Key Takeaways:

- Coinbase CEO Brian Armstrong urges U.S. lawmakers to allow stablecoin issuers to pay on-chain interest, aligning crypto with traditional banking benefits.

- Armstrong claims interest-bearing stablecoins could offer yields around 4%, enhancing consumer savings and boosting the U.S. economy.

- Current bills—the STABLE Act and GENIUS Act—do not support interest-bearing stablecoins, but legislative alignment may be forthcoming.

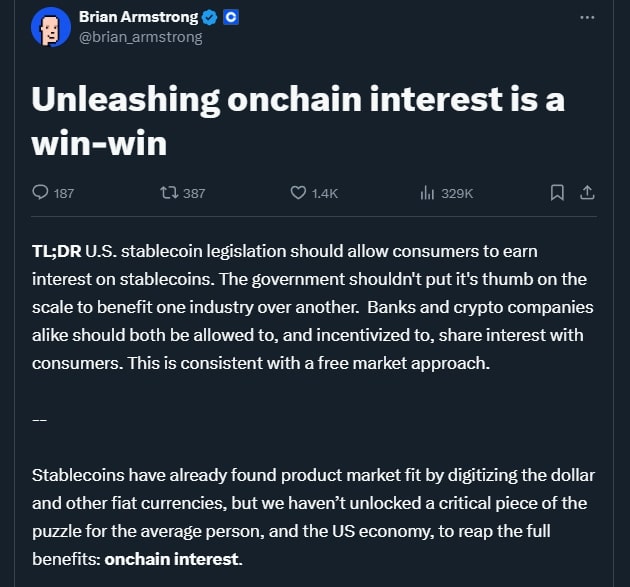

Coinbase CEO Brian Armstrong is urging U.S. lawmakers to reform stablecoin legislation to allow issuers to pay on-chain interest directly to holders.

In a March 31 post, he argued that stablecoins should function like traditional savings accounts, enabling interest payments and aligning with a free market approach.

Armstrong believes this change would benefit both consumers and the U.S. economy by offering higher yields—up to 4%, compared to the 0.41% average U.S. savings account rate in 2024.

Two major bills currently in progress—the STABLE Act and the GENIUS Act—do not permit interest-bearing stablecoins.

In fact, the STABLE Act explicitly prohibits it, while the GENIUS Act excludes interest-paying tokens from its definition of payment stablecoins.

Armstrong argues that updating the legislation would increase the appeal and global usage of dollar-backed stablecoins, potentially reinforcing U.S. dollar dominance and boosting economic activity.

🚨NEW: @RepBryanSteil tells me that after Wednesday’s markup, the STABLE Act will be “well positioned to mirror up” with the Senate’s GENIUS Act following a few more “draft rounds” in the House and Senate with technical assistance from the @SECGov and @CFTC.

— Eleanor Terrett (@EleanorTerrett) March 31, 2025

He believes that…

Representative Bryan Steil indicated that the differences between the two bills are mostly textual and could soon be reconciled.

Armstrong’s push reflects a broader call for regulatory clarity and innovation in crypto, aiming to give consumers access to more competitive financial products while supporting U.S. leadership in the digital economy.