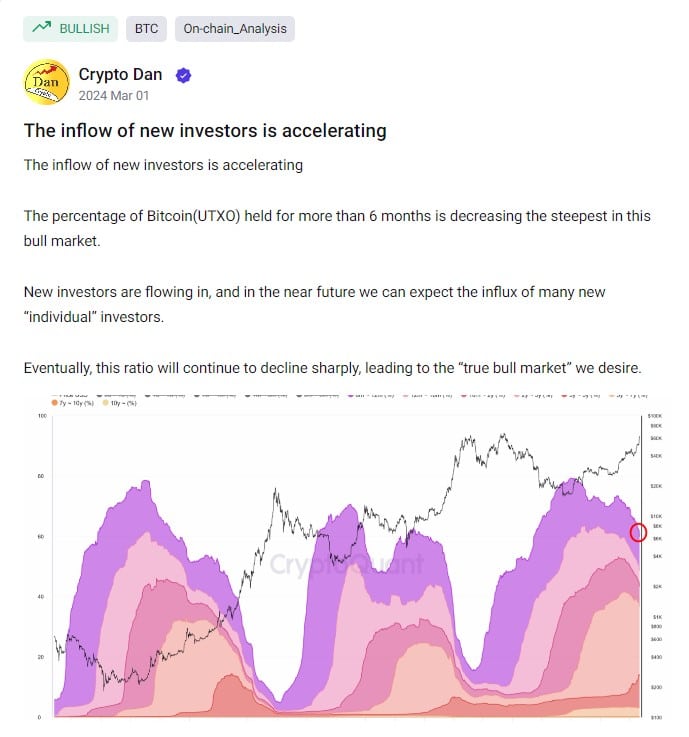

In addition, new data on Bitcoin market dynamics indicate an influx of new investors.

Crypto Dan, an analyst for CryptoQuant, noted changes in the age of unspent transaction outputs (UTXO), with an increase in activity from both new and previously dormant coins. This trend suggests a growing interest from new individual investors, potentially leading to a more robust bull market.